Klingbeil Refuses to Forgive the Wealthy Earners

Article: Klingbeil Assures No Relief for High Earners in Social Security Contributions

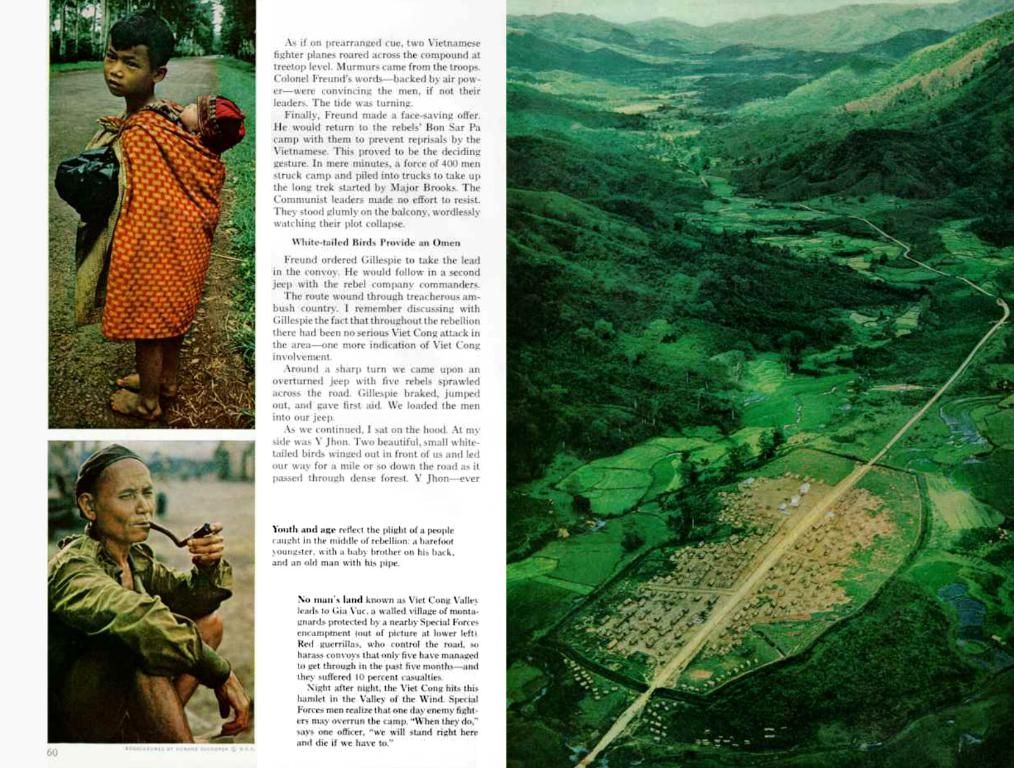

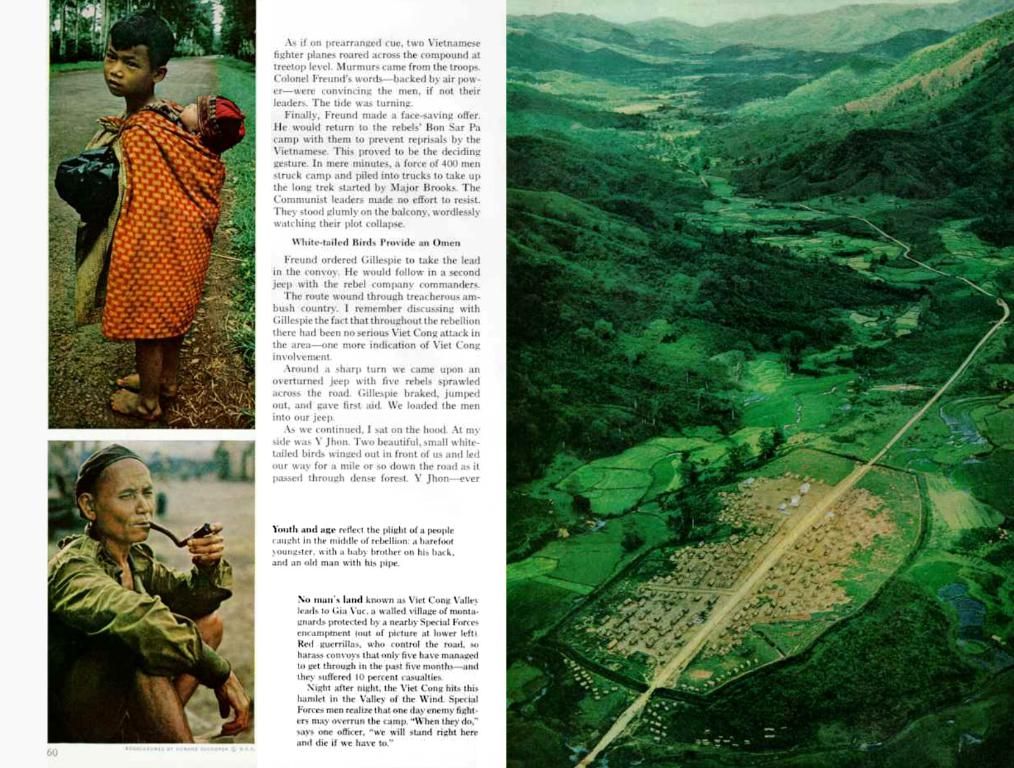

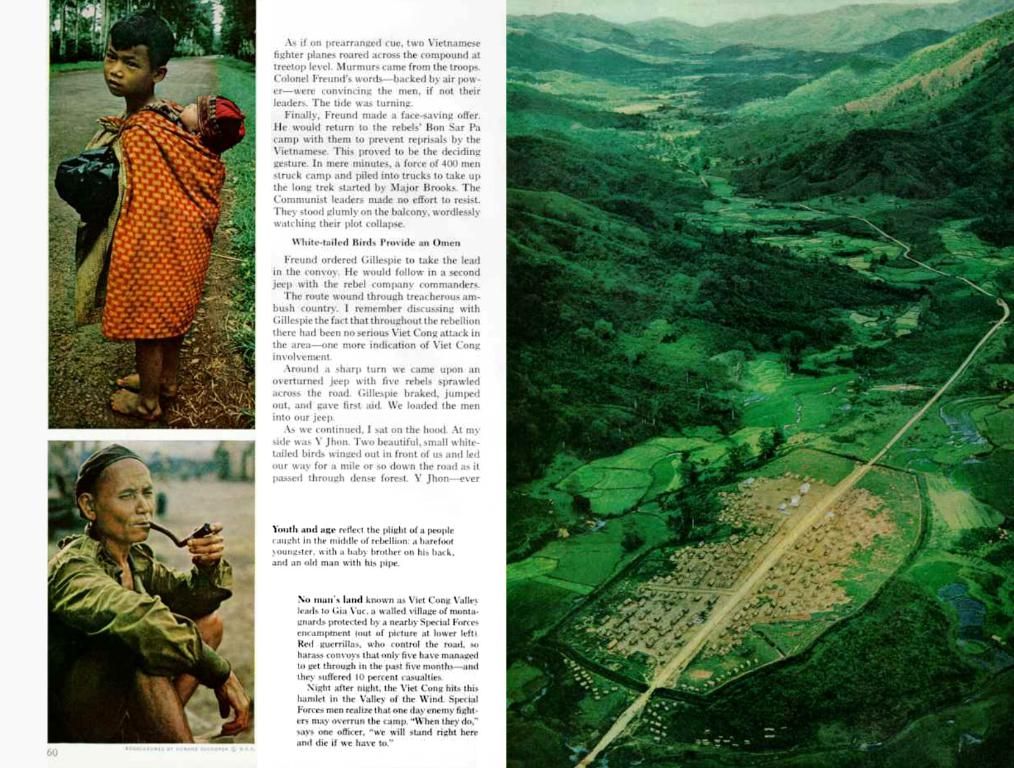

Increased social security contributions have been a noticeable trend on many pay stubs since the start of the year, with no immediate sign of abatement unless political intervention occurs. The SPD is looking toward tax reforms, according to Federal Minister of Finance Lars Klingbeil, who has expressed opposition to providing relief for high earners in the proposed tax reform.

Speaking to "Bild am Sonntag", Klingbeil acknowledged the concerns raised by surging social security contributions. He stated, "Rising contributions to social security pose a problem for both employees, who have less disposable income, and companies, facing higher wage costs." Klingbeil emphasized the need for stability in the contributions to mitigate the pressure on both employees and businesses.

The contributions to health and long-term care insurance are particularly at risk of significant hikes, a predicament that can only be temporarily alleviated with increased subsidies from the budget. Klingbeil, however, considers this a short-term solution, stating, "The finance minister cannot be constantly asked to provide more funds. We require structural reforms to permanently stabilize the contributions."

As the planned tax reform of the black-red coalition is underway, Klingbeil expressed his stance against relieving high earners, stating, "It's unfair if people like me receive more relief than the supermarket cashier. High earners like myself do not need state relief. My focus is on the hardworking people with low and middle incomes."

In shaping the budgets for the current and upcoming year, Klingbeil anticipates that the primary objective will be to ensure Germany's economic growth and job security. He plans to accomplish this by lowering energy prices and boosting investments through super-depreciation.

Furthermore, Klingbeil, who is also the chairman of the SPD, announced his intent to reform his party. He emphasized that the 16.4% election result served as a signal for change and improvement in their approach to citizens' funds and job creation.

While the SPD supports tax measures that primarily benefit higher earners, especially entrepreneurs, the social security contribution system for high earners will not be reformed as per the coalition agreement and the statements of SPD representatives such as Lars Klingbeil. The coalition agreement focuses on reducing corporate taxes and providing tax relief mainly for higher earners through income tax adjustments, not changes in social security contribution rules.

- In line with the SPD's focus on tax reforms, Klingbeil has proposed investments in areas like fitness-and-exercise programs and nutrition education for employees, as part of a workplace-wellness initiative, aiming to promote health-and-wellness among the workforce.

- Recognizing the importance of vocational training in the development of a strong community, Klingbeil has pledged to prioritize funding for vocational training programs, to equip workers with the skills necessary to excel in the modern workplace and to strengthen the economy.

- In a bid to support small and medium-sized businesses, Klingbeil has advocated for policies that would provide greater financial stability, such as adjustments to the taxes on business income, which could be part of the planned tax reform, ensuring positive implications for the economy and job security.

- As part of the ongoing political discourse, general-news media outlets have reported on the debate surrounding policies that address science, technology, engineering, and math (STEM) education, with Klingbeil expressing strong support for initiatives that promote vocational training in these fields, setting the stage for future economic growth and innovation.

- In addressing concerns about global economic uncertainties, Klingbeil has stressed that implementing measures for fiscal responsibility and managing public funds wisely is crucial, ensuring that Germany maintains financial stability in the face of political and economic upheavals at home and abroad.