Rhine metal on the brink of change.

Rheinmetall Shares: Potential Volatility Amid Peace Talks and Munich Security Conference

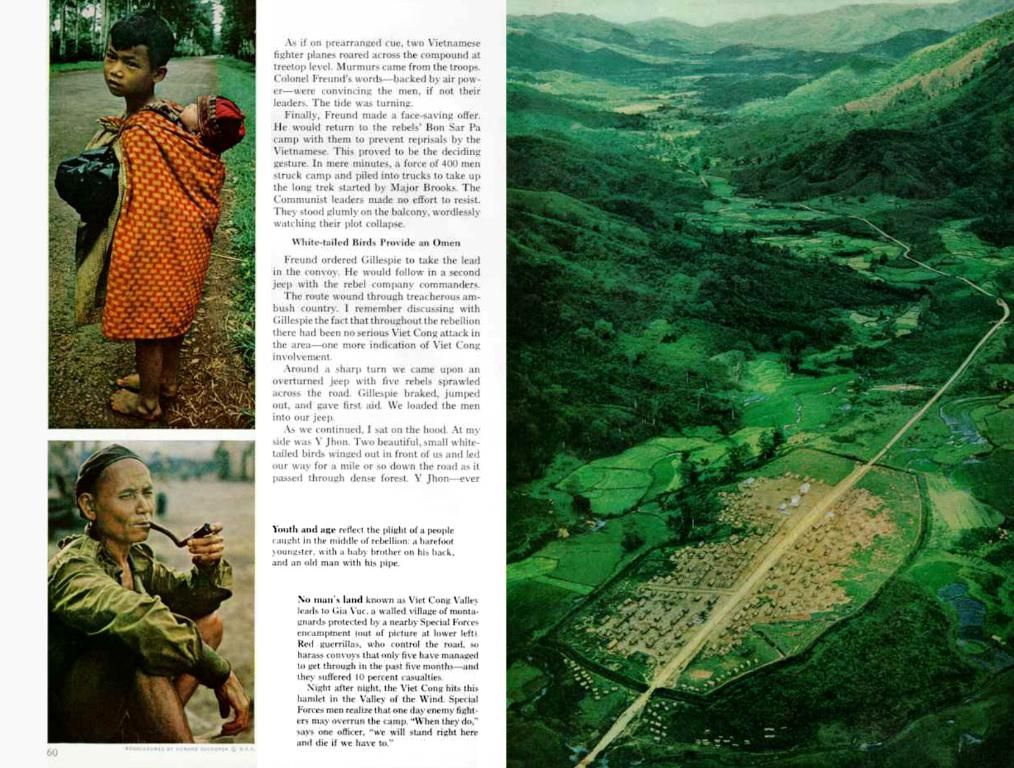

Investors have historically engaged in profit-taking with Rheinmetall shares after all-time highs or extended rallies, as seen last week when the stock dipped from a record high of 774.80 euros following peace talk rumors to its current level of 734.40 euros. Despite stabilizing on Monday and Tuesday, consolidation may not be complete, with the Munich Security Conference potentially causing price fluctuations.

While a drop below a certain level could be problematic for Rheinmetall shares, the defense stock's long-term viability remains strong. If peace talks progress in the coming weeks, a further fall in Rheinmetall shares is not impossible, but the overall upward trend still appears intact. A pullback to around 660 euros is a possibility, but the stock's upward trajectory is expected to resume.

The risk of a drop stems from the possibility of a tangible peace agreement that could dampen sentiment and lead to profit-taking. The Munich Security Conference, beginning later this week, may also cause fluctuations. Conversely, renewed security concerns could drive demand for defense stocks like Rheinmetall.

The order books at Rheinmetall are filled, and rearmament trends in the Western world show no signs of abating. As such, long-term investors can expect Rheinmetall's share price to rebound, with a break above 775 euros possible in the medium term. Price targets for the stock are often well above 800 euros.

Technical indicators suggest a robust short-term bullish trend for Rheinmetall, with the stock having risen in 8 of the last 10 days, resulting in a 9.4% increase over the past fortnight. If this upwards momentum persists, the stock could potentially rise by more than 55% in the next three months, with a 90% probability of trading between €2,480 and €2,981.78 by the end of this period. However, this forecast is primarily based on technical patterns and recent trading activity, rather than fundamental news.

In conclusion, while technical indicators suggest a strong short-term bullish trend for Rheinmetall, actual price movements will be sensitive to news from peace talks and security conferences. Positive developments towards peace could temporarily reverse momentum, while renewed security concerns may reinforce the current uptrend.

The Munich Security Conference, with its potential for causing price fluctuations, might pose a challenge for investors who are considering investing in Rheinmetall's finance sector, as the event could influence the stock market movements. On the other hand, the long-term business prospects of Rheinmetall remain buoyant due to its filled order books and the persistent rearmament trends in the Western world.