Life Insurance Company, Canara HSBC, Plans to Launch IPO by Filing Draft with Securities and Exchange Board of India (Sebi)

Unveiling the IPO: Canara HSBC Life Insurance Goes Public

Canara HSBC Life Insurance Company Ltd has kicked off the process of going public by filing preliminary papers with the Securities and Exchange Board of India (Sebi). This move signals an exciting chapter for the life insurance company, aiming to increase its footprint in the competitive Indian market.

In essence, this is an offer-for-sale (OFS), where promoters and an investor will dispose of 23.75 crore equity shares. Among the sellers, Canara Bank will offload 13.77 crore shares, HSBC Insurance (Asia-Pacific) Holdings Ltd will sell 47.5 lakh shares, and Punjab National Bank plans to divest 9.5 crore shares.

As it is an OFS, the insurance company won't receive any funds from the public issue.

Originating as a joint venture between Canara Bank, which owns a 51% stake, HSBC Group's HSBC Insurance (Asia Pacific) Holdings, boasting a 26% stake, and Punjab National Bank, this company boasts strong financial backing essential for its operations.

Last December, Canara Bank secured the Reserve Bank's approval for a proposal to divest its stake in life insurance and mutual fund ventures. The company's life insurance arm, Canara Robeco Asset Management Company (AMC), has also set its sights on the capital markets by filing draft IPO papers with Sebi.

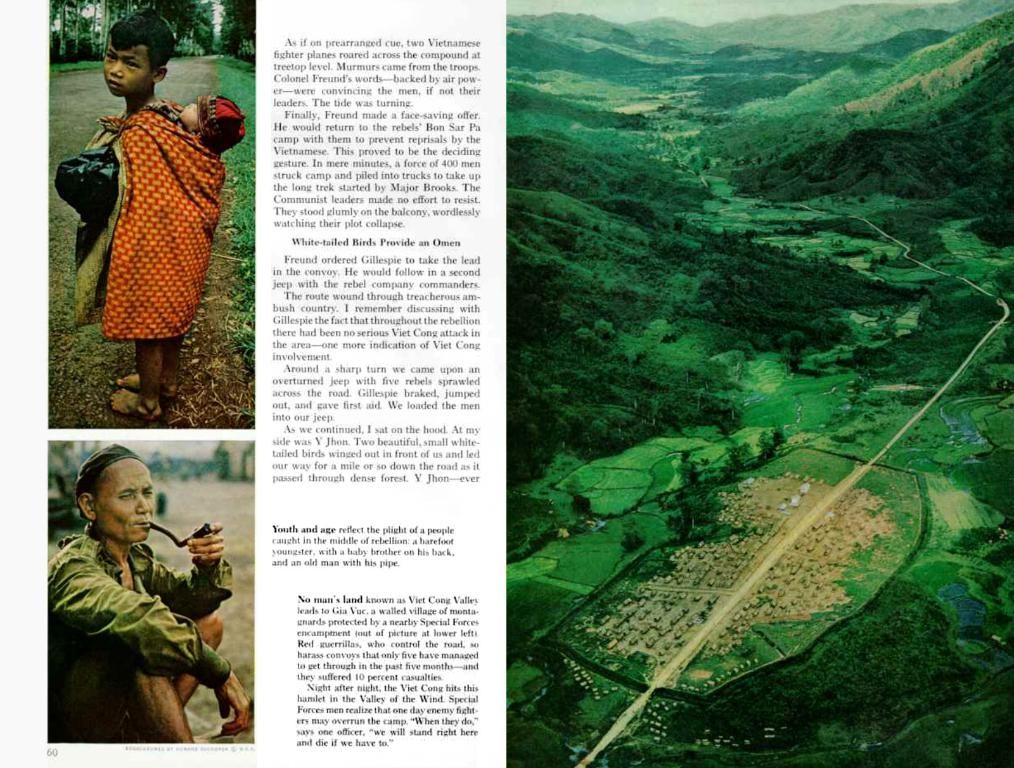

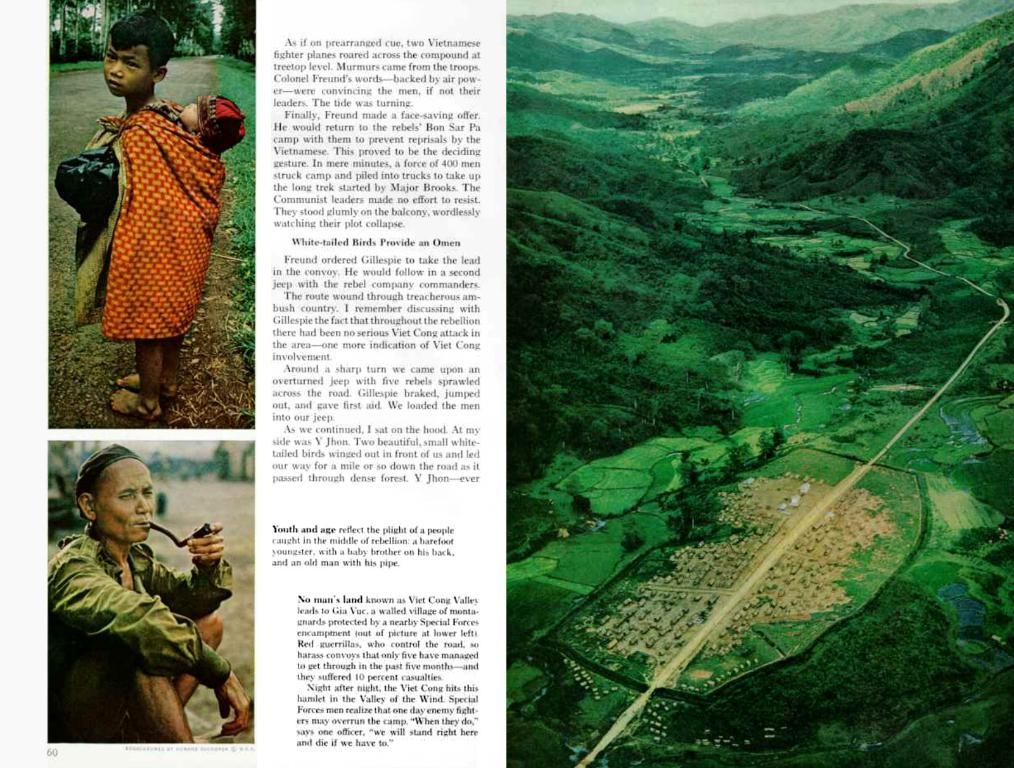

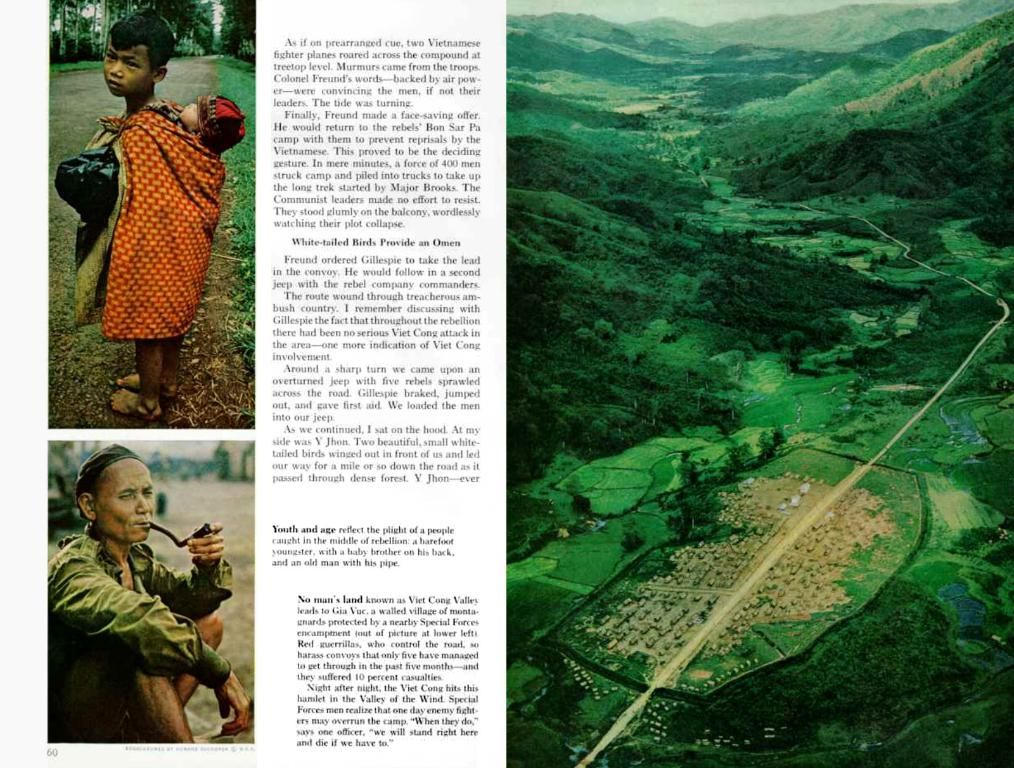

Taking Giant Strides in the Insurance SectorWith solid financial performance and steadily growing trust among its policyholders, Canara HSBC Life Insurance recently announced a Rs 250 crore bonus for FY 2025, a robust 7.90% increase over the previous year, distributed among more than 2.27 lakh policyholders. This speaks volumes about the company's financial strength and prudent investment strategy.

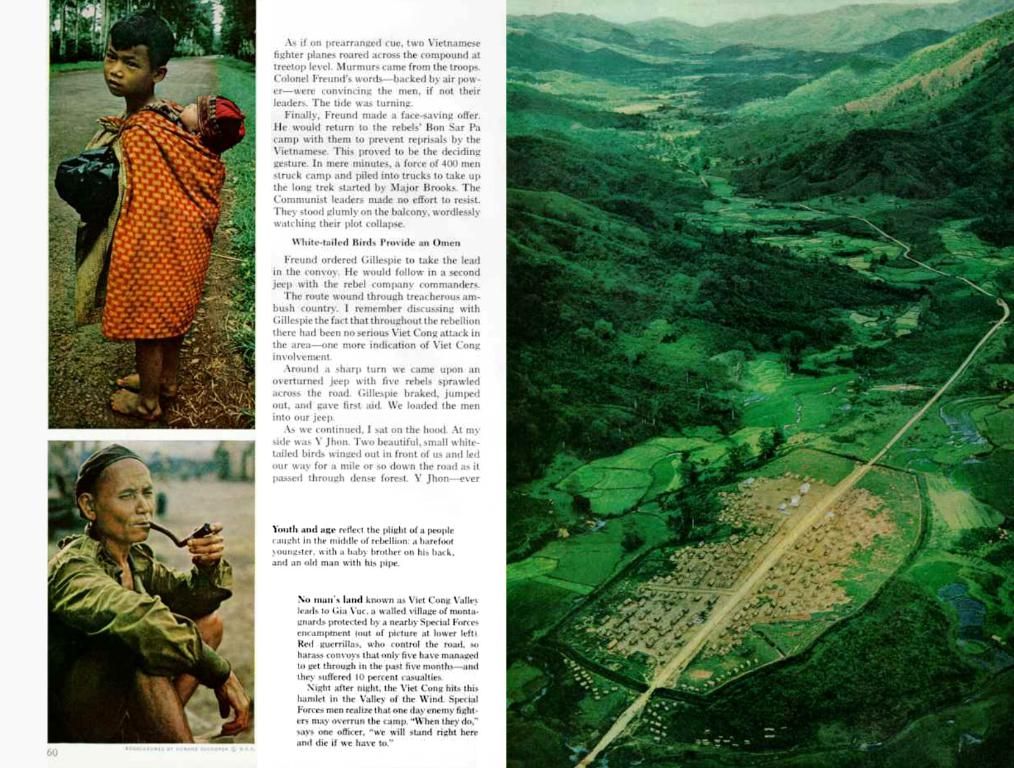

The IPO is expected to extend the company’s capital base, facilitating expansion and product diversification in the highly competitive insurance sector. Filed in April 2025, the IPO marks an important event in the year, given the uncertain economic climate influenced by global geopolitical tensions and market fluctuations[2].

Barely scratching the surface, the draft red herring prospectus (DRHP) reveals approximate revenues of Rs 7,020.67 crore and a profit after tax (PAT) of Rs 113.19 crore for the recent fiscal period[4]. With Canara Bank approving capital-raising plans of up to Rs 95 billion, part of which pertains to Canara HSBC Life Insurance's equity offering[5], this IPO stands as yet another noteworthy capital-raising endeavor from India's public sector.

Collaboration at the Heart of the VentureApart from Canara Bank as the primary backbone of the joint venture, HSBC Insurance (Asia-Pacific) Holdings Ltd brings international insurance knowledge and strategic vision to the table. Meanwhile, Punjab National Bank also plays a significant role by contributing to the life insurance business through this collaboration.

Hanging in the balance, the successful completion of this IPO represents a significant milestone for Canara HSBC Life Insurance, allowing it to seize opportunities in the Indian life insurance market, supported by a robust and strategic partnership among distinguished financial institutions.

The IPO of Canara HSBC Life Insurance Company Ltd is a significant step towards expanding their business operations, aiming to increase their footprint and compete effectively in the Indian market. This offer-for-sale (OFS) will see promoters and investors dispose of equity shares, providing the company with the necessary capital to diversify products and expand.

Directed by a strategic partnership between leading financial institutions, especially Canara Bank, HSBC Group, and Punjab National Bank, the company's solid financial performance and prudent investment strategy indicate a strong foundation for future investing success in the insurance sector.