Opting for an Economic Upturn: A Comprehensive Outlook on Germany's "Investment Booster" Plan

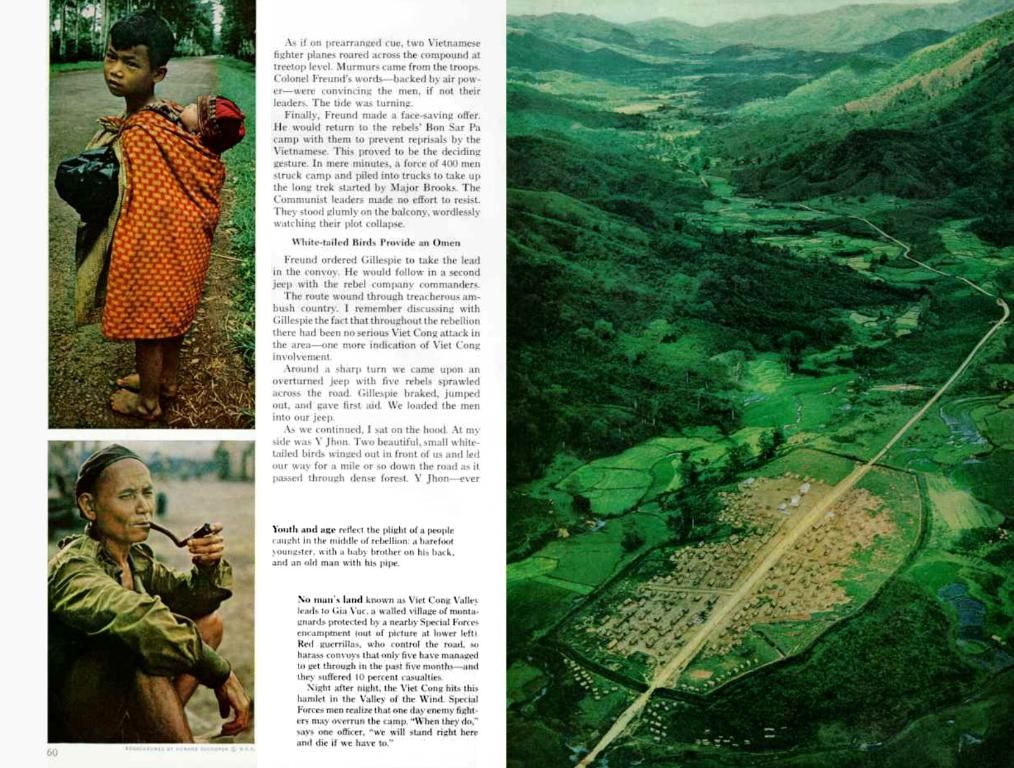

Discussion of proposed economic stimulus program by the government in Federal Cabinet meeting - Government officials deliberate over plans for financial backing aimed at stimulating economic growth.

The Federal Cabinet has set sail on an ambitious voyage to fortify Germany as a prime business hub and inject momentum into the nation's economy. This voyage is christened the "Investment Booster Plan." Here's what it entails:

Key Elements of the Investment Booster Agenda

- Gradual Corporate Tax Cuts: In a move to inspire investment, the corporate tax rate will progressively dip from its current 15% to 10% over the span of five years, with the first reductions scheduled to commences in 2028 and reaching completion by 2032. These cuts, set to reduce the total tax burden to roughly 25%, will provide a welcome breathing room to companies [1][2].

- Amplified Tax Research Allocations: The plan calls for a more liberal approach towards research funding to foster investment in innovation. Commencing in 2026, the maximum investment cap for research allowances will inflate from €10 million to €12 million. Furthermore, eligibility for these incentives will expand, and simplified processes will come into play via flat-rate deductions [1].

- Special Depreciation Bonus for Equipment Acquisitions: The plan proposes a "boost" for equipment depreciation, enabling businesses to drop 30% of the investment costs from their tax burden. This opportunity extends to investments made between July 1, 2025, and December 31, 2027[1][4], although specifics about electric vehicle depreciation were not clearly elucidated.

Waves of Change Expected from the Plan

- Growth and Job Preservation: Substantiating job security and encouraging economic expansion are key objectives of this plan. By offering businesses a degree of planning certainty and incentives to invest, the government aims to nurture Germany's competitiveness as a lucrative business destination [1][4].

- Bureaucratic Ease: Simplifying tax processes and introducing flat-rate deductions for research incentives are central to the plan's mission to dismantle bureaucratic obstacles, thereby making Germany an alluring prospect for investors [1].

- Fiscal Prudence: Ever mindful of fiscal discipline, the German government is diligently working to harmonize these investments with responsible budgeting. Balancing commitments to public finances, and adhering to European fiscal standards remains a priority [3][4].

In essence, the plan is poised to enhance Germany's attractiveness as a magnet for business investments, all while maintaining a firm grip on fiscal responsibility.

In the context of Germany's "Investment Booster Plan," the EC countries might consider vocational training programs as a potential investment opportunity, considering the plan's emphasis on job preservation and nurturing Germany's competitiveness. To further finance these programs, the plan includes simplified tax processes and increased research allowances, which could potentially encourage investments in innovative vocational training initiatives.