Winning the EuroMillions: Top Priority Unveiled in Our Survey

Winning the £208million EuroMillions jackpot? Here's what you should do - or not do!

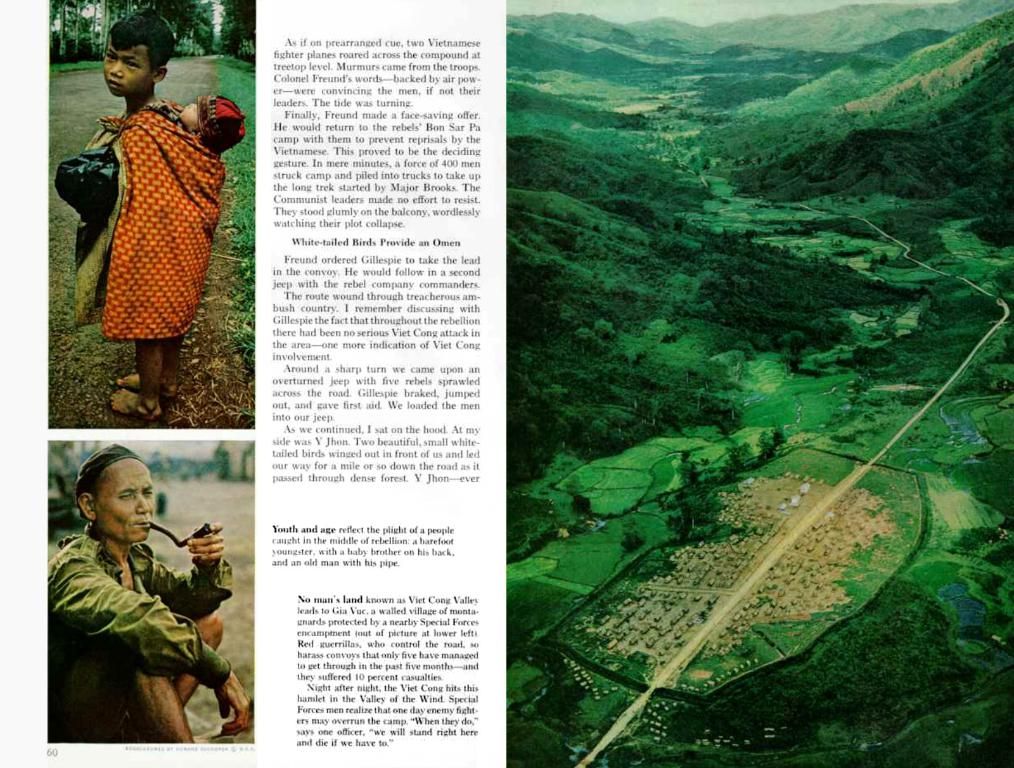

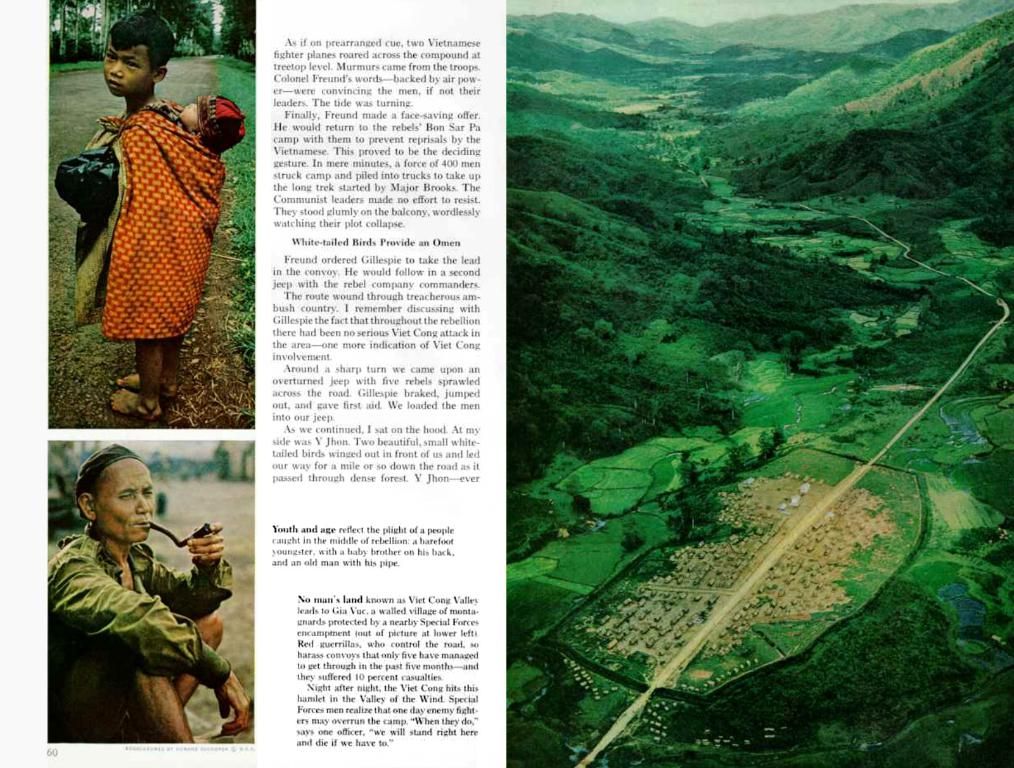

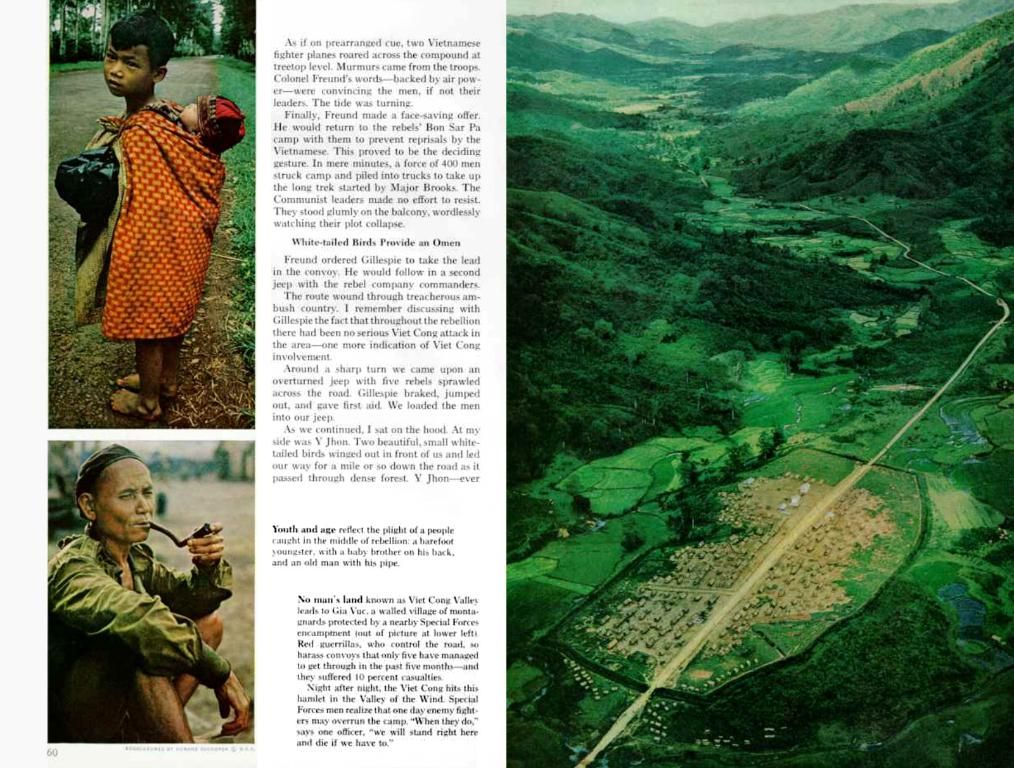

The EuroMillions madness is in full swing, with the record £208million jackpot still up for grabs in tonight's triple rollover. If you're one of the lucky few who manages to defy the odds, what's the first thing you'd do? That's the question we posed to This is Money and Mail Online readers, with a whopping 23,405 votes cast. The options were: pay off mortgage, buy a house, save/invest, travel, or help family/friends. While it's undeniable that all five categories will be on the agenda for the winner of a £200million+ lottery win, the poll revealed that helping family and friends was the priority, with a whopping 35% of people giving that answer.

Pay off mortgage and buy a house both received 21% of the vote, travel received 15%, and save/invest was at the bottom of the pile at 9%. But before you start thinking about all the fabulous things you could do with such a life-changing sum, there are a few tax implications you need to be aware of.

Matt Swatton, wealth planning director at wealth management firm Cannacord Wealth, has advised lottery winners on the unexpected challenges they face and how to navigate them in the past. "Many winners want to share their good fortune with family and friends," he said. "While gifting can be incredibly rewarding, it also comes with emotional and financial implications."

Firstly, you need to consider affordability - make sure you can afford the gift without compromising your own future. Winners who are gifting money to friends and family will also need to think about the tax implications of gifting. In the UK, gifts are generally free from inheritance tax if you live for seven years after making them. However, if the gift made was over £325,000, and the donor dies within seven years, the recipient could be liable for tax[1].

To get around this, the winner could set aside money to make a provision for any tax bill the recipient may face[1]. They could also set up a trust or take out an insurance policy that directly matches the tax liability as it reduces over seven years[1].

It's also important to consider the order that gifts are made, especially if earmarking money for your children's future using a trust in order to avoid unnecessary tax charges[1]. Engaging a qualified wealth manager can help lottery winners manage their wealth effectively, ensuring that gifts are made in a tax-efficient manner[2].

Managing expectations and boundaries with family members is crucial when sharing wealth, as it can impact personal relationships[2]. If considering charitable donations, a wealth manager can assist in identifying well-established causes and managing gifts to maximize tax efficiency[2].

In summary, while lottery winnings are not taxable, the tax implications arise from the income generated by these winnings and the potential for inheritance tax on gifts made. Strategic planning and consultation with financial advisors are essential for managing these tax implications effectively.

#### Additional Insights:

- Inheritance Tax in the UK: Inheritance tax is charged at 40% on any estate above the nil-rate band of £325,000. Gifts made during a person's lifetime are also subject to this tax if the donor dies within seven years[1].

- Exemptions and Reliefs: There are several exemptions and reliefs available that can help minimize inheritance tax payments, such as the £3,000 annual gift exemption and the gift aid scheme[1].

- Utilizing Trusts: Setting up a trust can help manage wealth effectively, avoiding unnecessary tax charges, and ensuring that assets are passed on to the intended beneficiaries while minimizing inheritance tax payments[1].

- Wealth Management: Engaging a wealth manager can help lottery winners navigate the complexities of managing their newfound wealth, ensuring that they make informed decisions and avoid common pitfalls[2].

- Impact on Personal Relationships: Distributing large sums of money can impact personal relationships, causing conflicts and strained connections[2]. It's essential to manage expectations, set boundaries, and communicate effectively with family members to avoid these issues.

References:

[1] HM Revenue & Customs - Inheritance Tax: https://www.gov.uk/inheritance-tax[2] Cannacord Wealth - Advice for Lottery Winners: Six Things They Must Do If They Win the Record EuroMillions: https://uk.cannacord.com/insights/advice-for-lottery-winners-six-things-they-must-do-if-they-win-the-record-euromillions[3] Financial Times - What lottery winners should know about wealth management: https://www.ft.com/content/5893da6c-3a8a-11e9-8640-e2c24ce76f0e[4] MoneySavingExpert - Lottery winners, what would you do? https://www.moneysavingexpert.com/deals/polls/lottery-winners-what-would-you-do/

- With such a life-changing sum, managing financial decisions wisely is crucial, and one might consider seeking advice from a wealth manager to ensure efficient use of funds.

- Apart from paying off the mortgage and investing in real estate or personal-finance opportunities, it's essential to think about long-term savings and pensions for a secure lifestyle in the future.

- Gifting to family and friends can bring immense joy, but it's important to be mindful of the inheritance tax implications in the UK, which may mean setting aside funds to cover any potential tax liabilities.

- Charitable donations can offer tax benefits, and a wealth manager can help identify well-established causes to maximize tax efficiency while positively impacting the lifestyle of others.