Searching for Optimal Home Loan Refinancing: Discovering Suitable Mortgage Providers that Align with Your Preferences

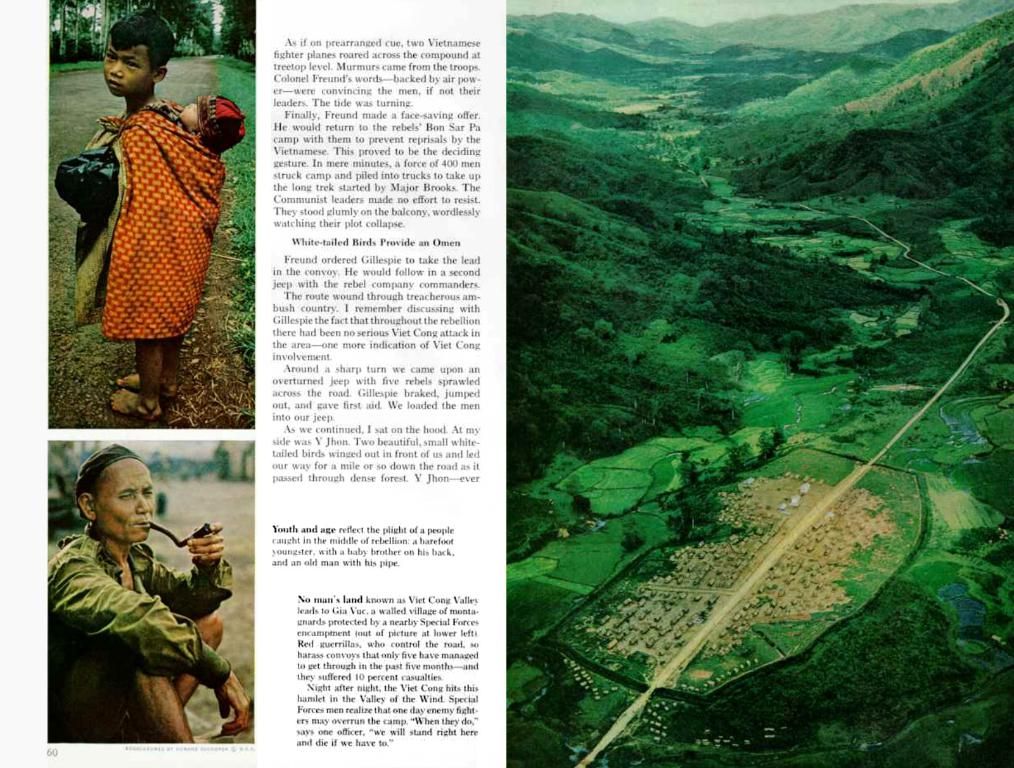

Looking to shake up your home loan in sunny Puerto Rico? Home refinancing could be your ticket to better loan terms, more manageable monthly payments, and a chance to tap into your home's equity.

In the hunt for a financial breath of fresh air, many homeowners in Puerto Rico contemplate if their current loan is still the one for them. With the right refinancing moves, you can say goodbye to high interest rates, hello to lower monthly payments, or enjoy the freedom of accessing your home's equity. But how do you find the best mortgage lenders in Puerto Rico to help you navigate this financial journey?

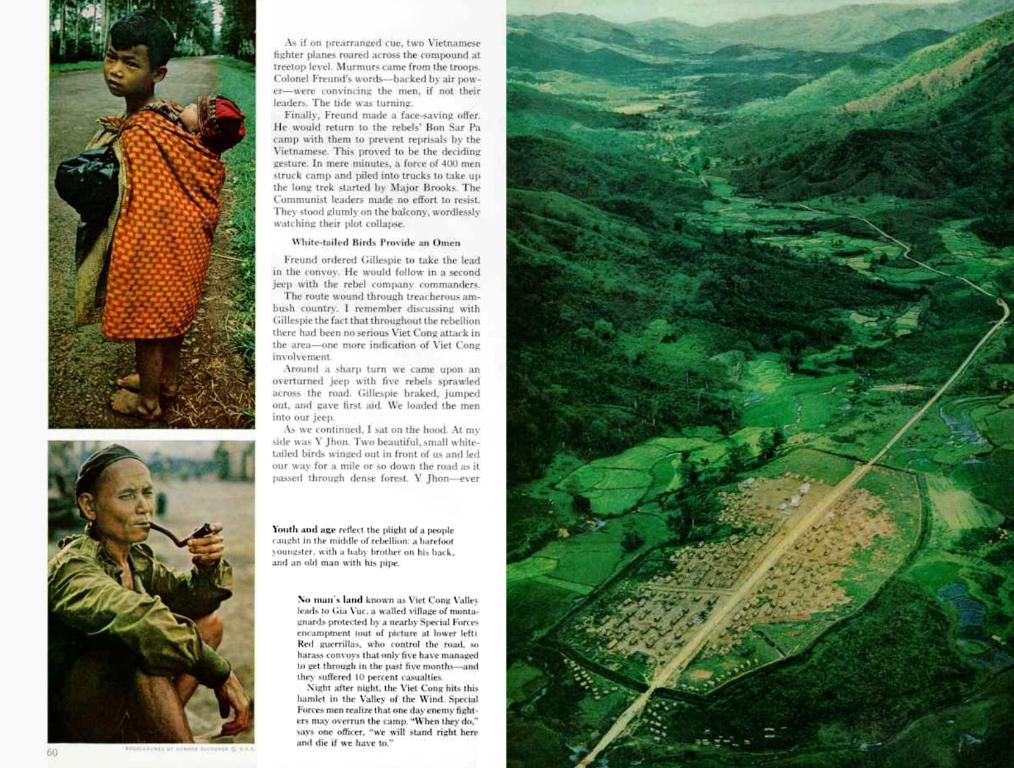

What's the deal with mortgage refinancing?

Mortgage refinancing is all about swapping your existing home loan with a spanking new one. The fresh loan pays off the old mortgage, offering new interest rates, terms, and monthly payments that benefit the borrower.

So, why refinance in Puerto Rico? Here are a few common reasons:

- Savvy savings on interest: Lower interest rates mean fewer monthly payments — it's that simple!

- Shedding the burden sooner: By reducing your loan term, you'll pay off your mortgage quicker.

- Lock in a fixed-rate mortgage: Tired of adjustable rate mortgages that keep you guessing? Switch to a fixed-rate mortgage and enjoy stable payments.

- Cashing in on equity: Access funds for home renovation, debt consolidation, or other financial needs by leveraging your home's equity.

What's on offer from Puerto Rico mortgage lenders?

From flexible loan terms to bilingual support, mortgage lenders in Puerto Rico have a range of options for homeowners like you.

- Flexible loan terms: Choose from loans with terms of 15, 20, or 30 years, or go for tailored terms suited to your unique financial situation.

- Competitive rates: Puerto Rico's mortgage market mirrors wider U.S. trends, with interest rates influenced by the U.S. Federal Reserve, local market conditions, and your credit score. Compare rates from various lenders for the best deals.

- Government-backed loans: Be it VA, FHA, or USDA loan refinancing for rural homeowners in Puerto Rico, many lenders cater to different preferences and circumstances.

- Special programs: Look for mortgage lenders with low-income borrower assistance or first-time refinancing incentives. For local homeowners in Puerto Rico, housing programs abound where lenders can help with refinancing expenses.

- Bilingual support: With language differences potentially posing barriers, standard mortgage lenders in Puerto Rico offer both English and Spanish services to ensure customers understand their options.

Terms and conditions can vary from one lender to another, so ensure you conduct a thorough comparison before making your decision.

Is refinancing the right move for you?

Refinancing offers benefits, but is it the ideal choice for everyone? Analyze your financial situation carefully, weighing several factors:

- Assess your credit score, check out various loan options and choose the best mortgage lenders in Puerto Rico to secure the best deal.

- Research online directories like Allmortgagedetail.com to uncover the top, experienced, and trustworthy mortgage lenders in Puerto Rico, and engage in detailed discussions about your mortgage refinancing needs.

With the right research and a touch of financial savvy, you'll find the perfect mortgage lender in Puerto Rico to help you tackle your home refinancing goals.

In your personal-finance journey, refinancing your home loan in Puerto Rico could be a viable option to secure better loan terms, reduce monthly payments, or tap into your home's equity. To achieve this, you might want to work with mortgage lenders offering flexible loan terms, competitive rates, and bilingual support—some of the options available in Puerto Rico.