Gold prices surge due to escalating Israel-Iran conflict and President Trump's evacuation recommendation, causing increased demand.

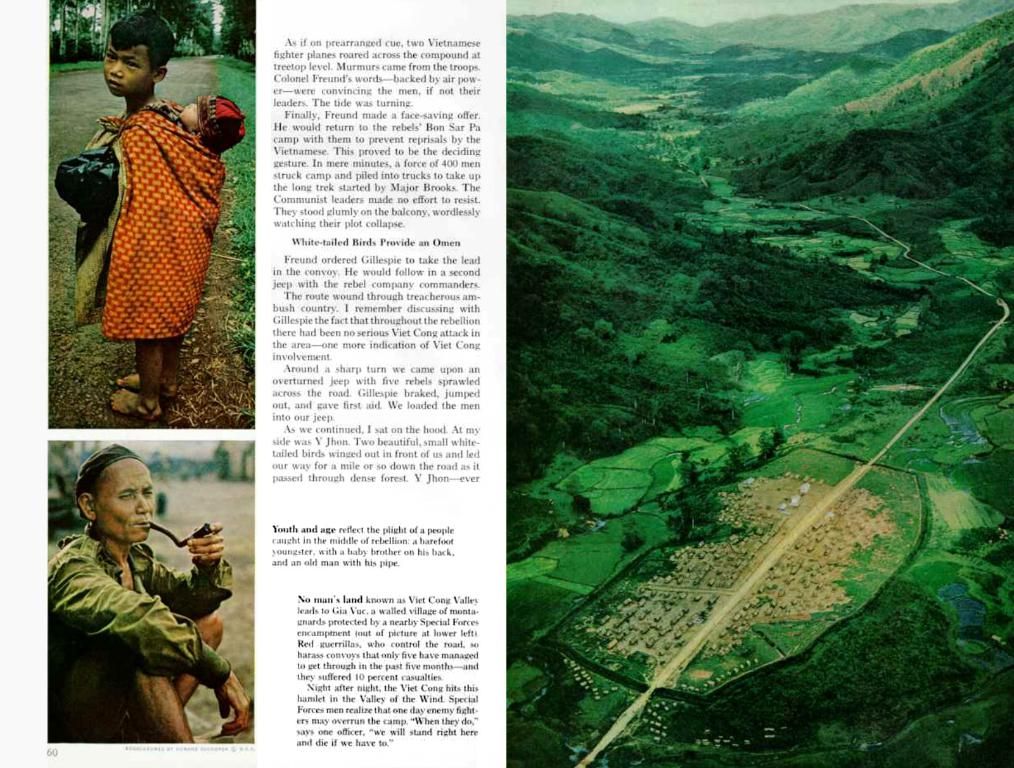

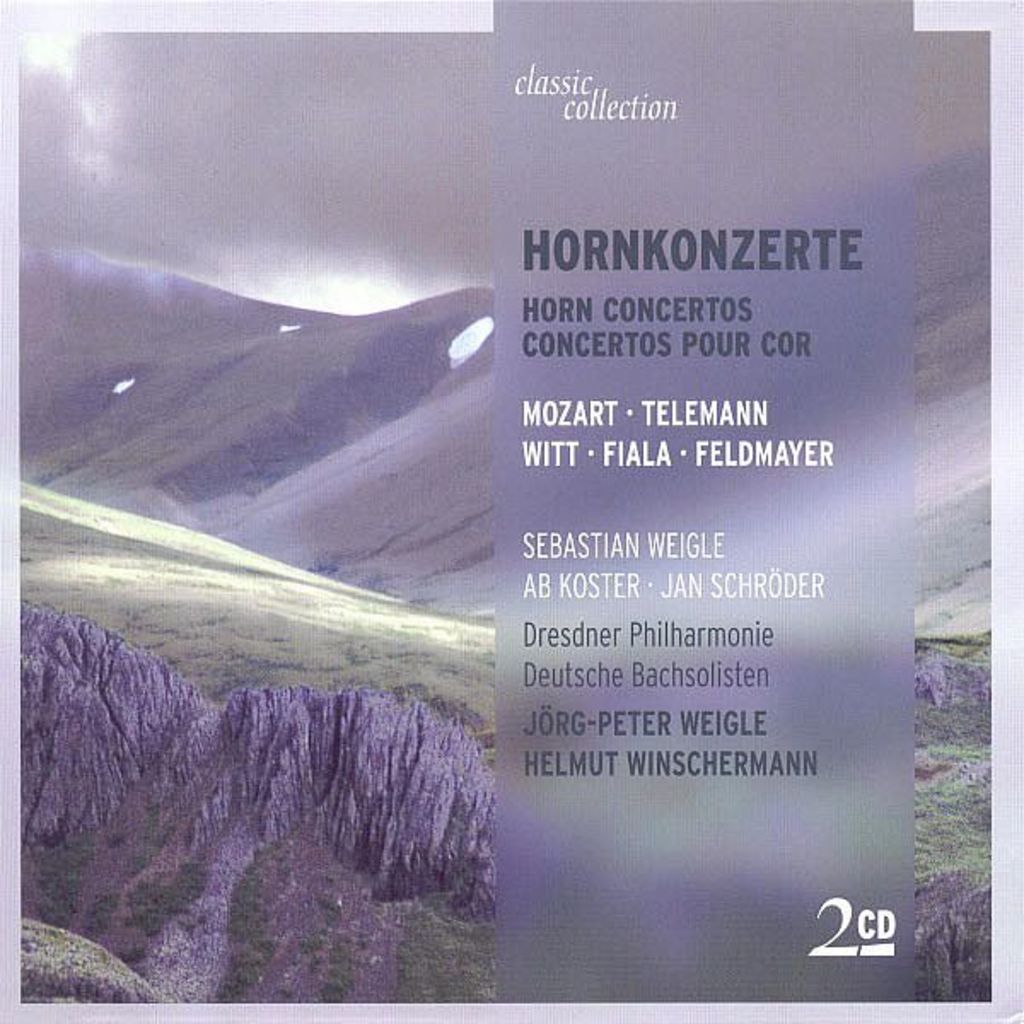

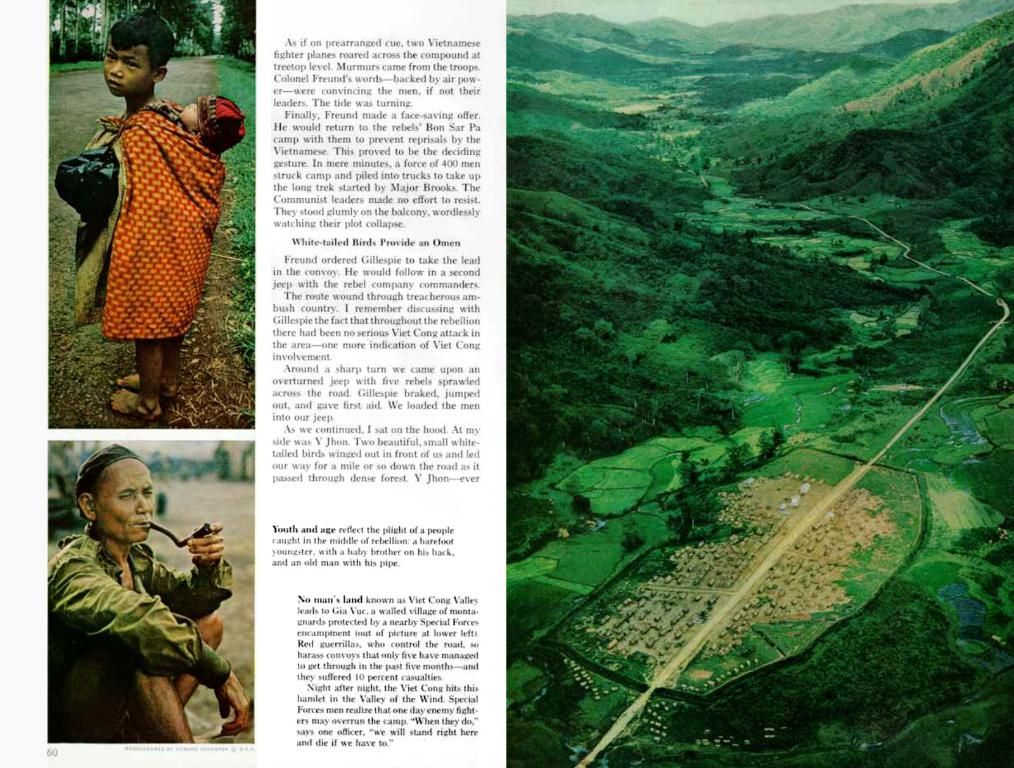

Worker arranges high-purity gold bars for sale at the ABC Refinery in Sydney, Australia, on April 30. [AP/YONHAP]

Related Insights

The Allure of Gold in Times of Turmoil

Gold prices zooming towards record highs often coincide with geopolitical conflicts, a failing dollar, or refinery production troubles due to some interconnected factors:

Geopolitical Clashes Unleash Safe-Haven Demand

Geopolitical tensions, such as the ongoing Israel-Iran conflict, trigger investors to seek safe-haven assets like gold. This is because gold is viewed as a stable haven during uncertain times, offering a reliable reserve of value[1][2][4]. Plus, an escalation in the risk of broader instability or conflict in key regions fuels a risk premium that boosts gold prices[1][4].

Dollar Weakness Ignites Gold Prices

Generally, gold prices and the US dollar have an inverse relationship. As the dollar weakens, it becomes less costly for foreign investors to purchase gold, generating increased demand and driving prices upward[1]. A weaker US dollar may also reflect waning confidence in the nation's economy, making alternative investments like gold more enticing[1].

Refinery Snafus Fuel Gold's Appeal

Refinery production mishaps are mostly associated with oil and gas markets, but they can influence gold prices through secondary economic and political factors:

- Disrupted supply chains in energy markets caused by conflicts in the Middle East can push up costs and volatility in global energy markets. This chaos can spill over into other commodities, including gold, as investors flock to safer assets[4].

- The aftermath of production problems, like inflation or economic instability, can amplify gold's allure as a hedge against uncertainty.

In essence, gold prices surge due to escalating geopolitical tensions and a weaker dollar, primarily because of the secure-haven demand and inverse relationship between gold and the dollar. Production problems at refineries contribute to economic unpredictability, encouraging investors to turn to safer assets like gold.

- During challenging economic times, investors seek refuge in assets like gold, leading to an increase in gold prices during geopolitical crises or a failing dollar.

- As the US dollar weakens, it makes it cheaper for foreign investors to buy gold, increasing demand and pushing gold prices higher.

- Disruptions in refinery production, while primarily associated with oil and gas markets, can impact gold prices by causing secondary economic and political factors, such as inflation or economic instability, that make gold a more attractive hedge against uncertainty.

- Investors looking for safe-haven assets often turn to gold when geopolitical tensions escalate or when the risk of instability or conflict is high, pushing gold prices to record highs.