Investing $1,000 in Celsius Holdings' stock 6.5 years ago would fetch you this much value presently.

Investors should likely give kudos to CEO John Fieldly for the significant returns they've seen in Celsius Holdings (CELH 6.33%) stock. Fieldly's control over the company transformed it from a relatively unknown entity to one of the top-performing energy drink companies.

These benefits have been particularly advantageous for shareholders who invested in Celsius stock back in April 2018 when Fieldly took charge. The numbers speak for themselves, showcasing how backing the right leader can benefit both the company and its investors.

The rise of Celsius stock

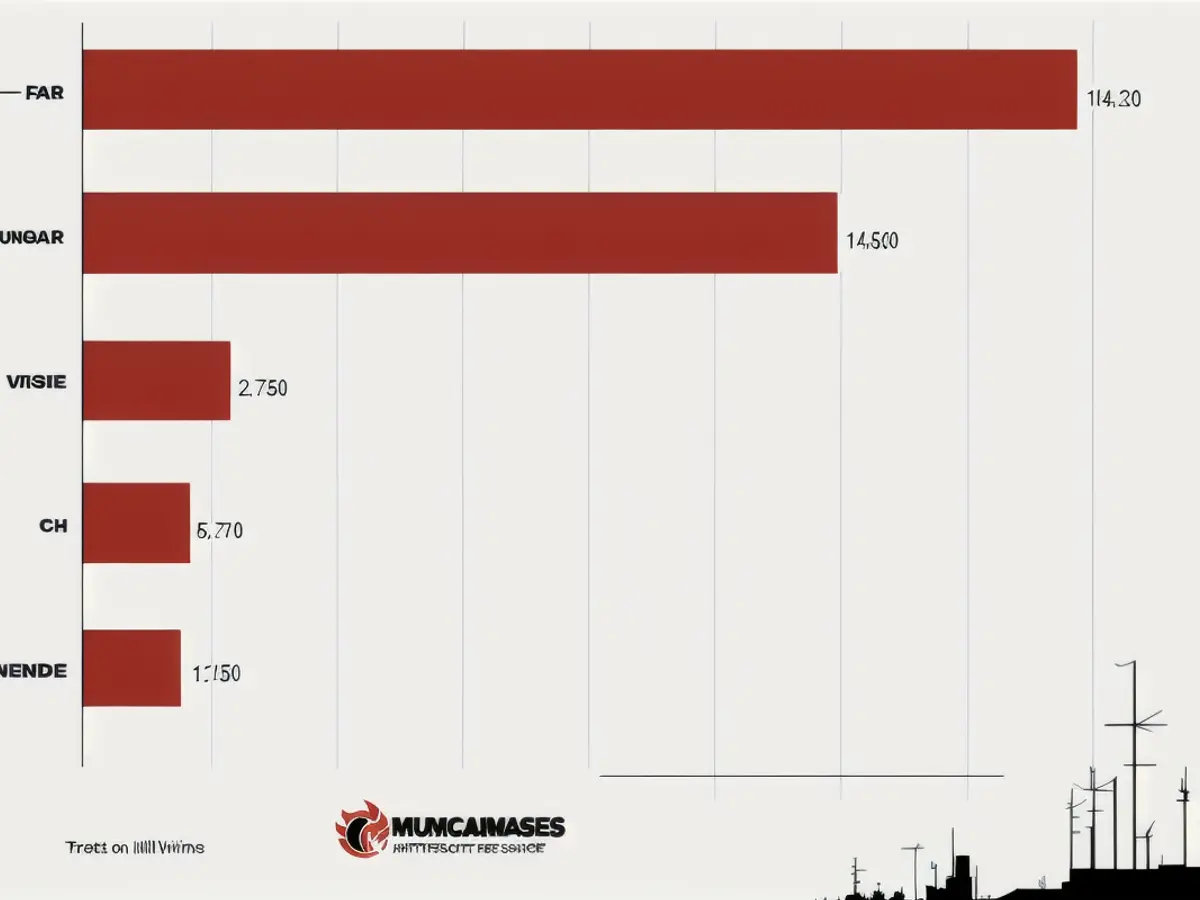

Hypothetically, if you had dropped $1,000 on Celsius stock in April 2018, that investment would now be worth around $18,600. This staggering increase of approximately 1,760% surpasses the S&P 500's (^GSPC -0.41%) modest total return of 158% during the same period.

Under Fieldly's guidance, Celsius has distinguished itself in two major ways. First, it focuses on utilizing natural ingredients in its energy drinks, deriving caffeine from guarana extract, a plant-based substitute. This eco-friendly approach has helped build a loyal following within the fitness community.

Second, a partnership with PepsiCo in 2022 secured prime shelf space with major retailers like Costco and Walmart's Sam's Club. Today, the product is widely available on Amazon, making Celsius the third-most popular energy drink, trailing only Red Bull and Monster Beverage.

Are investors missing the boat?

Despite the impressive gains, Celsius investors might have an exclusive opportunity to invest. A slide in orders from a major distributor (presumably PepsiCo) has resulted in a nearly 75% decline in share prices. The company's revenue growth for the first three quarters of 2024 was only 5% yearly, a significant drop from the 102% annual revenue increase seen in 2023.

This slowdown might make investors hesitant about the company's 39 P/E ratio. However, there's significant potential for international expansion, which accounted for only 7% of revenue in Q3. If the distribution issue resolves itself and the company can rekindle growth, investors who made initial investments in April 2018 and held on stand to see further returns beyond the $18,600 mark.

In light of the company's challenges, some investors might be second-guessing their decision to invest in Celsius, given its high 39 P/E ratio and recent revenue growth decline. However, the potential for international expansion, currently accounting for only 7% of revenue, offers a compelling reason for long-term investors to remain optimistic, especially considering the significant returns they have already seen since April 2018.

To maximize their profits, investors in this situation might consider analyzing the company's financial statements and considering strategic investing in Celsius's international expansion, as the resolution of the current distribution issue and the rekindling of growth could lead to even more substantial returns.