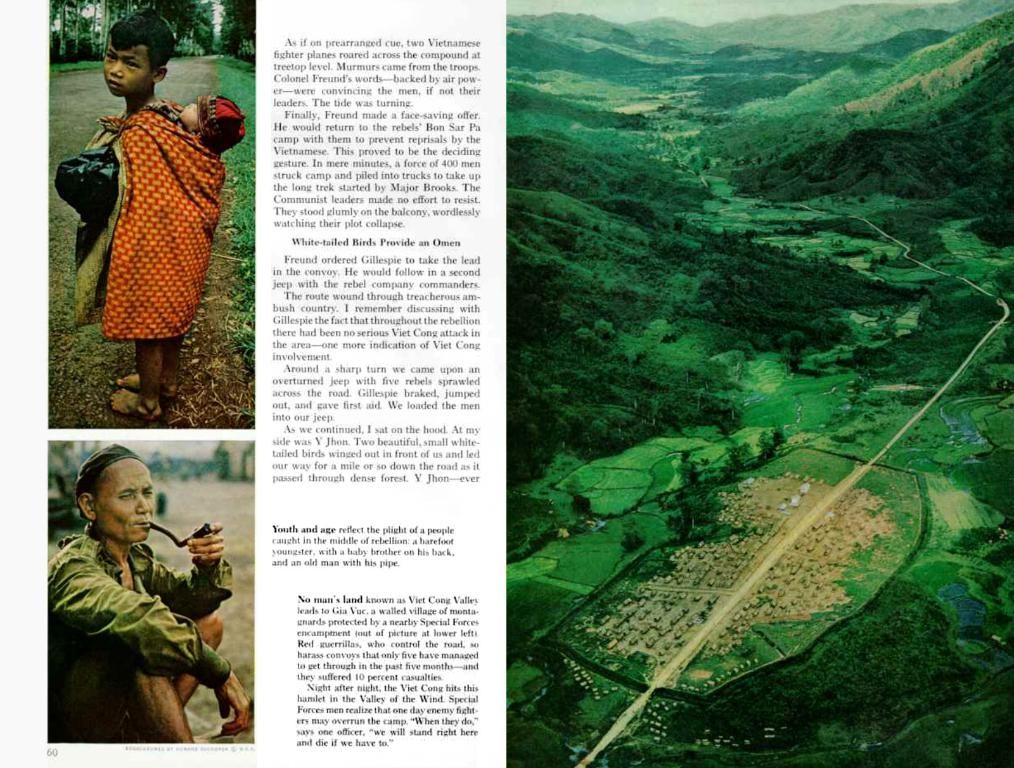

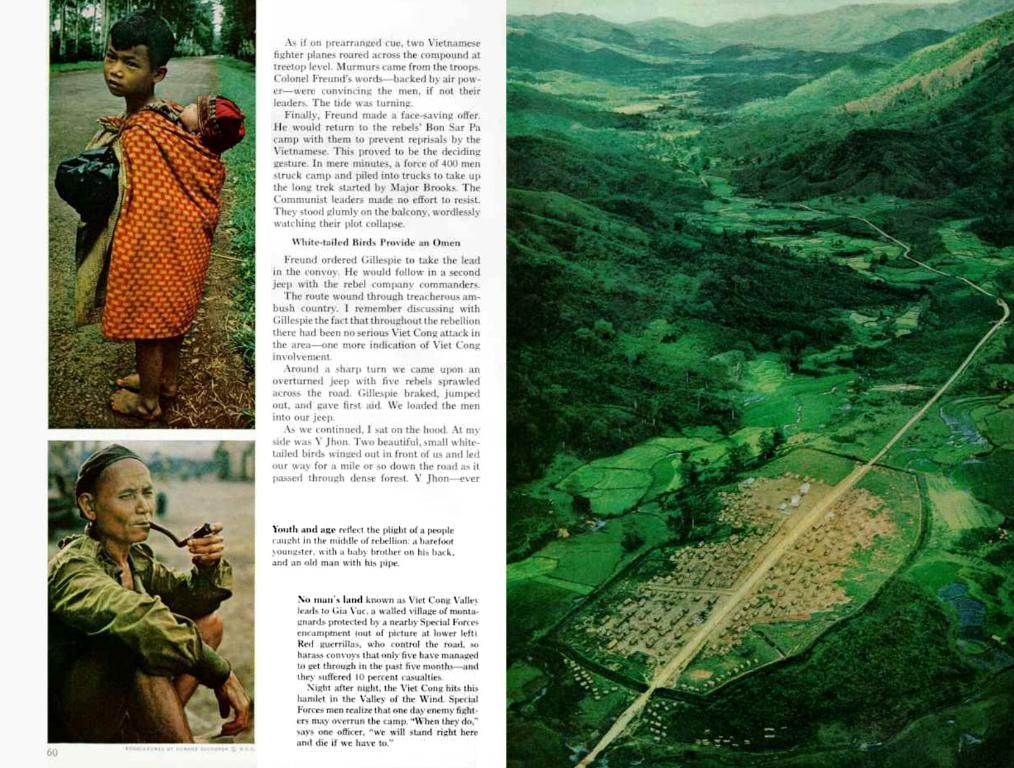

The "clandestine CAC 40", secretive companies governed by French moguls

Let's unravel this billion-dollar puzzle (roughly $1.7 trillion euros)! Since April 23rd, Marguerite Béard, 47, ex-BNP Paribas' agency network chief, has been helming Dutch bank ABN Amro. What's the connection between this bank and the list of big names we're about to drop?

Let's dive into some famous American brands first: Estée Lauder, Ralph Lauren, Tory Burch, Michael Kors, Neutrogena, and Bloomingdale’s department stores. Then there's a bunch of pharmaceutical heavyweights: AstraZeneca, UCB, LEO Pharma, Takeda, Moderna, Kenvue, Incyte. Don't forget the German Nivea-Beiersdorf, Swiss Nestlé, Italian insurance giant Generali, Belgian defense and industrial equipment manufacturer John Cockerill, Swiss temp agency Adecco, British retailer Kingfisher, Chinese JD Sports, and the elevator kings Kone. We've also got Dutch company ASML, whose tech wizardry prints no electronic chip, and two tech darlings: Expedia, ruling the online travel agencies (like Hotels.com, Abritel...), and Instacart, the top dog for U.S. grocery delivery. Last but not least, a bunch of "unicorns" (startups worth over $1 billion): Datadog, Snowflake, F5, Front, Upgrade, Hugging Face, Deel...

You only missed out on reading less than 13% of this article. The rest is reserved for those who subscribe.

Insights: These companies all sit atop their respective industries as powerhouse, multinational corporations. Though the search results only explicitly name ABN Amro, Ralph Lauren, and PepsiCo (not listed in the query but included in the search results)[5], these listed companies share common traits:

- Leading the pack: Representing industries from banking (ABN Amro) to fashion (Ralph Lauren, Michael Kors), pharmaceuticals (AstraZeneca, Moderna), consumer goods (Nestlé, Neutrogena), tech (ASML, Datadog), and retail (Bloomingdale’s, JD Sports).

- Global domination: Most operate internationally, boasting substantial market capitalizations (e.g., ASML’s $350B+ valuation, Moderna’s $40B+ post-pandemic growth).

- Strong brand loyalty: Companies like Estée Lauder, Tory Burch, and Nivea garner fanatical customer devotion.

- Industry variety: Covering luxuries, biomedicine, logistics, fintech (Deel, Upgrade), and cloud computing (Snowflake).

The focus on these companies seems to revolve around large-cap multinationals frequently found in financial analyses or investment portfolios[5]. The lack of common ownership or activism ties (e.g., AdRespect’s LGBTQ+ campaigns apply to IKEA and PepsiCo but not others)[1][3][5] suggests that their primary shared trait is corporate prominence.

- The powerhouse, multinational corporations like Estée Lauder, AstraZeneca, and Neutrogena, who lead various industries such as fashion, pharmaceuticals, and consumer goods, respectively, share common traits, including strong brand loyalty and global domination.

- These companies, including Dutch bank ABN Amro and American brand Ralph Lauren, operate across diverse sectors including banking, fashion, pharmaceuticals, tech, and retail, and are often found in financial analyses and investment portfolios.

- The conspicuous absence of common ownership or activism ties among these companies suggests that their primary shared trait is simply their corporate prominence that places them as key players in their respective industries.