Fed Chairman Powell suggests potential absence of rate reduction in March

In a shift towards a less restrictive stance and with the economy continuing to thrive, Federal Reserve Chairman Jerome Powell expressed no urgency to adjust policies further. Testifying on Capitol Hill, Powell aligned with Fed officials and Wall Street's expectations of maintaining interest rates at the March meeting.

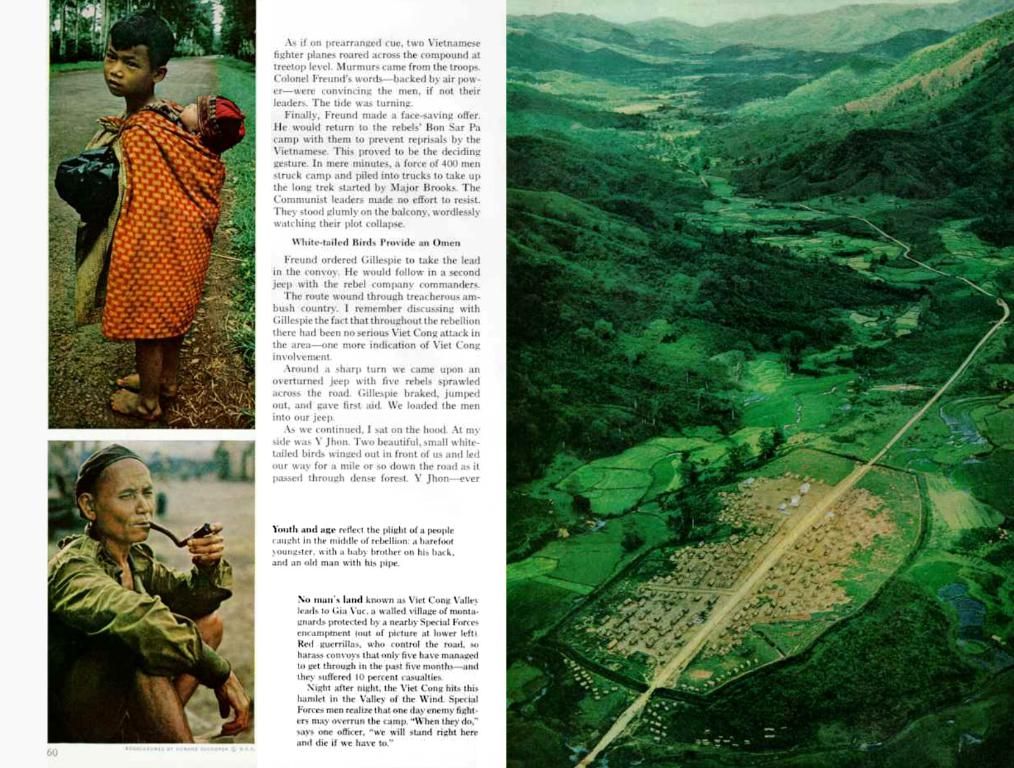

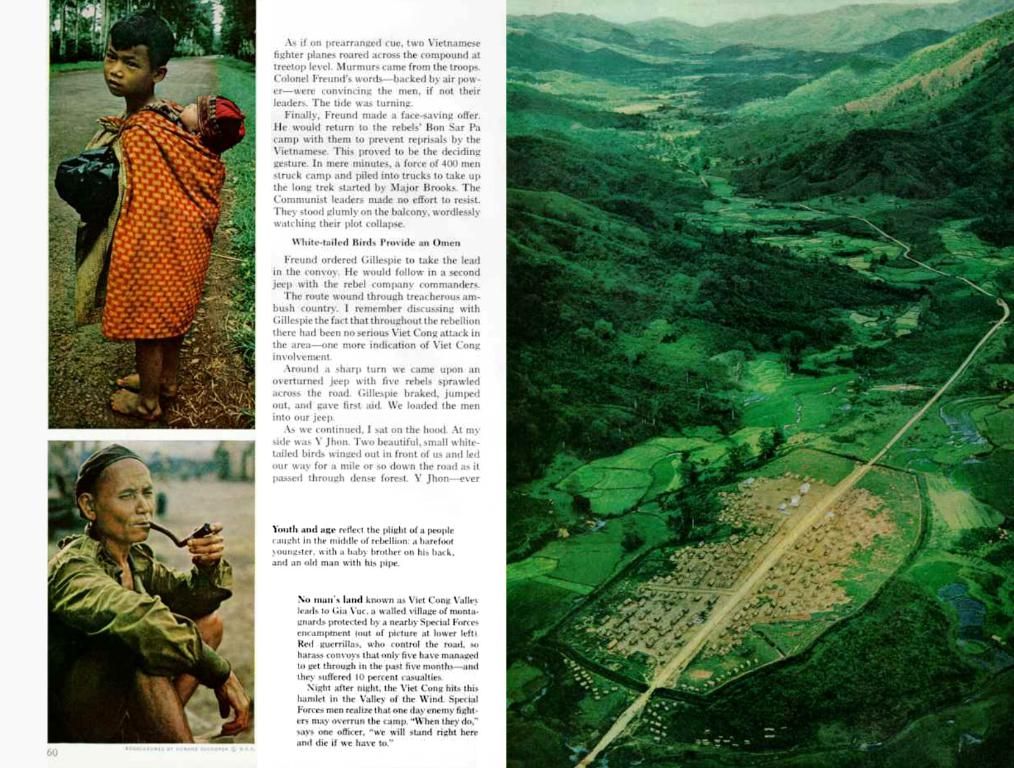

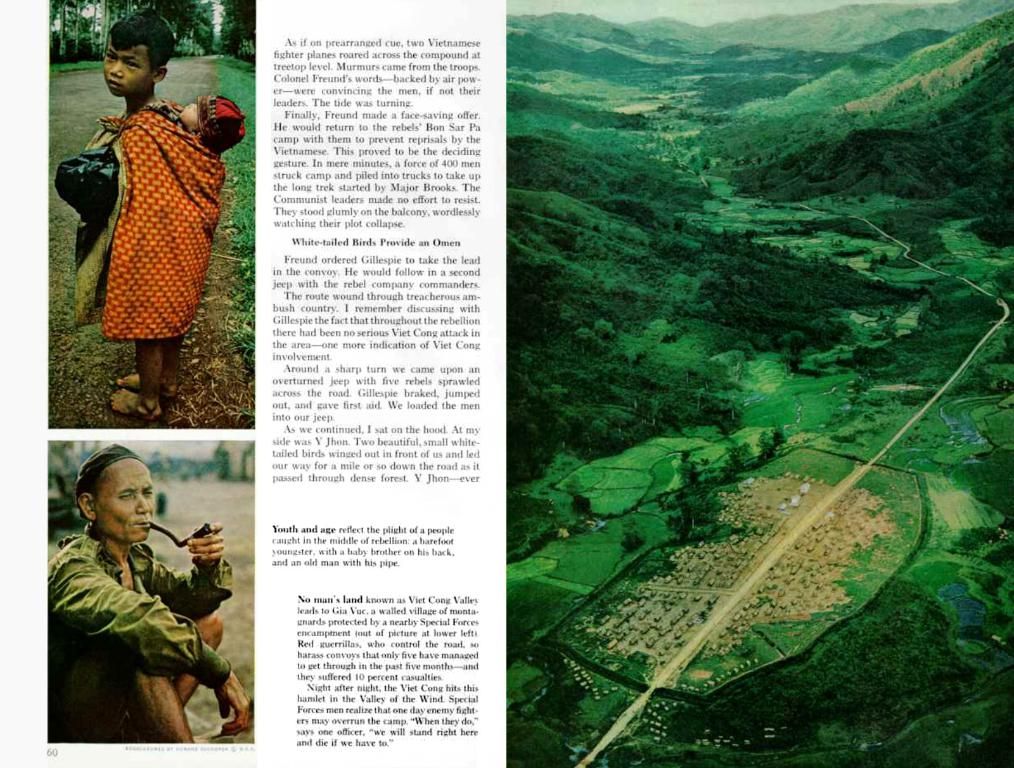

The economic landscape, however, is evolving under President Trump's policies. Implementing tariffs, mass deportations, reducing regulations, and planning tax cut extensions bring uncertainty to consumers and businesses. Such instability has caused the National Federation of Independent Business' Uncertainty Index to surge, with US consumers expressing growing doubts due to inflation fears.

Fed economists must now adapt their models to account for this drastically different environment, as Trump's shock therapy puts the economy on edge. Despite these challenges, the U.S. economy remains robust with solid growth, low unemployment, and healthy consumer spending. The Fed can afford to be patient, focusing on controlling inflation, which is showing limited progress.

Interest rates could hold steady for months, especially considering the economy's strength and a healthy labor market. This stance is a clear departure from the aggressive rate cuts in 2019, reflecting the Fed's increased confidence in the economy's ability to handle inflationary pressures.

Enrichment Insights:

While Trump's policies may increase inflationary pressures in the short term, offsetting measures like tax cuts and deregulation may help keep overall inflation under control. However, the labor market may face challenges due to immigration policies and protectionist trade measures, impacting global supply chains and potentially reducing global GDP growth. Geopolitical tensions, particularly with the BRICS bloc, also remain a concern, potentially impacting international relations and economic stability.

The evolving economic landscape due to President Trump's policies has businesses grappling with uncertainty, as tariffs, mass deportations, and reduced regulations create inflation fears among consumers. Despite this, the Fed maintains a steady approach towards business, with interest rates expected to hold steady for months, given the economy's robust health and strong labor market.