Major Financial Corporation TD Plans $3 Billion Portfolio Reduction, Lays Off 2,000 Staff Members as Part of Budget-Slashing Measures

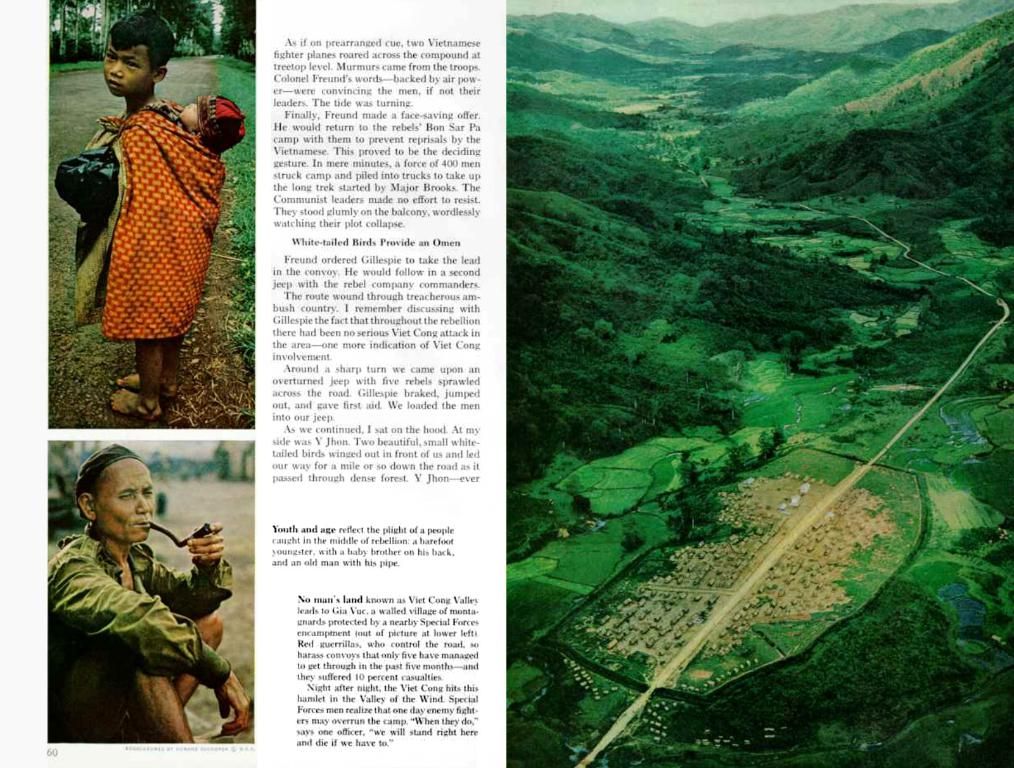

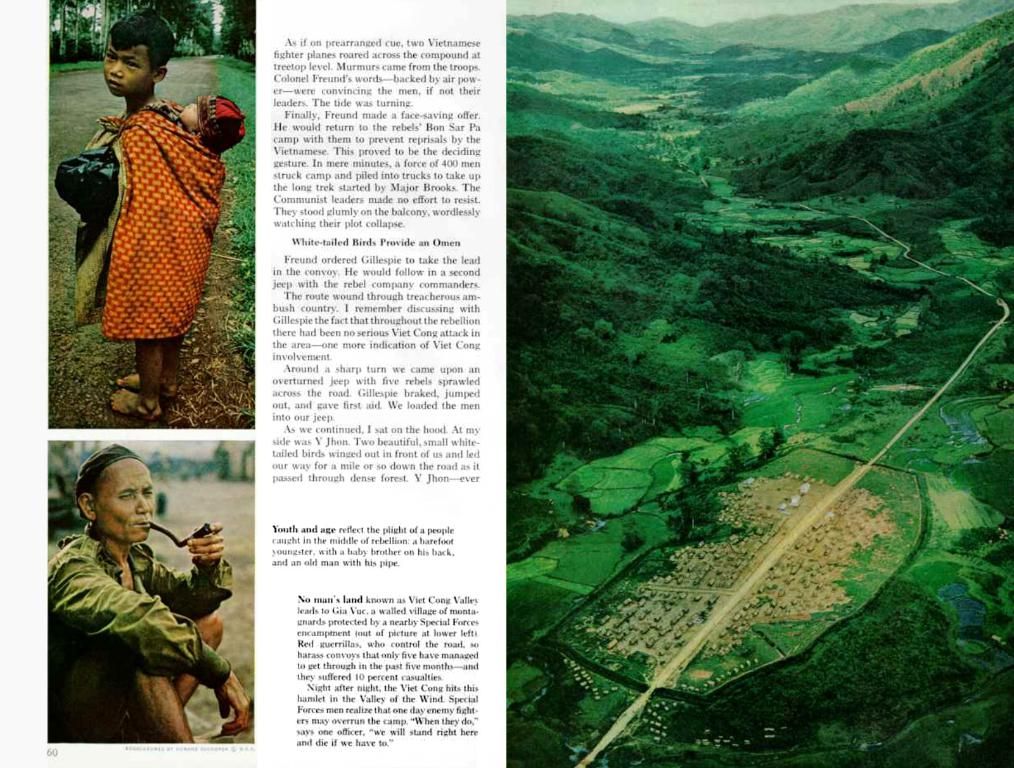

Toronto Dominion Bank Announces Restructuring Program and Workforce Reduction

Toronto Dominion Bank (TD) has revealed plans to wind down a $3 billion investment portfolio and cut its headcount by approximately 2,000 employees. The move is part of a restructuring program aimed at reducing costs, enhancing efficiency, and streamlining operations.

In a recent earnings call, TD's senior vice president and chief financial officer, Kelvin Tran, shared the bank's intention to restructure its operations in order to lower structural costs and bolster investment in future growth initiatives. Tran anticipated that this would necessitate the layoff of around 2,000 employees, equating to a 2% reduction of the bank's workforce.

Addressing shareholders, TD Bank group president and CEO, Raymond Chun, revealed that the bank plans to shut down its US point-of-sale financing operations, which service third-party retailers. The bank determined that this business presented challenges in terms of profitability and scalability and is expected to be accretive to US retail return on equity (ROE).

Chun explained that the bank will be focusing on core businesses and will be identifying opportunities for operational improvements and cost reductions through a strategic review process. The bank aims to achieve annual savings of up to C$650 million via this program, with C$100 million expected to be achieved in fiscal 2025.

Affected employees will be entitled to significant severance packages, including base salary, bonuses, commissions, and benefits continuation, potentially extending for up to 24 months of compensation.

TD had admitted to violating the Bank Secrecy Act in 2024, resulting in fines totaling $3.1 billion from the Department of Justice and the Financial Crimes Enforcement Network (FinCEN). The bank was found to have failed to adequately track trillions of dollars in transactions, making it easy for criminals to move large sums of money to high-risk destinations.

For more updates on the financial industry, visit our categories covering bitcoin, ethereum, trading, altcoins, financeflux, blockchain, futuremash, regulators, and scams, hacks, and breaches.

Stay connected with us through Telegram, Facebook, and join our subscriber list to receive email alerts. Read our blog, The Daily Hodl Mix, for exclusive insights on the future of finance.

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should conduct their own due diligence before making any high-risk investments in bitcoin, cryptocurrency, or digital assets. Please be aware that your transfers and trades are at your own risk, and any losses incurred are your responsibility. The Daily Hodl does not recommend purchasing or selling any cryptocurrencies or digital assets, nor does it serve as an investment advisor. Please be advised that The Daily Hodl participates in affiliate marketing.

*Image generated by Midjourney

- Despite Toronto Dominion Bank's restructuring program and workforce reduction, the bank continues to monitor the cryptocurrency and blockchain industry as part of its broader investment strategy in the finance and business sectors.

- With the digital currencies market gaining traction, some analysts speculate that TD's divestment from certain business divisions could free up resources to invest in altcoins and blockchain technology, particularly in the emerging banking-and-insurance sector.

- The layoffs at Toronto Dominion Bank could potentially impact the careers of professionals with expertise in blockchain and fintech, as it may spur a rise in job opportunities in cryptocurrency and altcoin companies that are actively seeking skilled talent in the industry.