Stock exchanges in the U.S. experience declines: Drop for Dow Jones Industrial Average, S&P 500, and Nasdaq Composite - Pressure mounts for Nvidia and Advanced Micro Devices (AMD)

The U.S. stock markets ended the day on a sombre note, with all major indices closing in the red on Monday. The S&P 500 was down 0.3 percent, hovering around 6,375 points, while the Dow Jones Industrial Average closed at 43,975 points, a decline of 0.5 percent. The tech-heavy Nasdaq also saw a dip, with the Nasdaq 100 calculated at around 23,525 points, down 0.4 percent.

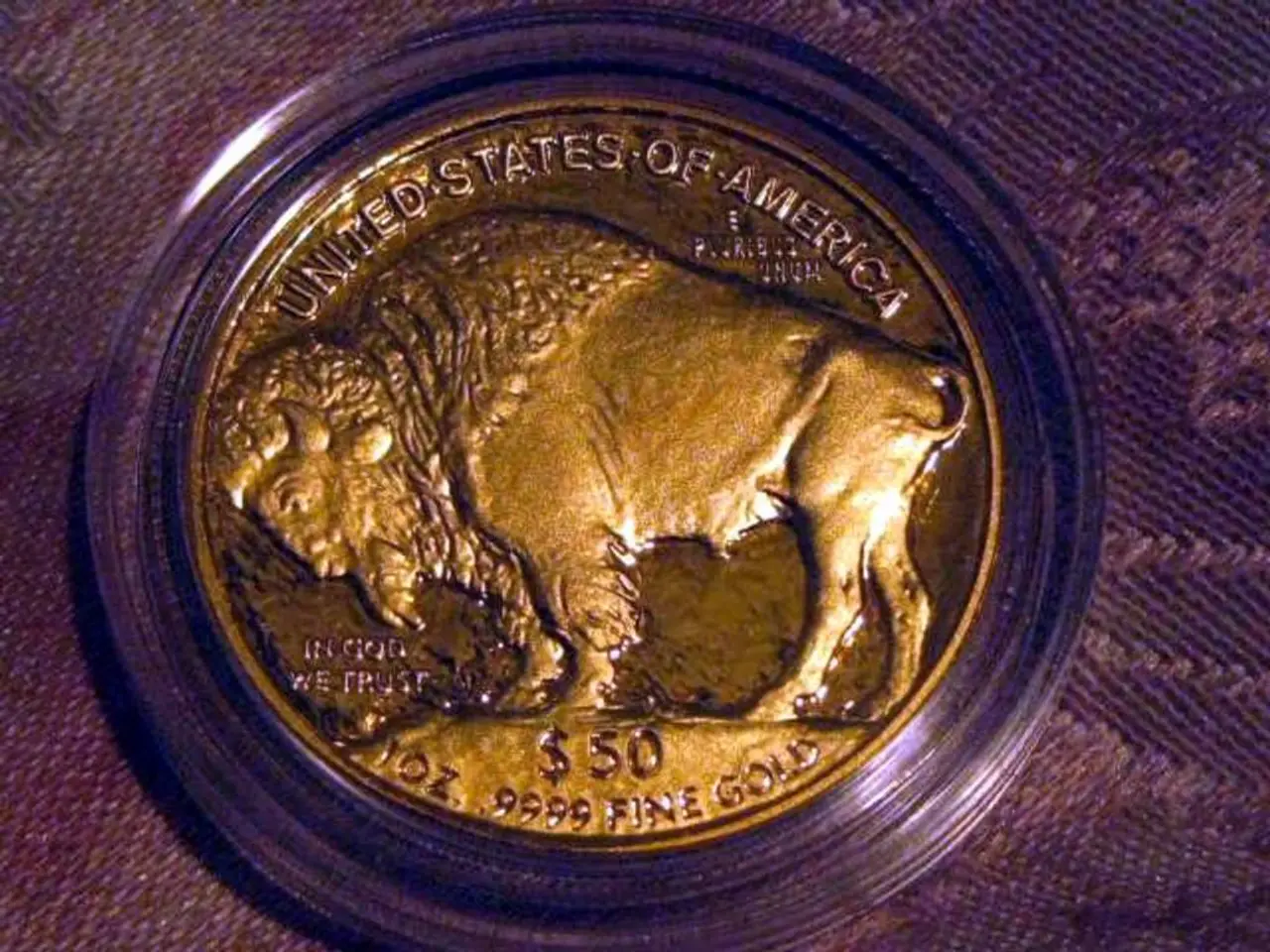

The price of a barrel of Brent crude oil saw a minor increase, rising by 17 cents or 0.3 percent from the close of the previous trading day, reaching $66.76 at 10 pm German time. Contrastingly, the price of gold took a significant hit, with an ounce of gold trading at $3,351, a decrease of 1.4 percent.

The weakening of the European common currency was also observed on Monday evening, with one euro costing 1.1603 US dollars. Notably, U.S. President Donald Trump announced that he would not impose tariffs on gold.

In a surprising turn of events, U.S. President Trump postponed the planned 100 percent tariffs on China by another 90 days. This decision may have had a ripple effect on the markets, as uncertainty surrounding trade tensions between the two economic powerhouses has often been a cause for concern among investors.

In the tech sector, both Nvidia and AMD closed in the red. It was recently reported that these companies have agreed to hand over 15 percent of their revenues from the sale of their advanced chips to the U.S. government. The impact of these revenue agreements on the companies' stock prices is yet to be fully understood, and further details are awaited.

As always, market movements can be influenced by a multitude of factors, and the current information available does not provide a definitive explanation for the stock market declines experienced on Monday. For a more accurate analysis, additional data or reports on Monday’s market activity, as well as recent news regarding these companies' financial agreements and trade developments, would be beneficial.

Financing for technology companies might be affected by the agreement to hand over a portion of their advanced chip revenue to the U.S. government, potentially influencing future investing decisions in the stock market. The stock market's decline on Monday could be linked to the ongoing trade tensions between the U.S. and China, as the postponement of proposed tariffs doesn't completely alleviate uncertainty in the market.