Managing Mortgage Deal Progression - Ensuring Deal Continuity within Mortgage Banking

A Mortgage Banking Executive Assistant is the stealthy hero of the fast-paced industry, tackling time-consuming tasks with ease and finesse.

Far from boring administrative work, this role is crucial for streamlining daily operations and allowing businesses to focus on growth.

Stealth Agents, a trusted ally, provides these skilled assistants to keep your processes on track, ensuring accuracy and timely task completion.

With reliable support, you can say goodbye to errors, hello to efficient workflows, and finally have time to build those goldmine client relationships. Plus, their services are tailored to meet your unique needs, delivering unmatched efficiency and consistently high-quality output.

Book a free consultation now to learn more about how they can help, including superior virtual assistant pricing that will make your wallet dance with joy.

The Prime Responsibilities of a Mortgage Banking Executive Assistant

1. Running the Administration Show

A Mortgage Banking Executive Assistant is in charge of handling all administrative tasks, ensuring the smooth operation of the executive's schedule and workload. This includes organizing and maintaining calendars, scheduling appointments, and coordinating meetings. EST executive assistants prioritize tasks in alignment with the organization's goals, ensuring no critical deadlines are missed. Long-term executive assistance allows mortgage banking executives to focus on high-level decision-making by delegating these duties. The Mortgage Virtual Assistant also prepares documents, creates reports, manages communications, and guides correspondence to reflect professionalism and clarity.

2. Becoming the Liaison between Teams and Clients

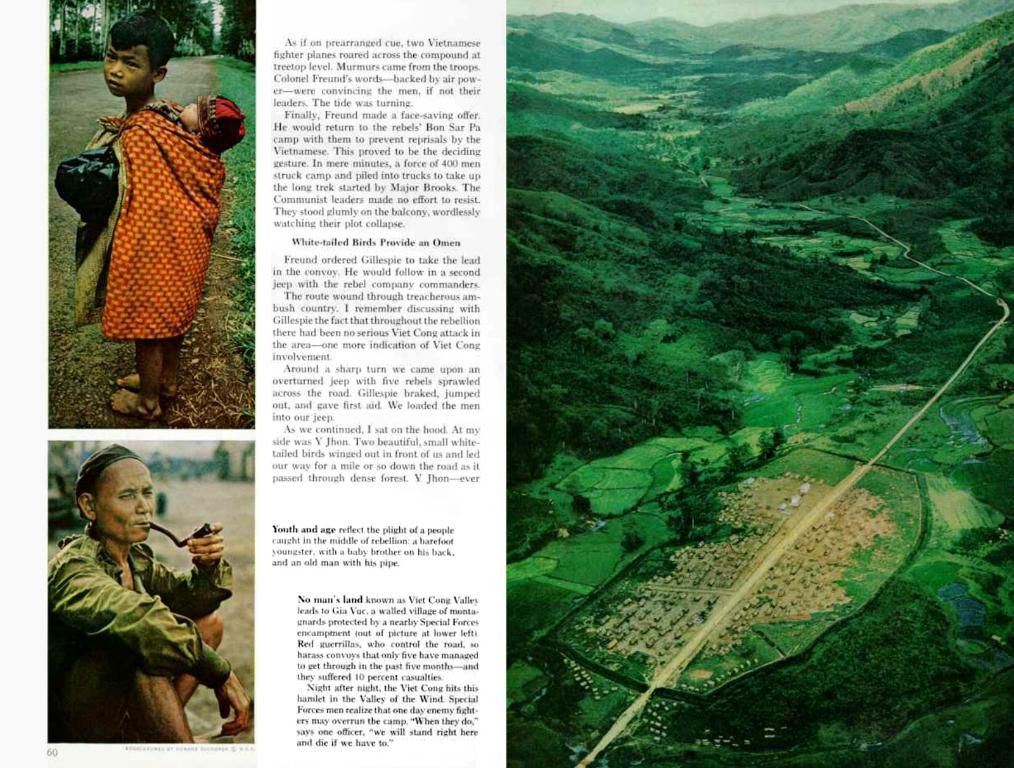

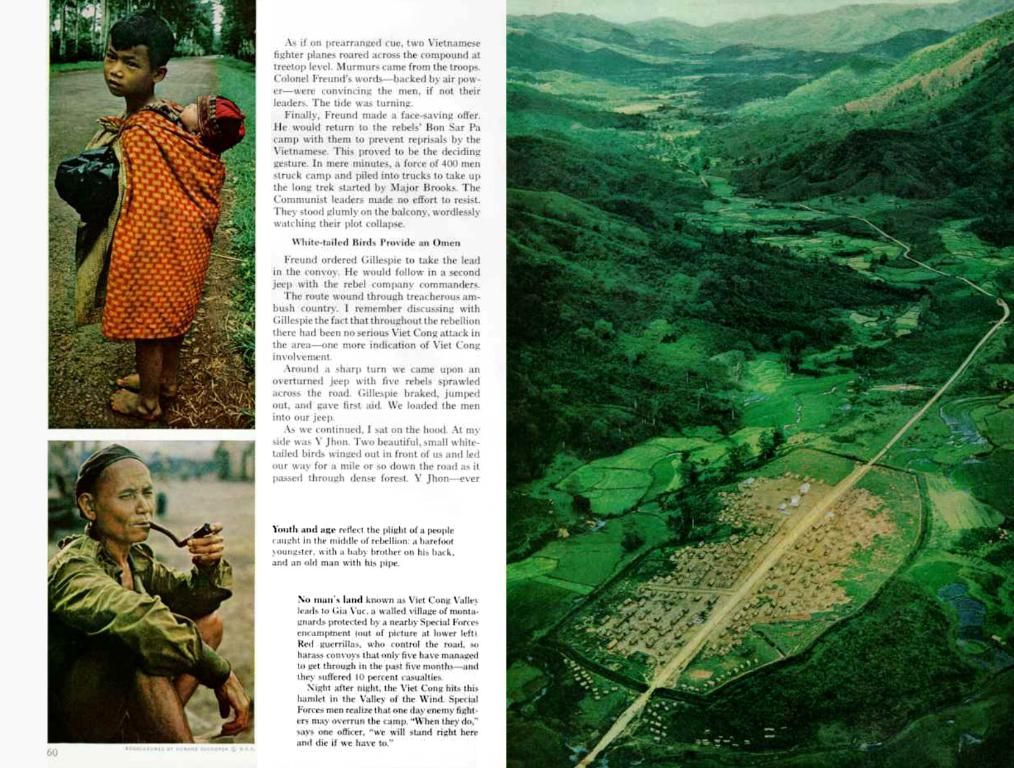

A Mortgage Banking Executive Assistant often serves as the primary contact point for internal teams and external clients, coordinating communications, and keeping executives informed about important updates and developments. Executive assistants with AI and automation skills bridge the gap between departments, ensuring efficient follow-ups. This liaison role streamlines processes and builds strong professional relationships. Female executive assistants also maintain client data, set up client meetings, and quickly address client-related matters, creating a seamless flow of information within the organization.

3. Taking Care of Confidential Matters

Mortgage Banking Executive Assistants protect sensitive client and company data by managing confidential files, maintaining data privacy, and following regulatory requirements. They also stay focused and organized to reduce errors and are tech-savvy, working with financial documents and handling sensitive agreements that require meticulous attention to detail. By taking care in managing confidential materials, they reduce risks and uphold the company's trustworthiness.

4. Lending a Hand in Financial and Operational Oversight

Mortgage Banking Executive Assistants aid executives by supporting financial and operational management tasks. They may analyze data, track project timelines, and assist with budget preparations as part of their responsibilities. This involves creating financial summaries and reviewing documents with precision and accuracy, allowing them to provide key insights that can guide executive decisions. Their cross-functional role ensures operations are well-organized and that different teams work cohesively toward shared objectives.

5. Maintaining a professional Approach

A Mortgage Banking Executive Assistant is often the first point of contact for clients and stakeholders, making professionalism essential. They ensure the executive's workplace is organized and welcoming, and their demeanor, communication style, and organizational skills project a positive impression of the organization. Executive assistants help maintain a polished image by proactively managing schedules and resolving potential conflicts. Creating an efficient work environment allows executives to perform at their best.

How Does a Mortgage Banking Executive Assistant Benefit a Business Owner?

1. Freeing Up Time

A Mortgage Banking Executive Assistant effectively handles administrative tasks, allowing business owners to focus on critical decisions that drive growth. They also manage communication with clients, responding to inquiries, and scheduling necessary follow-ups, freeing up the owner's time for more important tasks. This reduces administrative burdens and minimizes opportunities for errors in managing daily responsibilities.

2. Strengthening Communication Across Teams

A Mortgage Banking Executive Assistant ensures effective communication by bridging gaps between the business owner and their staff or clients. They coordinate messages, keep team members informed, and ensure information isn't miscommunicated. Their focus on tracking deadlines and communicating expectations improves accountability within the workplace. When special events, projects, or meetings arise, they ensure proper planning and coordination, solidifying relationships.

3. Creating a Professional Business Environment

The Mortgage Banking Executive Assistant's role includes preparing meeting spaces, ensuring everything is in order, and managing event logistics. Their proactive approach to maintaining a professional atmosphere ensures that business activities are conducted in an organized manner. They also support the executive by creating polished documents, reports, or correspondence. An assistant who maintains professionalism contributes to an improved perception of the company, reinforcing its credibility and organization.

4. Streamlining Task Prioritization

A Mortgage Banking Executive Assistant skillfully manages tasks, helping business owners prioritize their to-do lists effectively. This involves identifying which tasks require immediate attention, monitoring project milestones, and ensuring workflows remain on track. This streamlined task management leads to a more productive workday and consistent progress in reaching goals.

5. Safeguarding Confidential Information

Mortgage Banking Executive Assistants carefully handle sensitive information, ensuring confidentiality and following compliance standards. This focus on protecting essential business details builds trust between the executive assistant and the business owner.

6. Providing Financial Support

Mortgage Banking Executive Assistants contribute significantly to managing financial tasks that require precision and reliability. They assist in budget planning, preparing accurate expense reports, and reviewing spending patterns. This detailed financial oversight allows the owner to make decisions with improved clarity and confidence.

7. Enhancing Client Relationships

A Mortgage Banking Executive Assistant is invaluable in building and maintaining strong client relationships. They manage appointments, prepare meeting agendas, and ensure clients receive timely updates. The assistant's skills and professionalism create a positive client experience, encouraging loyalty and trust in your services.

8. Focusing on Business Growth

A Mortgage Banking Executive Assistant supports the business owner in achieving their goals by facilitating growth through their administrative support. They help the owner allocate more time toward strategic planning and expansion efforts, taking on short-term projects that align with the business's broader objectives. They are adaptable, ensuring smooth operations and focusing on the growth of the business.

Finding the Ideal Mortgage Banking Executive Assistant

To find an ideal Mortgage Banking Executive Assistant, a business owner should focus on creating a detailed job description, outlining essential qualifications and responsibilities. Researching references, verifying professional experience, and establishing an effective interview process can help identify candidates with the right attitude, skills, and adaptability. Assessing technical proficiency, such as familiarity with industry-specific software, is important to ensure the assistant can support key functions immediately. Clear expectations foster a productive working relationship.

Hiring from Stealth Agents

Hiring a Mortgage Banking Executive Assistant from Stealth Agents ensures access to professionals with specialized knowledge in the industry. Their team provides assistants trained to manage schedules, prepare reports, and coordinate documentation, maintaining industry-specific regulatory requirements. With a focus on thorough screening, Stealth Agents hires candidates who bring efficiency and reliability to the role. Collaborating with them simplifies day-to-day operations and supports business growth effectively. The support of a Mortgage Banking Executive Assistant allows a business owner to stay focused on strategic planning and expansion efforts.

- A Mortgage Banking Virtual Assistant, provided by Stealth Agents, can streamline workflows within a business by efficiently handling administrative tasks, scheduling appointments, and coordinating meetings.

- By outsourcing administrative duties to a Mortgage Banking Virtual Assistant, business owners can leverage their skills to prioritize tasks in alignment with the organization's goals and ensure critical deadlines are met.

- With the support of a Mortgage Banking Virtual Assistant from Stealth Agents, businesses can benefit from superior virtual assistant pricing and tailored services that deliver unmatched efficiency and high-quality output.

- The Mortgage Banking Virtual Assistant hired through Stealth Agents can also lend a hand in financial management by providing key insights that guide executive decisions and assisting in budget preparations.

- Utilizing the services of a Mortgage Banking Virtual Assistant from Stealth Agents allows business owners to say goodbye to errors, focus on growth and productivity, and build stronger client relationships, ensuring a more successful business overall.