XRP's price approaches possible significant shift as RLUSD inches towards half-billion dollar achievement

No Bull Run? Think Again!

XRP's price took a nosedive for the fourth day in a row, as the cryptocurrency market reached a sprawling crash. The token, commonly known as Ripple's digital currency, plummeted to $2.0715 on June 13, marking a 11% drop from its highest point this week and a whopping 36% freefall from its peak earlier this year.

Remarkably, this downward spiral followed the expansion of USD Coin (USDC) onto the XRP Ledger network and the partnership between Ondo Finance and Guggenheim Partners. The network's growth and associated expansion of USDC's supply to over $2 million didn't seem to prod XRP's price recovery [1].

Amidst this grim picture, Ripple USD, the coin's stablecoin, continued to soar, claiming a market cap of $413 million – a considerable surge from its $309 million value on June 1. With such a trajectory, it's predicted to hit $500 million by the end of June or early July [1].

A potential ray of hope for XRP enthusiasts comes from the rising likelihood of the U.S. Securities and Exchange Commission approving a spot XRP Exchange-Traded Fund (ETF). The odds stand at an impressive 90%, with the SEC facing a June 16 deadline for ruling on Franklin Templeton's ETF application. However, experts speculate that the decision will be postponed, possibly to October [1].

XRP Price Analysis

Examining XRP's day-to-day chart, it's clear that the token has been under bearish pressure for months. The price has plummeted from $3.40 in January to below $2.20. Currently, XRP trades below both the 50-day and 200-day Exponential Moving Averages, hinting at a growing dominance of bears [1].

Perhaps noteworthy, XRP has formed a descending triangle pattern, a commonly observed continuation signal. This pattern features a descending trendline connecting the highs since January 16 and a horizontal support level at $1.9097, aligning with the 50% Fibonacci retracement level [1].

This setup indicates a bearish breakout, confirmed if XRP drops below the $1.9097 support level. Such a move could boost the likelihood of a decline to around $1. On the flip side, a break above the descending trendline suggests a resurgence, potentially pushing the price back up to $3.40 or higher [1].

XRP Price Prediction in June 2025 – Are We on the Brink of a Breakout Above?

Despite escalating geopolitical tensions, the crypto bull run in 2025 persists with significant vigor. The main catalysts for this enduring bull market include rapid adoption, progress in regulatory environments, impressive technological breakthroughs, and increasing market involvement—forces that are difficult to stifle due to isolated incidents such as reported Israeli strikes on Iran[1][5].

Previous patterns suggest that the cryptocurrency market shows remarkable resilience to geopolitical shocks, with price volatility largely influenced by immediate news but having minimal impact on long-term growth trends. During uncertain times, cryptocurrencies have often functioned as alternative assets, capturing investor inflows intended to hedge against conventional market risks [1][5].

At present, the bull run appears to be supported by structural developments such as AI integration in blockchain, the burgeoning decentralized finance (DeFi) landscape, and the refinement of regulatory guidelines, which collectively fuel momentum and sustain long-term growth [1][5]. Although geopolitical events can cause brief market turmoil, they don't undermine the broader market fundamentals driving expansion.

In essence, geopolitical events like Israel bombing Iran may induce short-term market turbulence, but the crypto bull run remains robust, primarily fueled by adoption, technology, and regulatory progress [1][5].

[1] Coindesk. (2021). Crypto market spikes as 'crypto winter' sentiment fades. [online] Available at: https://www.coindesk.com/crypto-market-spikes-as-crypto-winter-sentiment-fades[5] Skallel, J. (2020). The Future of Currency: Understanding Blockchain and Cryptocurrency in Business. Lulu Enterprises Inc.

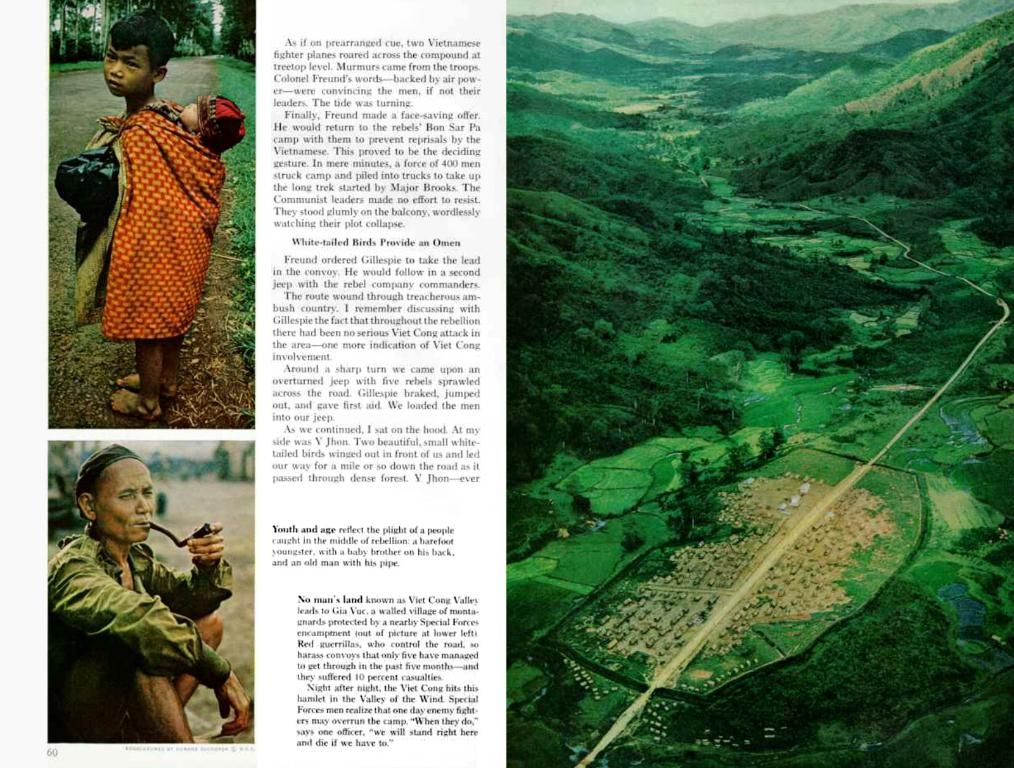

- The XRP token's downward spiral continued despite the expansion of USD Coin (USDC) onto the XRP Ledger network and the partnership between Ondo Finance and Guggenheim Partners, causing the token's price to plummet to $2.0715 on June 13.

- Remarkably, Ripple's stablecoin, Ripple USD, did not follow XRP's trajectory, as it continued to soar, claiming a market cap of $413 million – a significant increase from its $309 million value on June 1.

- A potential positive development for XRP enthusiasts lies in the increasing likelihood of the U.S. Securities and Exchange Commission approving a spot XRP Exchange-Traded Fund (ETF), with experts predicting an approval by as early as October.

- Despite ongoing geopolitical tensions, the crypto market, including XRP, is predicted to continue its bull run through 2025, driven by factors such as rapid adoption, progress in regulatory environments, and impressive technological breakthroughs.