Opportune Moment for Islamic Finance, Says Professor Gatsi

Let's Hear It for Alternative Finance!* Ghana looks to shake up its finance game with Islamic finance* Total global asset value of Islamic finance projected to reach US$4.94trillion by 2025

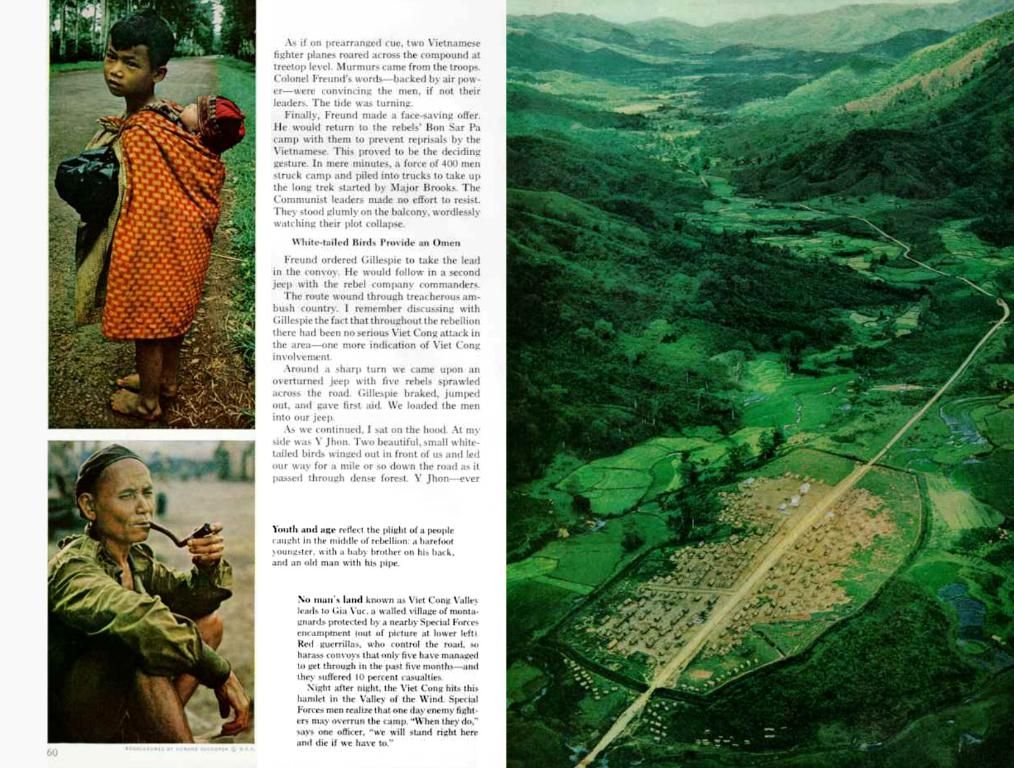

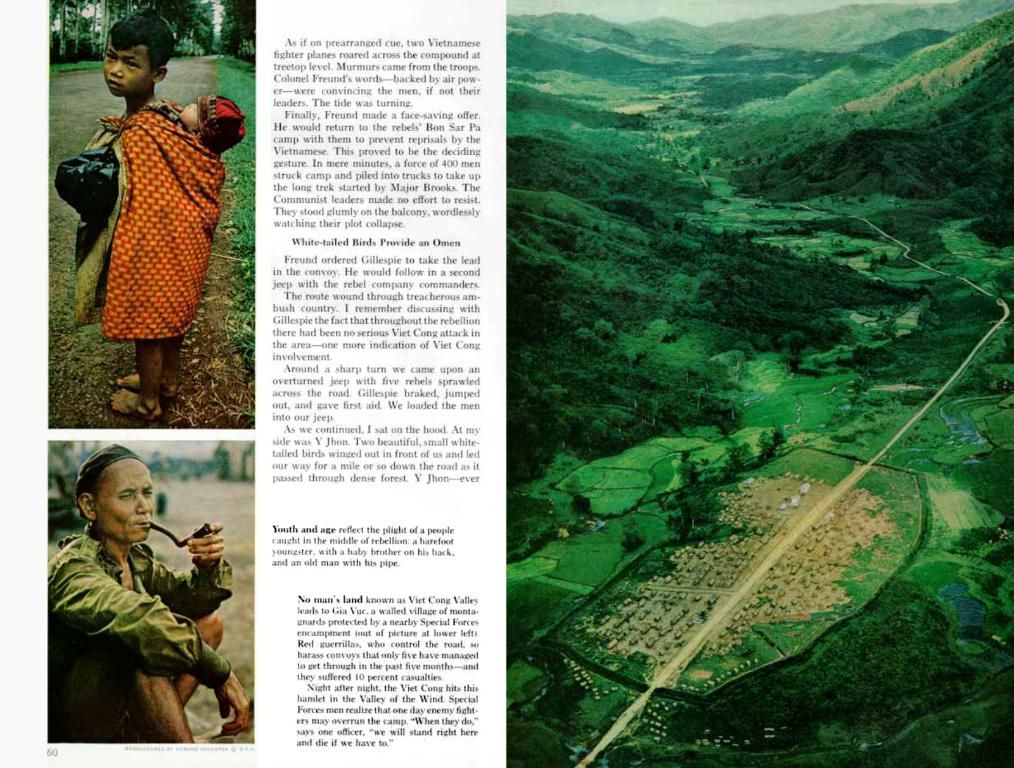

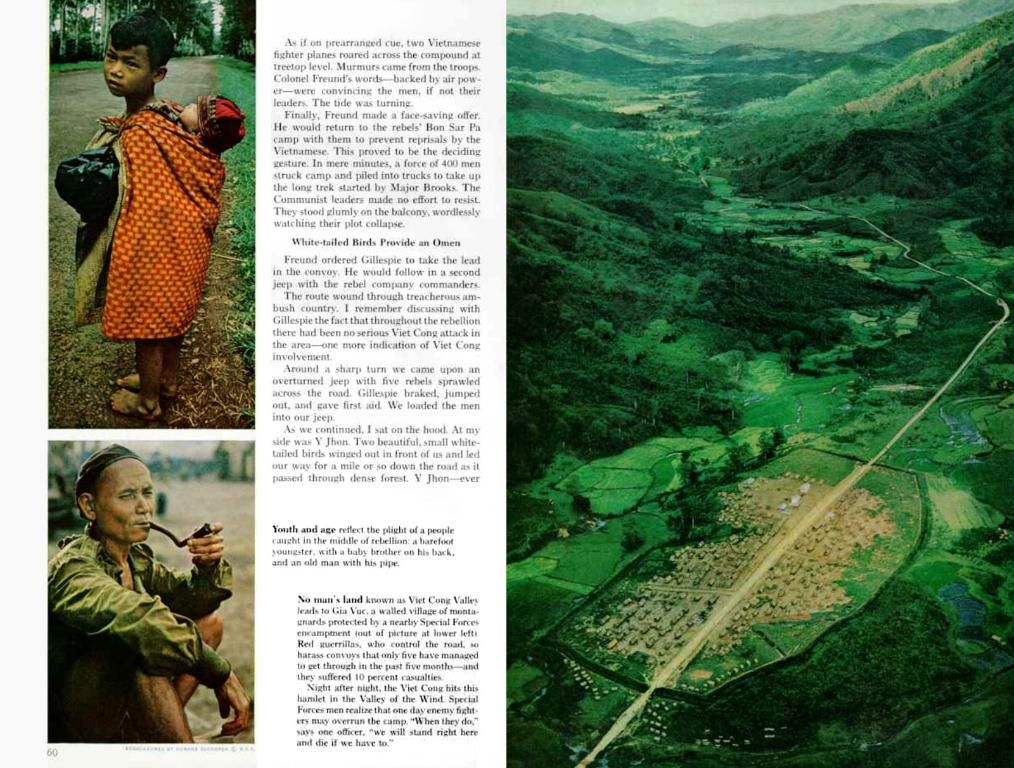

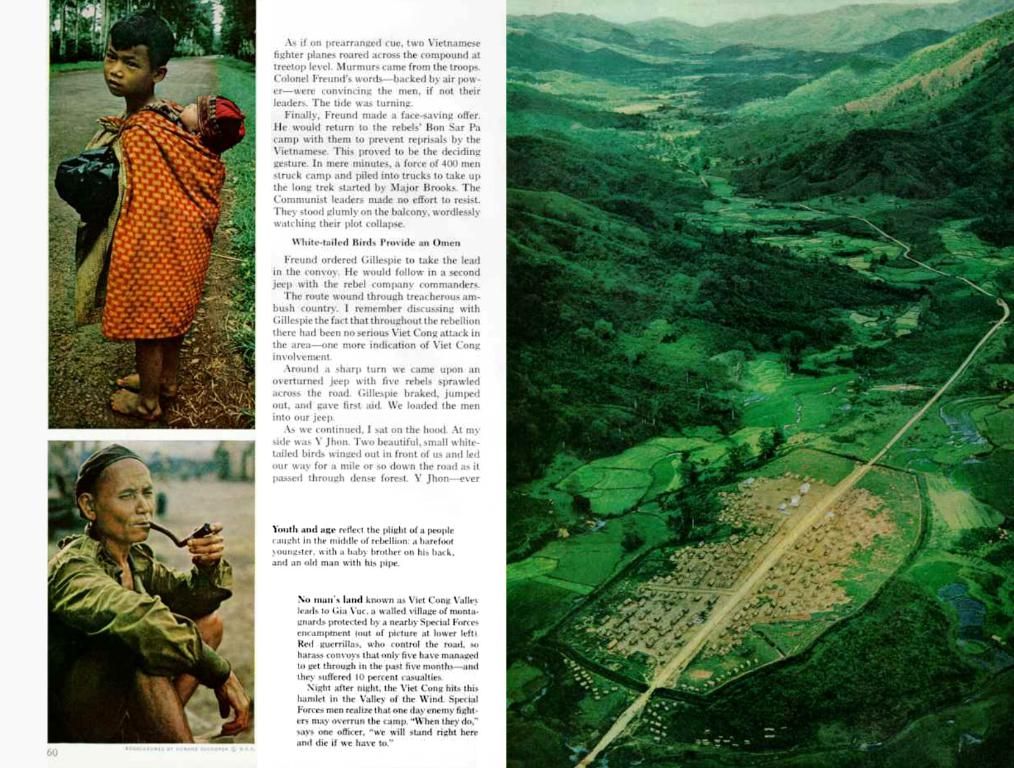

It's high time to unlock the doors to alternative means of financing, and that means embracing ethical finance, especially Islamic finance, argues Professor John Gartchie Gatsi, from the University of Cape Coast (UCC) Business School.

With the banking industry's growth expected to slow down in the mid-term due to the approaching Domestic Debt Exchange Programme (DDEP), which can affect the cost and access to loans, Prof. Gatsi suggests Islamic finance - anticipated to reach a total global asset value of US$4.94 trillion by 2025 - could be just what the doctor ordered for lending to businesses and families at interest rates significantly lower than the current average of 36 percent.

Often known as Islamic banking, it's all about banks and clients sharing profits and losses, and Prof. Gatsi believes that such a system could kickstart infrastructure-focused public-private partnerships (PPPs), as its core principles support initiatives that promote social inclusivity and development.

"Islamic finance offers nearly all the same financial products as traditional finance, but places more emphasis on partnerships and joint ventures, while striving to promote financial inclusion," he told the B&FT. Adding that introducing ethical finance products would help strengthen Ghana's financial ecosystem.

Calling for reforms to the Banks and Specialised Deposit-taking Institutions Act, 2016 (Act 930) to incorporate ethical banking, Prof. Gatsi says failure to adapt the law to accommodate Islamic finance means that Ghana could miss out on the countless benefits it offers, as well as increased options for financial products. He explains that Act 930 was designed for conventional banks, and it needs to be updated to include the necessary legal flexibility to accommodate the governance structures needed for Islamic banking.

In other countries, flexible laws have allowed conventional banks to open ethical finance windows, resulting in a win-win situation. Without adjustments to Ghana's legislation, we risk losing out on the manifold advantages that ethical finance provides, Prof. Gatsi warns.

He highlights that the growth of Islamic finance in non-Muslim countries demonstrates that the benefits extend beyond the issue of ethical finance and should be viewed from a financial inclusion perspective rather than a religious standpoint. "It's all about development, not religion, and should be seen as a chance to diversify our funding options," he concludes.

On the Rise

According to the Islamic Finance Development Report 2021, the Islamic finance industry is set to expand from US$3.374 trillion across 135 countries in 2020 to US$4.94 trillion by 2025, growing at an average rate of 8 percent. The report also showcases corporate social responsibility expenditure, which reached US$1.28 billion.

Furthermore, the report underscores the continued strong demand for sovereign Sukuk bonds (sharia-compliant bonds) - low-risk investments - as evident by their oversubscription rates. To satisfy this demand, numerous jumbo issuances were conducted in 2020 and the first half of 2021. Notable African countries like Uganda, Nigeria, and Egypt are among the issuers of sharia-compliant bonds on the continent.

Regulatory Revamp

To effectively integrate Islamic finance into the Ghanaian financial system, several regulatory changes are required, such as:

- Islamic Financial Products Included:

- Introducing Sharia-compliant liquidity management tools like Sukuk (Islamic bonds) and commodity Murabaha, which currently are absent from Act 930.

- Defined Licensing Requirements:

- Act 930 specifies a wide range of financial services but needs more clear conditions for non-interest banking like Islamic banking, including Sharia governance and risk management requirements.

- Prohibition of Speculative Activities:

- Explicitly defining permissible investments and transactions under Islamic finance within Act 930.

- Enhanced Sharia Oversight:

- Including provisions for the formation of Sharia Supervisory Boards or similar entities within banks, to ensure strict adherence to Islamic principles in products and services.

- Specialist Criteria for Islamic Banking:

- Clear requirements for directors and management personnel in Islamic banking, outlining their necessity in Islamic finance.

- Project Finance Compatibility:

- Ensuring that Islamic finance guidelines align with project finance laws and regulations, including security, bankruptcy, and foreign investment laws.

Setting the Stage for Islamic Finance

- Regulatory Framework: Create a clear regulatory framework outlining the specific requirements for Islamic banking operations in Ghana.

- Professional Training and Capacity Building: Provide training for financial professionals to effectively implement Islamic finance principles.

- Public Awareness: Launch public awareness campaigns to inform consumers about the benefits and differences between Islamic banking and conventional banking.

By enacting these changes, Ghana stands poised to assimilate Islamic finance into its financial landscape, thus promoting financial inclusion and attracting investors interested in Sharia-compliant products.

- By 2025, it's projected that the global asset value of Islamic finance will reach US$4.94 trillion, offering a potential avenue for lower interest rates on loans to businesses and families.

- As the banking industry's growth forecast slows down, the embrace of Islamic finance, with its core principles promoting social inclusivity and development, could initiate infrastructure-focused public-private partnerships (PPPs).

- Islamic finance, also known as Islamic banking, focuses on the sharing of profits and losses between banks and clients, and could strengthen Ghana's financial ecosystem by introducing ethical finance products.

- To accommodate Islamic finance in the existing legal structure, the Banks and Specialised Deposit-taking Institutions Act, 2016 (Act 930) needs to be updated, ensuring it includes the necessary legal flexibility to accommodate the unique governance structures needed for Islamic banking.

- The growth of Islamic finance in non-Muslim countries not only demonstrates the benefits of ethical finance but also highlights the potential for financial inclusion, offering increased options for financial products and diversifying funding sources.