Inflation rate decreases to 1.7% in May, according to Central Statistical Office data.

Revised Article:

Hey there! Let's chat about the latest inflation numbers, shall we? The Central Statistics Office (CSO) recently reported that the annual inflation rate plummeted to 1.7% in May from a staggering 2.2% in April. Interesting, huh?

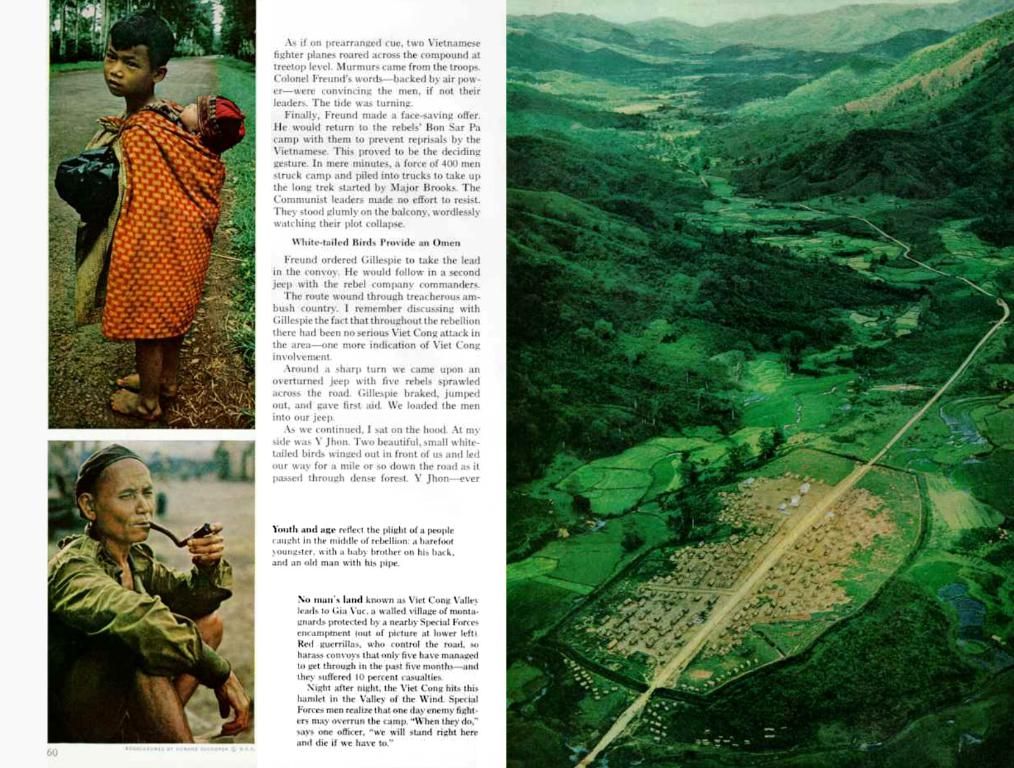

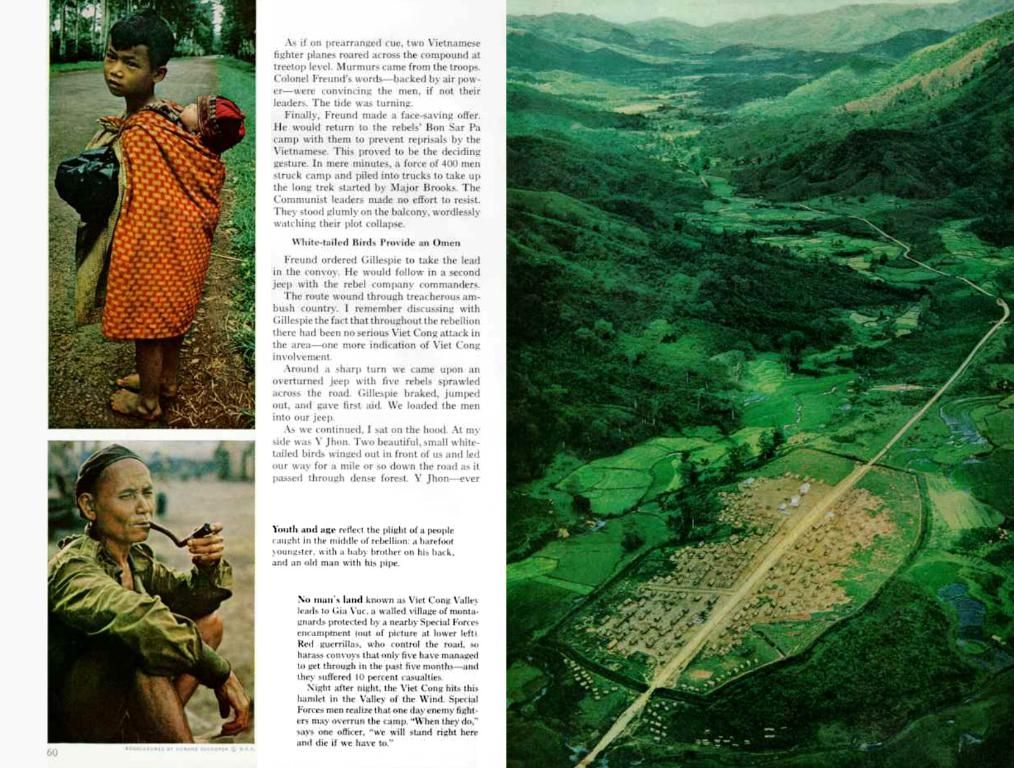

Month-on-month, inflation remained flat, while the Harmonised Index of Consumer Prices, which strips out mortgage interest costs, dipped to 1.4% compared to 2% in April. Now, here's where it gets intriguing. The most significant price hikes in the past 12 months were noticed in food and non-alcoholic beverages, which surged by 4%. That means meat, chocolate, milk, cheese, eggs, and even booze and tobacco saw an increase of 3.1%.

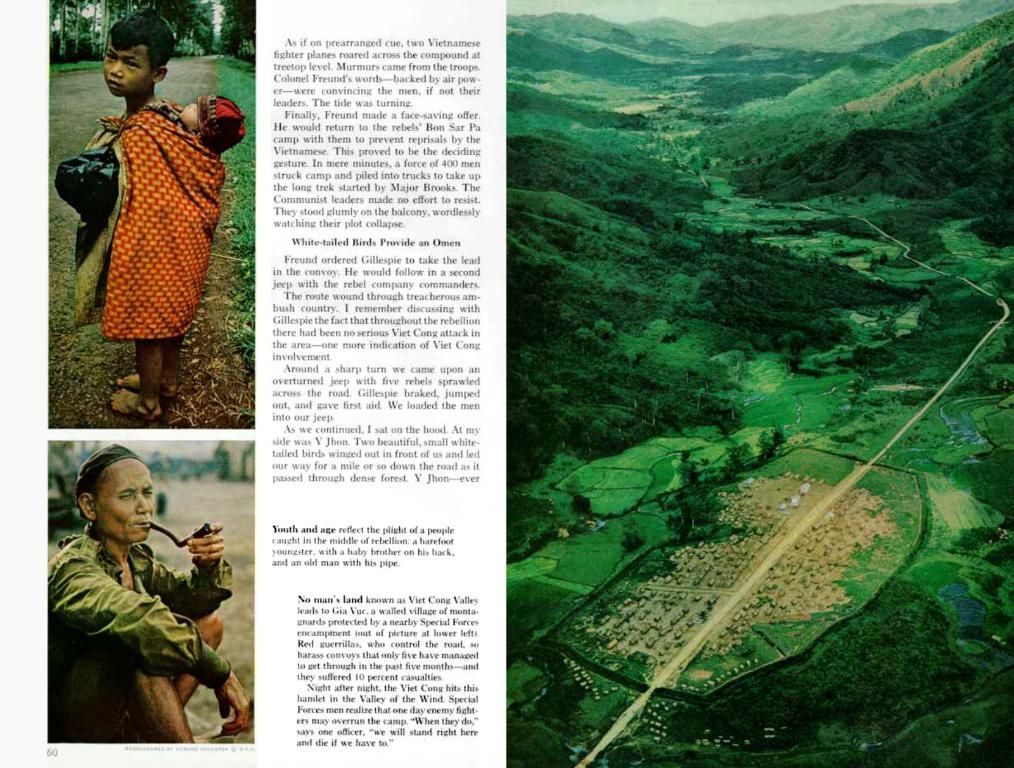

The cost of renting a place and electricity also went up – 5.3% for rents and 1.3% for electricity. Health and motor insurance premiums followed suit, each increasing by a whopping 8.7% and 8.5%, respectively. But there were some silver linings – transport costs slowed, mainly due to lower prices for airfares, petrol, and diesel. Clothing and footwear prices even dropped by 1.9%.

The CSO also published the National Average Prices for selected goods and services for May. Did you know that a pound of butter cost €1.03 more, while Irish cheddar cheese per kg increased by 57 cent? Two litres of full-fat milk went up by 27 cent, and an 800g loaf of white/brown sliced pan increased by five cent. Spaghetti per 500g also saw a two-cent increase.

On the brighter side, the price of a 2.5kg bag of potatoes fell by 25 cent compared to last year. However, remember that these are just averages. Prices can vary widely based on location and specific stores.

Now, what about the comments from Dominic Lumsden, a spokesperson for Peopl Insurance? Well, he pointed out that while inflation rate has eased overall, there are several areas where inflation is running above average. But here's the catch – the data provided doesn't confirm that Peopl Insurance had specific insights into these areas.

Generally, the National Transport Authority (NTA) Inflation Report shows significant inflation in tender prices and property values, but it doesn't focus specifically on insurance sector inflation or Peopl Insurance for that period. Insurance premium growth might have outpaced general inflation rates in certain years, but that's not directly linked to Ireland or May 2022, nor is it from Peopl Insurance. So, we're left with a bit of a mystery here! Food for thought, right?

In the realm of business finance, Peopl Insurance expressed concerns about certain sectors experiencing inflation rates above average, despite the overall easing of inflation. Interestingly, the National Transport Authority's Inflation Report suggests significant inflation in tender prices and property values, but it does not provide insights specific to the insurance sector or Peopl Insurance for that period.