United States Contemplates Imposing Maximum Tariffs of Nearly 35,200%

A Brand-New Take on Way-High Tariffs on Southeast Asian Solar Panels

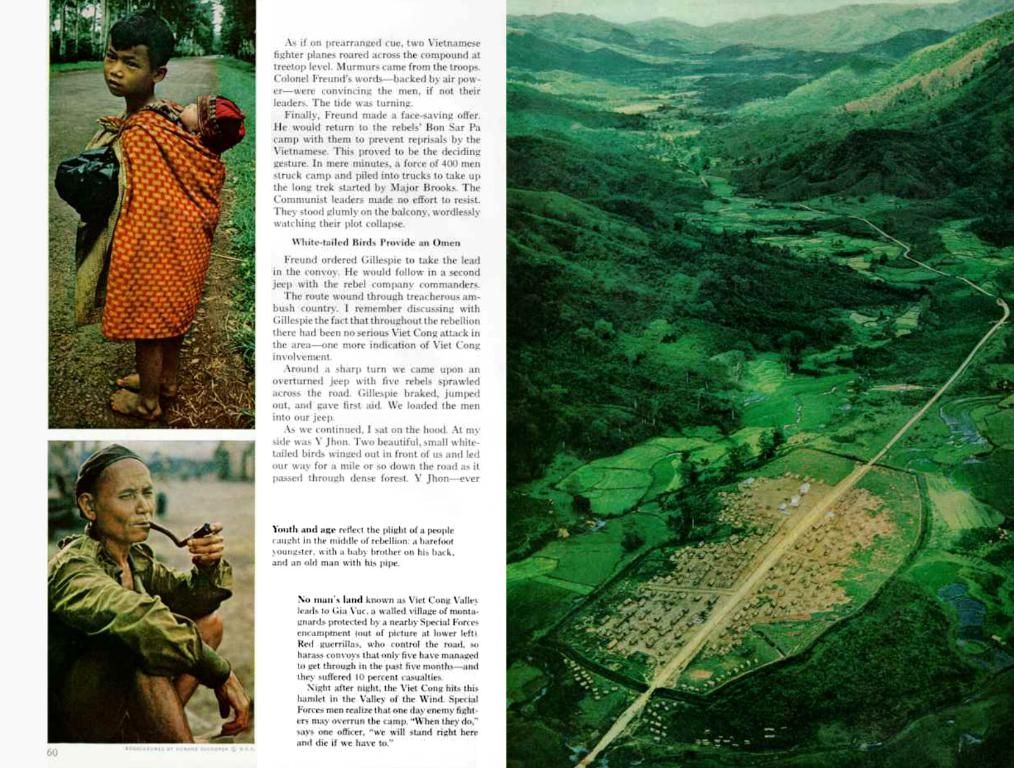

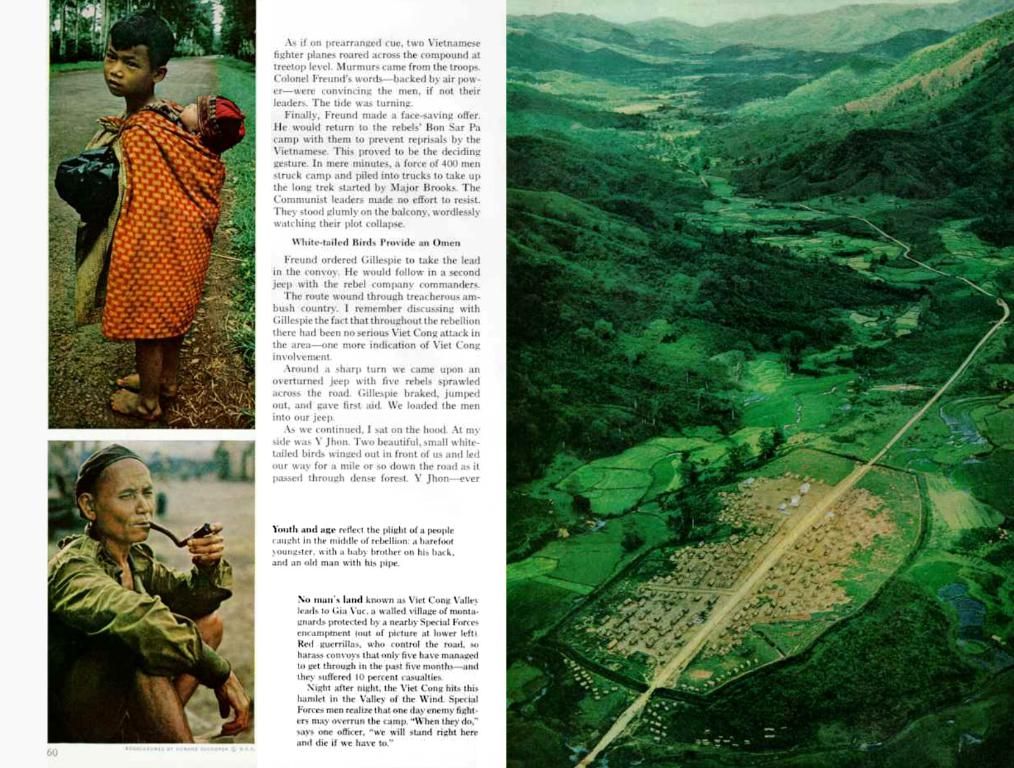

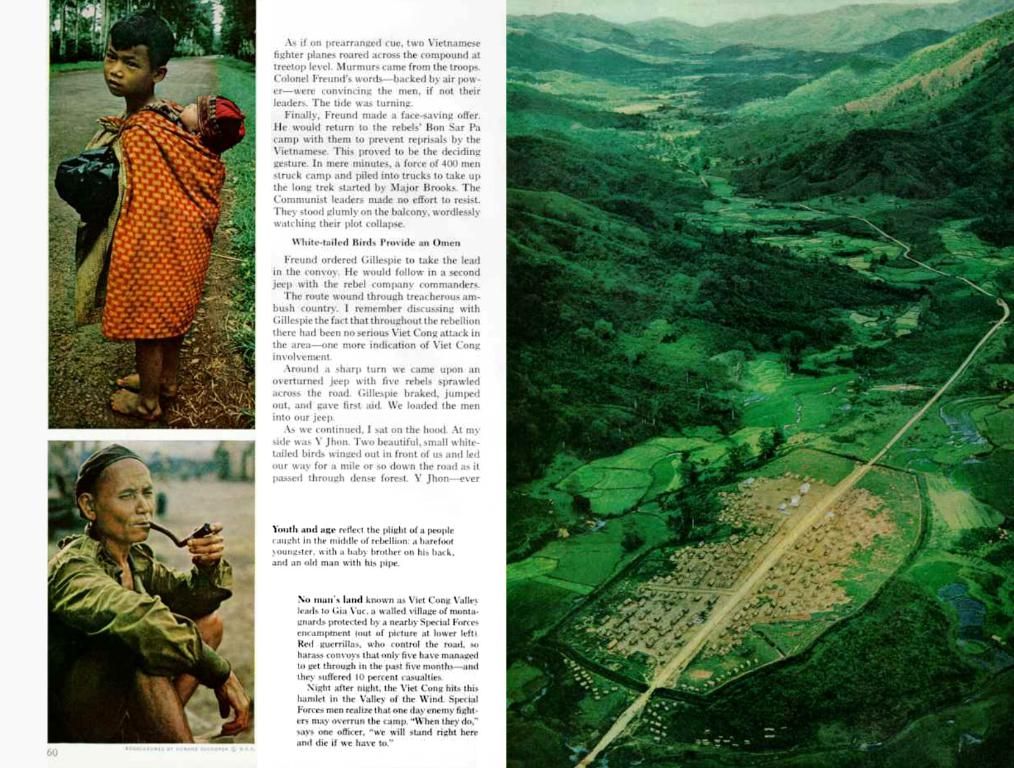

Get ready, folks! The U.S. administration has thrown a curveball in the technology world. This time, the focus is on solar panels imported from Cambodia, Malaysia, Thailand, and Vietnam, with proposed import taxes that could soar up to an astounding 3521%.

Got your attention? Let's dive in! The source of this fascinating development stems from a thorough investigation conducted by the International Trade Administration (ITA), an arm of the U.S. Commerce Department, back in April 2024. The investigation concluded that these Southeast Asian solar producers were reaping Chinese government subsidies in the backdoor, offering their offerings at prices below production costs.

Here's the interesting twist: Those Cambodian companies Hounen Solar and Solar Long PV-Tech will face the steepest tariffs—a whopping 3521%, leading to taxes 35 times their products' price. Fun fact: that tariff figure alone would add significant teeth to the jaws of any tax collector!

I bet you're curious about the potential impact: over $12 billion worth of imports were targeted in 2023, according to Commerce Department Intelligence. It seems like this decision won't be switching off the lights just yet.

Now, buckle up, because things get tricky. These tariffs will be added on top of the 10% levies from President Donald Trump imposed in April 2, going back a year. Moreover, it's crucial to mention that Vietnam is in for an additional 38% if we consider the "reciprocal" tariffs announced simultaneously.

What started all this? A petition filed by the American Solar Industry Alliance, composed of key players in the solar sector, accused manufacturers from these Southeast Asian nations of being mere subsidiaries of Chinese companies, receiving undisclosed Chinese subsidies. Now that's some fascinating political intrigue!

It seems like the U.S. is once again shaking up global trade dynamics, causing ripples in international relations.

Background: The proposed tariffs align with a trend, as former President Trump had previously imposed tariffs on Chinese solar imports, reaching up to 145%. Interestingly, current tariffs mirror this approach to address similar issues in Southeast Asia, where companies, linked to Chinese firms, are believed to bypass existing restrictions through regional assembly lines.

Now let's talk impact:- Economic Impact: With the tariffs advantageous for local solar manufacturers like First Solar and Hanwha Qcells, heightened competition for cheaper imports will be reduced.- Consumer Impact: On the flip side, opponents argue that these tariffs may cause solar panel prices in the U.S. to skyrocket, potentially slowing the adoption of solar energy.

World affairs: Trade tensions have been escalating, with China retaliating by slapping its own tariffs on U.S. products. This seesaw could continue, leading to further escalations and strained international trade relations.

Lastly, the stock market: Indian solar companies, such as Premier Energies and Waaree Energies, are basking in gains as investors bet on potential future opportunities in the global market.

- The International Trade Administration (ITA) concluded that solar producers in Cambodia, Malaysia, Thailand, and Vietnam were receiving Chinese government subsidies, leading to proposed import taxes that could reach an astonishing 3521%.

- Hounen Solar and Solar Long PV-Tech from Cambodia will face the steepest tariffs, amounting to a massive 3521%, nearly 35 times their product's price.

- In 2023, over $12 billion worth of imports were targeted, indicating that the decision won't completely switch off the solar panel market.

- President Donald Trump had previously imposed 10% levies on solar imports in April 2023. These new tariffs will be added on top, making the total significantly higher.

- Vietnam will face an additional 38% in tariffs if we consider the "reciprocal" tariffs announced simultaneously. This political intrigue is driven by a petition filed by the American Solar Industry Alliance.

- The new tariffs aligned with a trend set by former President Trump, who imposed tariffs on Chinese solar imports, reaching up to 145%. This approach is now being used to address similar issues in Southeast Asia, where companies are believed to be bypassing existing restrictions through regional assembly lines.

![Unveiling: Explicit Details Disclosed on [Person's Name]'s Controversial Activities U.S. Government Plans to Impose Steep Tariffs on Southeast Asian Solar Panels, Aiming to Counteract China's Favorable Policies for the Industry in Affected Regions, with Tariff Rates Set as High as 3521%](https://capitalvue.top/en/img/2025/04/24/1111434/jpeg/4-3/1200/75/the-following.webp)