Tax Dispute Between Labour Party and Inheritance Tax Remains Unresolved, Continues to Cause Stir

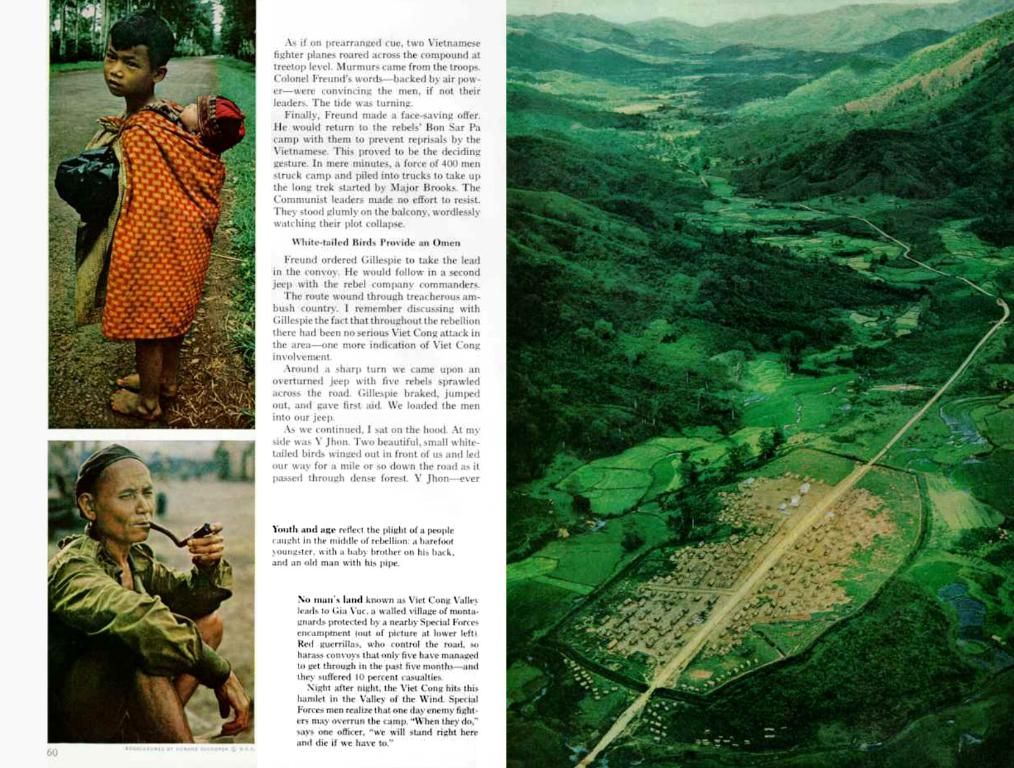

Farmers and politicians were taken aback when tractors roared into Parliament Square, led by the catchy tune of Aqua's Barbie Girl, demanding a halt to the government's controversial inheritance tax (IHT) reforms. As of November, this grassroots movement had gained some high-profile supporters like Jeremy Clarkson.

These new IHT rules, introduced in the Autumn Budget, aim to change the way businesses and farms are exempt from these taxes. From April next year, only up to £1m of farming and business assets will be fully exempt, with the relief slashed to 50% for any additional assets.

Tory's Troubles with IHT

The crux of the controversy lies in claims that the tax unfairly targets small, family-owned businesses and farms that contribute to the "community fabric," as head of tax, investigations, and financial crime at RPC Law Firm, Adam Craggs, expressed to City AM. Less than a month ago, the National Farmers Union (NFU) published an open letter to Chancellor Rachel Reeves, urging the measure's retraction, with NFU President Tom Bradshaw stating, "the family farm tax is... unfit to become legislation and is triggering a crisis of confidence across the farming sector."

The Tories have branded the IHT as "punitive" and detrimental to growth. In a recent statement, Shadow Business Secretary Andrew Griffith said, "this policy will carve up successful enterprises as they are handed down to the next generation," while promising his party would reverse the "vindictive" tax at the earliest opportunity, claiming it penalties "risk takers and wealth creators."

The Confederation of British Industry's economic consultancy arm, CBI Economics, maintains that the tax could cost the UK 200,000 jobs, and instead of raising £1.8bn in tax revenue as promised, would result in a net fiscal cost of £1.9bn.

Tory MP Edward Leigh questioned the government's logic: "I cannot understand why they are focusing on family farms." Jeremy Clarkson, a well-known farmer and TV personality, stated in 2021 that avoiding inheritance tax was vital in his decision to purchase a farm; however, he later retracted this statement in 2024, according to BBC reports.

Defending the Tax

Government officials argue that the majority of businesses and farms will remain unaffected by these reforms. A Treasury spokesperson said, "our reforms to Agricultural and Business Property Reliefs will mean three-quarters of estates will continue to pay no inheritance tax at all, while the remaining quarter will pay half the inheritance tax that most estates pay."

Treasury Minister James Murray claimed that while IHT "advantages" for owners of agricultural and business assets will be slashed, they will still be taxed at a "much lower" effective rate of 20% compared to the 40% charged on most other assets. Murray added, "We want to continue supporting small and family-owned farms and businesses in particular."

The IHT reforms can also be viewed in the context of the government grappling with a so-called "£22bn black hole" in public spending, as Chancellor Rachel Reeves mentioned in her recent speech. The government expects to collect £500m a year through these reforms, though the Confederation of British Industry analysis indicates they would instead cost the Treasury £1.9bn by the end of the decade.

Possible U-Turn Unlikely

Despite Labour acquiring a reputation for reversing unpopular policies under pressure, expert Adam Craggs suggests a full U-turn seems unlikely, as the government appears committed to reforming what it sees as a generous relief. However, continued opposition from professional bodies and small business owners could lead to amendments, such as introducing "transitional reliefs, tapering for the elderly, or inflation-linked adjustments."

Disrupting Succession Plans and Local Economies

The tax is criticized for upending lengthy succession plans that have been in the works for decades. Elderly business owners, particularly those in poor health, may struggle to restructure their estates before the changes take effect, as the proposed reforms risk forcing businesses to be sold off to meet inheritance tax liabilities, which could damage local economies.

"The threat of businesses being sold off to meet IHT liabilities risks damaging local economies and the fabric of rural communities," Craggs explained.

The Lib Dems' Position

The IHT reforms could potentially "sound the death knell for local farmers and the small businesses that rely on them," the Liberal Democrats claimed. Although they seem to align with the Conservatives on this issue, the Liberal Democrats seek to emphasize their independence.

Steff Aquarone, a Liberal Democrat MP, explained, "It's a stretch to say that IHT is bad for business, unless it creates an existential threat because of sudden changes impacting a specific sector, like farming."

A Bolder Approach from Reform UK

Reform UK has opted for a more radical solution: scrapping IHT entirely. This move has garnered support among over 60% of Reform UK voters. Nigel Farage, Reform UK leader, denounced the tax as "unpleasant," stating, "they've just lost their parents, and suddenly the taxman is after them." Deputy Leader Richard Tice labeled IHT a "double tax," declaring his party's intention to abolish it if they win the next election. Scrapping the tax entirely would result in a loss of £9.1bn to the exchequer, representing just under 1% of the total government budget.

Debates Over Paperwork and Enforcement

Critics fear that these reforms will lead to increased bureaucracy and litigation, potentially causing delays in HMRC enforcement and years of disputes for families and businesses.

"This reform is likely to lead to an increase in intrusive and protracted HMRC enquiries and litigation before the tax tribunals," Craggs said.

According to Price Bailey, HMRC is already dealing with a third more inheritance tax enquiries compared to the previous year, illustrating businesses' struggle to comprehend the implications of the changes. "Valuation, the prospect of double taxation, the timing of gifts, and arguments over active trading status, will all become fertile ground for challenge," Craggs added.

With the proposed changes facing strong opposition, it remains to be seen whether the government will consider the concerns raised by various sectors and make adjustments to their inheritance tax reforms.

- The inheritance tax (IHT) reforms, introduced by the government, aim to change the exemptions for businesses and farms from these taxes, but the changes have met criticism, especially from the farming sector.

- Investors like Jeremy Clarkson have shown support for the grassroots movement opposing the IHT reforms, which target family-owned businesses and farms.

- The Tories claim that the IHT is punitive and detrimental to growth, while Adam Craggs, head of tax at RPC Law Firm, expressed concern that the tax could disadvantage small, family-owned businesses and farms.

- The government claims that the reforms will only affect a quarter of estates, with the rest remaining exempt, while still being taxed at a lower rate compared to most other assets.

- The Liberal Democrats suggest that the IHT reforms could harm local economies, particularly farmers and small businesses, while Reform UK proposes a more radical solution: scrapping IHT entirely.