Mayhem in the German Market: Uncertain Times Ahead for Siemens

Siemens Remains Steady Amidst Volatile Conditions

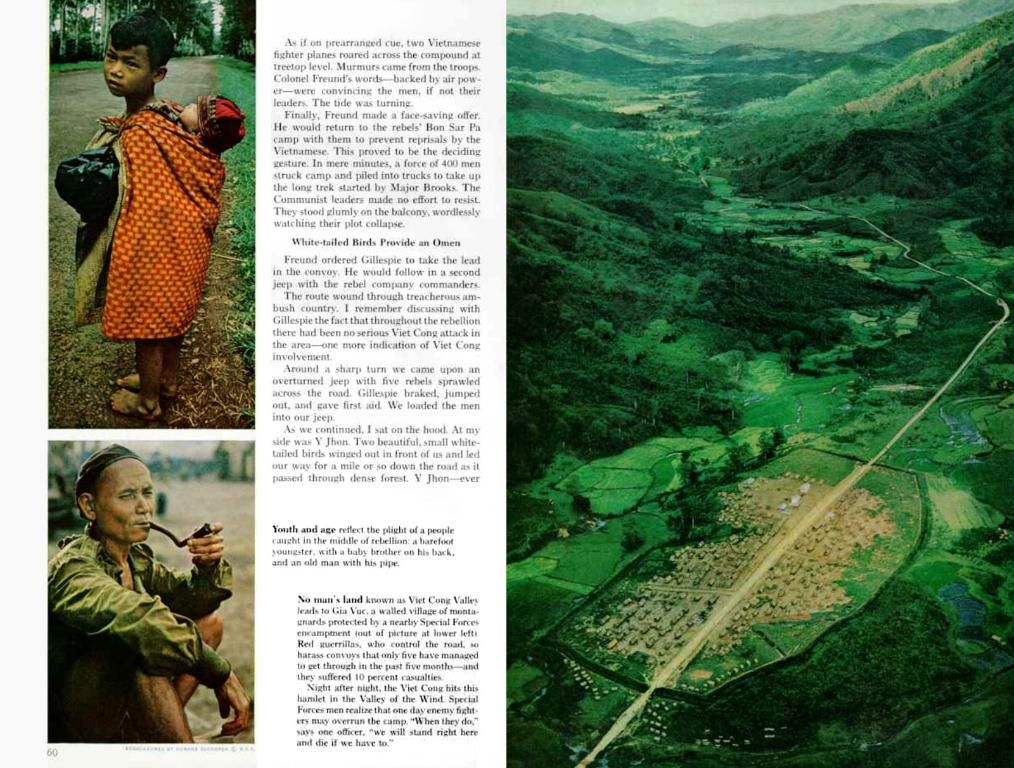

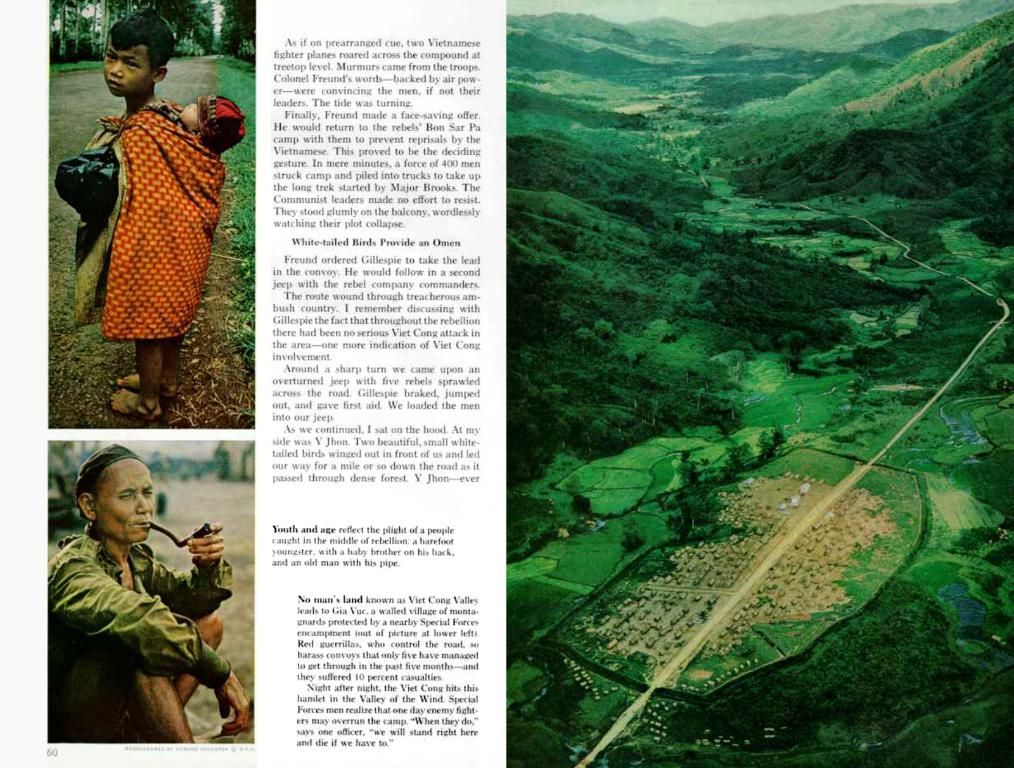

It's a turbulent ride for German industries, with the customs clash causing unheard-of chaos. Siemens, a beacon of Germany's export business model, is under the microscope as investors eagerly await its half-year results on May 15th. The second quarter was expected to sail smoothly, but the new trade barriers have got everyone on edge.

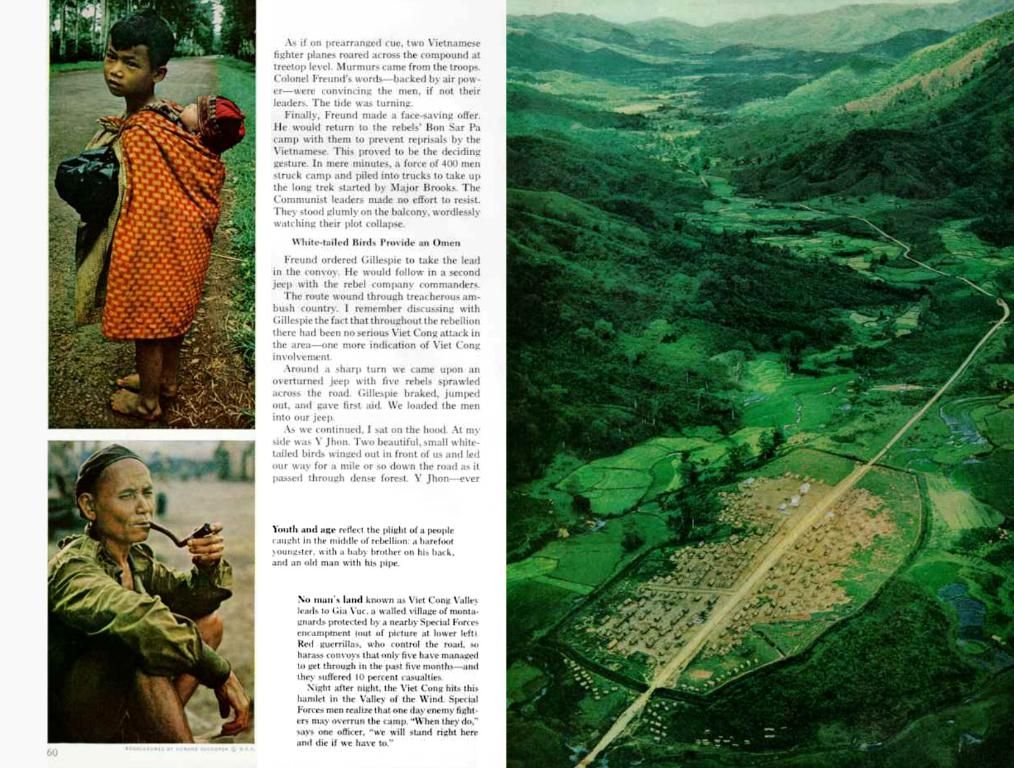

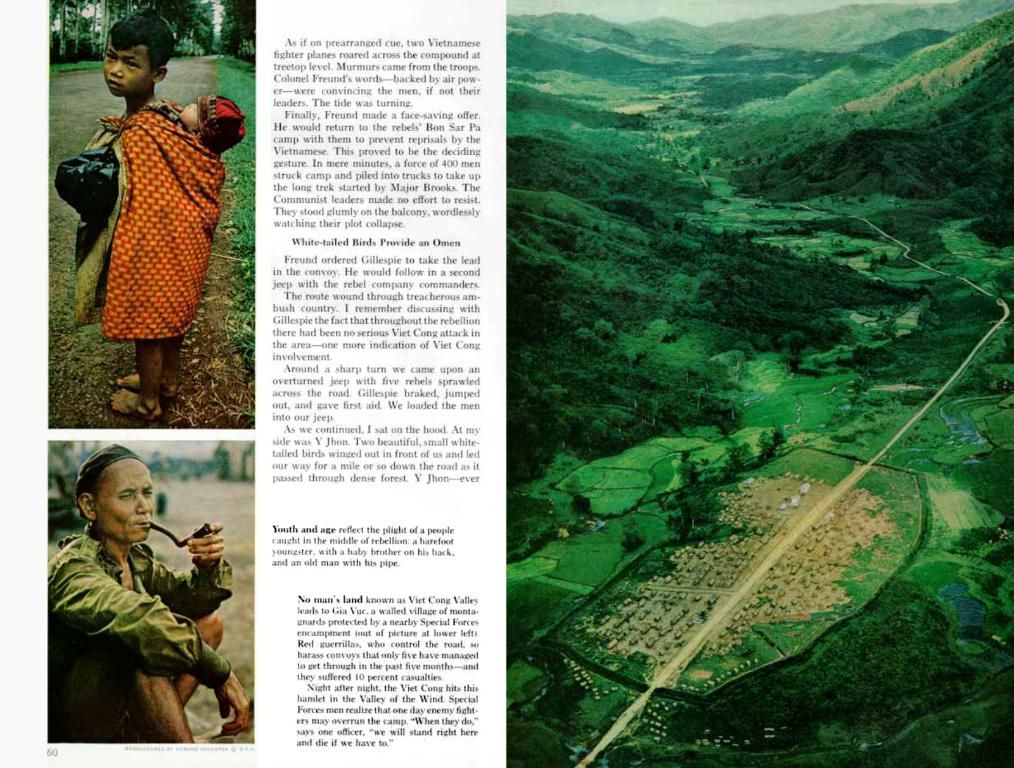

By Mike F., Munich

Quarterly presentations aren't just about crunching numbers; they're also predicting the future. With the current trade barriers causing a stir, investors are hoping to gauge the impacts on Siemens when its CEO, Roland Busch, and CFO, Ralf Thomas, shed light on the company's half-year results on May 15th. They'll be eyeing closely: How is the Siemens world coping under President Donald Trump's reign?

Forecast take center stage

It's no secret that Siemens can't afford to mince words about investing billions in the US. The repercussions aren't simple. The forecast for the current fiscal year needs to be meticulously calculated – even if CFO Thomas hinted in late March that he wasn't planning to alter the forecast. But times have changed since then.

Manufacturing boost from new factories

Predicting the effects beyond the current fiscal year is challenging. On one hand, reduced global trade might cast a shadow on Siemens. On the other, the company stands to gain by selling oodles of equipment to customers worldwide who are building new factories to manufacture locally.

The motive behind the Dotmatics and Altair acquisitions for around 15 billion euros doesn't seem to be called into question just because both companies hail from the US. It's not Trump's erratic policies that dictate the strategic success, but the growth achieved through the acquisitions. With high multiples – in Dotmatics' case, the price is 16 times the revenue – management has some persuading to do.

Buckles under the Dollar

In the short term, Siemens does bear the brunt of US politics. The weak dollar bites as Siemens is a net exporter from the Eurozone to the rest of the world. The euro's strength will likely make itself felt in the third quarter. By the end of September 2024, the risk against the euro was hedged with a course of 1.25 euros/dollar through forward transactions. It also stings that Siemens' main customer, the automotive industry, is struggling under the trade policy. Around a fifth of the revenues of the Digital Industries segment come from this source, followed by mechanical engineering with 15%. Siemens' customers, once brimming with expansion ambitions, now appear hesitant. The planned job cuts are a hot topic of discussion.

Looking on the bright side, the recovery of the China business of Digital Industries might be underscored positively on May 15th. Thomas hinted to investors at the end of March that the second quarter had gone as planned. Analysts anticipate an average revenue growth of 3.8% to 19.6 billion euros and an operating result of 2.8 (i.V. 2.5) billion euros in the industrial core business.

Insights:

- Resilience in Uncertainty: Siemens has shown a knack for persevering in uncertain economic conditions, thanks to its global reach and diverse business activities.

- Segment Sensitivities: Siemens' business segments, Smart Infrastructure (SI) and Digital Industries (DI), respond differently to economic conditions. SI performs well in times of heightened demand for electrification and infrastructure projects, while DI might face cyclical challenges in demand.

- Financial Strength: Siemens typically delivers solid financial results, with a focus on profitability and growth, regardless of economic uncertainties.

Hypothetical Impact on Siemens:

- Trade Tensions: These could have led to delayed investment decisions by customers, affecting order intake and revenue growth.

- Trump's Policies: The specific consequences would hinge on policies affecting global trade and economic relations, which might impact Siemens' supply chains and customer confidence.

- Despite the unpredictability of the current trade situation, investors and analysts are closely monitoring Siemens' finance and business strategies, particularly in regards to the impact of President Donald Trump's policies, as the company prepares to reveal its half-year results on May 15th.

- In the face of potential challenges posed by trade barriers and changes in foreign exchange rates, Siemens continues to engage in significant financial ventures, such as the acquisitions of Dotmatics and Altair, demonstrating the industry's commitment to growth and expansion, regardless of external factors.