Title: Should You Buy, Sell, or Hold LLY Stock at $750?

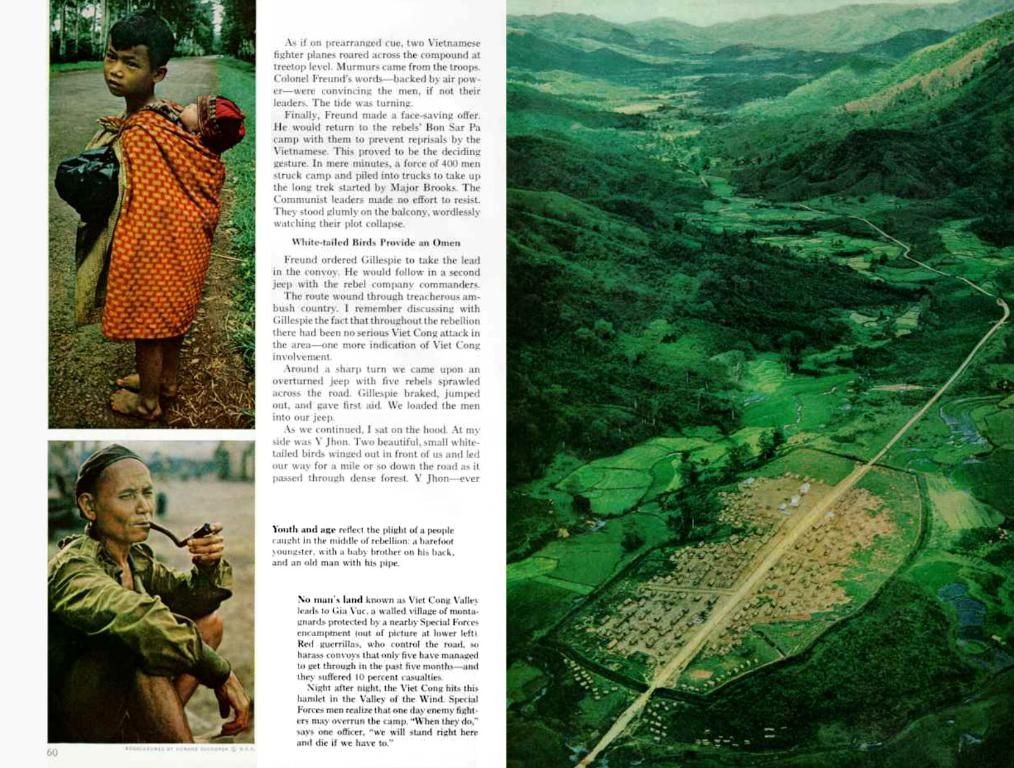

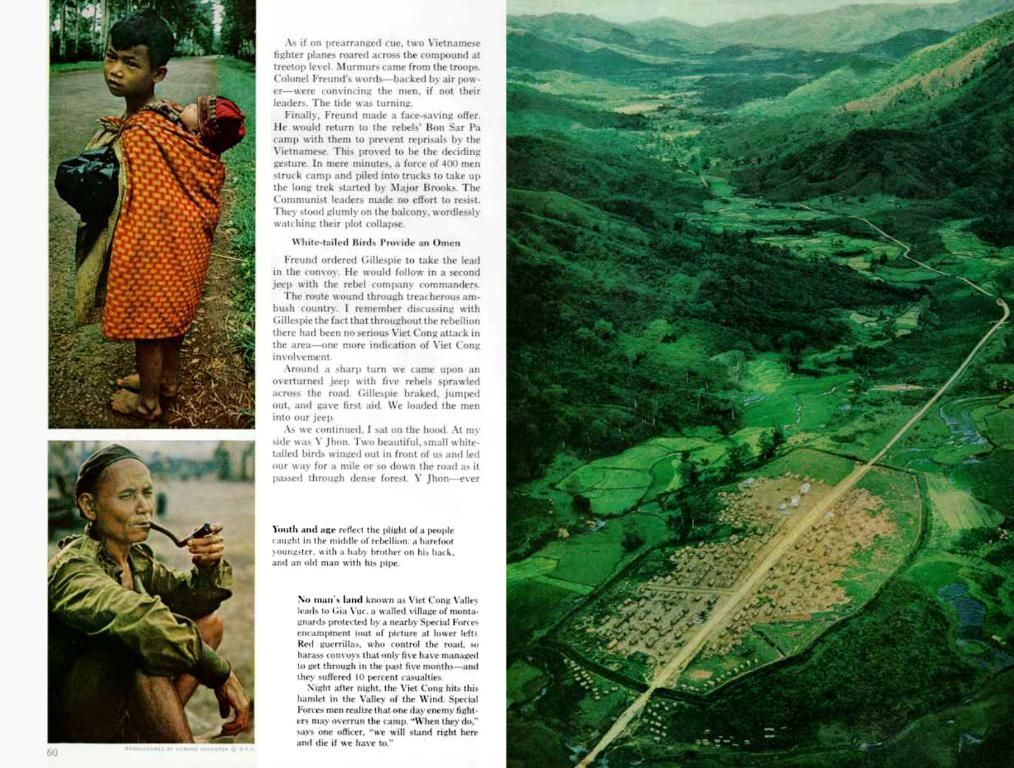

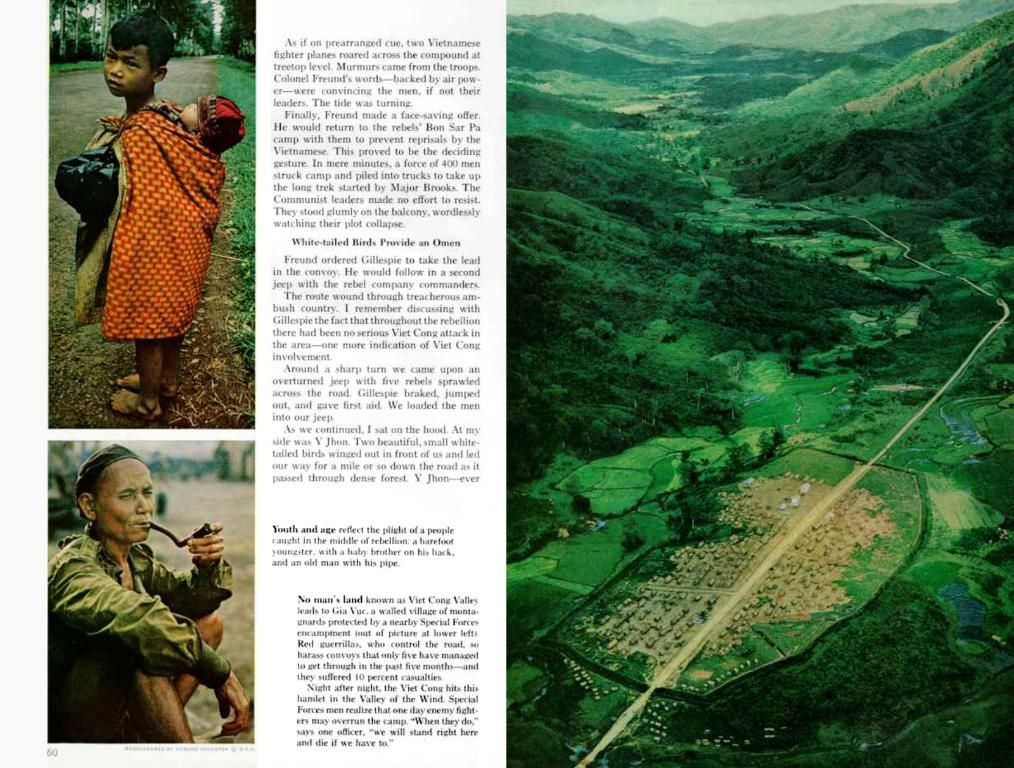

Eli Lilly's shares took a dip of over 6% on January 14, 2025, as the pharmaceutical giant revealed that the growth of its obesity drugs was not as swift as anticipated. Consequently, the company adjusted its Q4 revenue estimate downward by 5% to $13.5 billion, falling $500 million short of analyst predictions. For the full year 2025, Lilly projected revenues to reach $45 billion, demonstrating a 32% growth over 2024 levels. However, this falls short of the $45.4 billion consensus estimate.

Investors seemed unimpressed by this development, resulting in the stock slide. Yet, this downturn might present a promising opportunity for long-term investors, given Eli Lilly's robust outlook for 2025. The company's top-line is expected to fall within the range of $58 billion to $61 billion, which represents a 32% growth at the midpoint, surpassing the anticipated 2024 revenue of $45 billion.

Eli Lilly has enjoyed substantial success recently, primarily due to the high demand for its obesity and diabetes drugs, such as Zepbound and Mounjaro. Lilly's extensive pipeline also includes drugs undergoing clinical trials in various therapeutic areas. Looking ahead, the company may get regulatory approval for another weight-loss drug, orforglipron, as early as 2026. This, coupled with anticipated market share gains and the launch of weight-loss drugs in new markets, is likely to bolster Eli Lilly's sales for the future.

Investors seeking more stability and higher returns may find solace in the *High-Quality Portfolio, which has consistently outperformed the S&P 500 since its inception, delivering over 91% returns.

Why does the High-Quality Portfolio thrive? Partially due to the fact that HQ Portfolio stocks yield better returns with reduced risk compared to the benchmark index. This is reflected in the HQ Portfolio performance metrics.

The current volatile macroeconomic climate, marked by uncertainties in interest rates and geopolitical tensions, might provide an ideal setting for LLY to rebound. With a promising 2025 outlook and solid growth potential in the years to come, the current dip in LLY shares presents an enticing opportunity for long-term investors. Industry analysts' average price estimate of $985 signifies an approximately 30% increase from current levels.

Comparisons of Lilly's performance with its peers can be found in the *Peer Comparisons* section.

Invest in Trefis *Market Beating Portfolios*.

Discover all Trefis *Price Estimates*.

Sources:

- Eli Lilly Press Release, 2025

- Eli Lilly Earnings Call Transcript, 2025

- FactSet, 2025

- Thomson Reuters, 2025

Despite the temporary dip in Eli Lilly's shares due to slower growth in obesity drug sales than anticipated, the company remains optimistic about its future. With the potential regulatory approval of another weight-loss drug, orforglipron, in 2026 and market expansion, Lilly's Mounjaro and Zepbound obesity and diabetes drugs are expected to bolster its sales. Additionally, Eli Lilly's valuation, currently undervalued according to analysts, might increase, as indicated by the average price estimate of $985.