Corporate Lending Slows Down - Why Businesses Aren't Borrowing Despite Lower Interest Rates

mpi Frankfurt

Eurozone credit provision is in disarray

Banks across the Eurozone are ironically reluctant to dish out loans to businesses, even as interest rates dip. In November, banking institutions only upped their lending to non-financial companies by 1.0% year-on-year. This slow progress was announced by the European Central Bank on Thursday, following a growth rate of 1.2% in October [1]. On the other hand, the picture looks slightly brighter for consumers, as lending increased from 0.8% in October to 0.9% in November.

Hold Up, What's Going On Here?

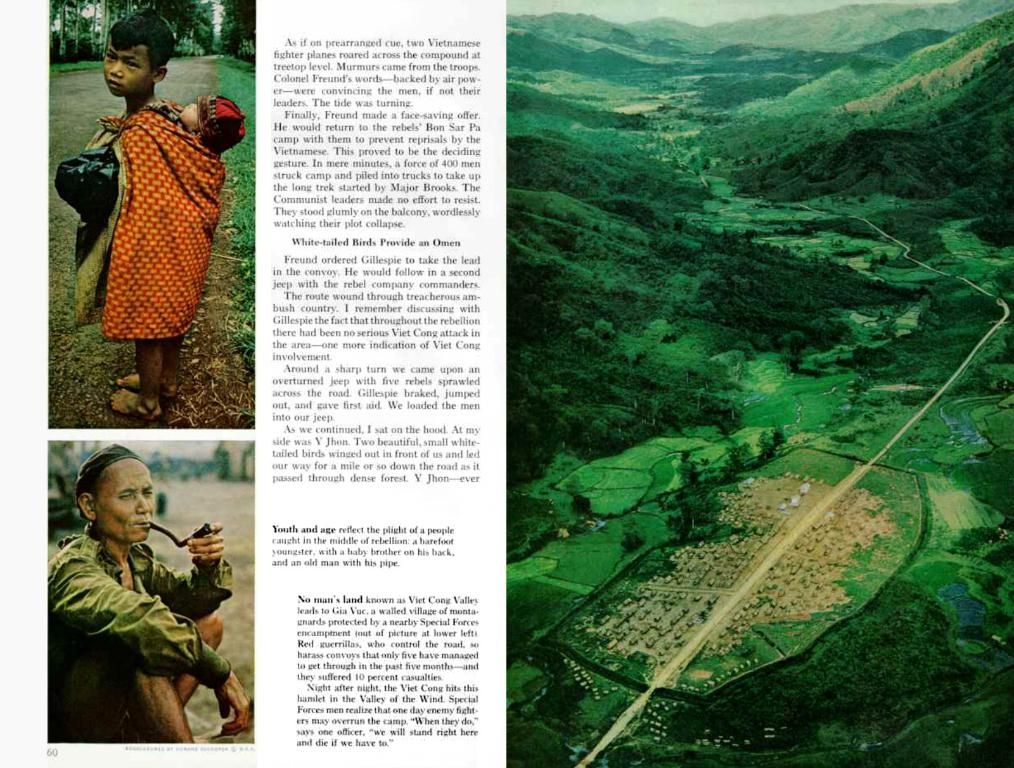

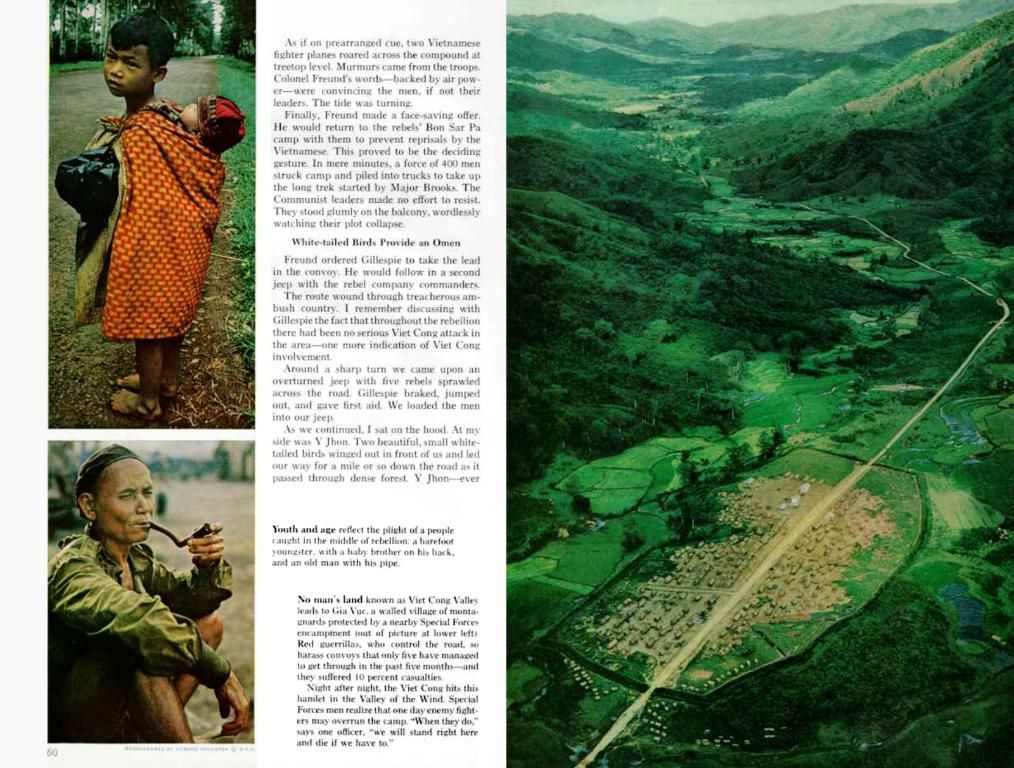

Turns out, things aren't as simple as they seem. Banks seem to be playing it safe with corporate loans, despite lower interest rates [2]. Here are the reasons behind the cautious lending:

Risky Business

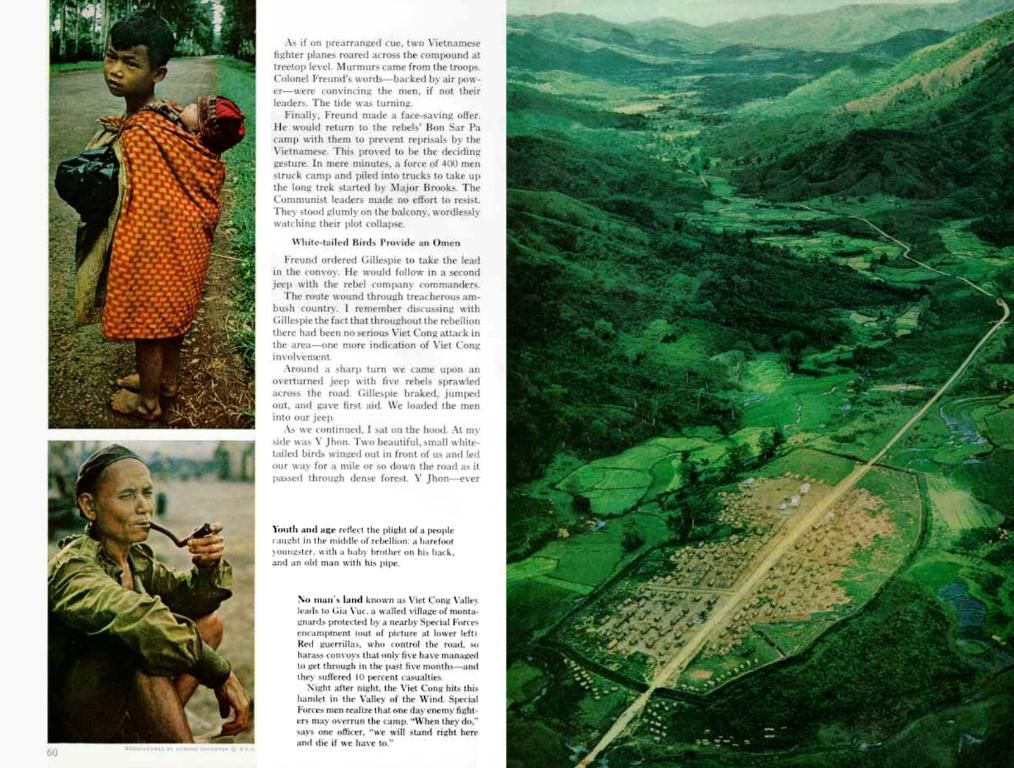

Eurozone banks have tightened credit standards for corporate loans, with 3% of banks reporting a small net tightening in Q1 2025 [2]. This trend, which has continued since late 2024, can be attributed to:

- High Stakes: Banks are wary of deteriorating economic outlooks and firm-specific vulnerabilities, particularly in export-dependent industries that are sensitive to U.S. demand fluctuations [1].

- Bad Apples: Non-performing loan ratios and collateral valuations continue to constrain banks, particularly in Germany and smaller Eurozone economies [1].

- Roll the Dice: Sectors like energy and real estate face escalating default risks (projected at 4.8% in 2025) [4], prompting banks to steer clear of overexposure to these markets.

Who Needs a Loan Anyway?

Demand for corporate loans has shifted into slightly negative territory in Q1 2025 [3][2], mainly due to:

- Timing is Everything: Firms are focusing more on refinancing existing debt rather than seeking new loans, as over €1.5 trillion in European corporate debt set to mature through 2025 [4].

- Policy Paranoia: Geopolitical fragmentation and regulatory ambiguity deterr firms from making capital expenditure plans [1][4].

- Squeezed Margin: Higher operating costs and compressed profits leave limited cash for debt servicing, particularly for small and medium-sized enterprises [1].

Money, Where Art Thou?

The sluggish M1 growth indicates that rather than borrowing, firms and households are:

- Getting Their House in Order: Paying off high-interest debt instead of taking on new loans [4].

- Holding Onto Their Coins: Building cash buffers in response to recessionary risks, as seen with Davidson Kempner's focus on asset-heavy industries with unpredictable cash flow [4].

- Hedging Their Bets: Exporters hoard euros to shield against dollar-denominated input cost volatility [1].

Game Changers in Credit Markets

Structured credit volumes are expected to grow by 18% in 2025, as investors venture into high-yielding securitized products to bypass traditional bank lending [4]. This shift in the credit market explains why M1 growth lags despite credit market activity in certain segments.

In a nutshell, the current state of corporate borrowing demonstrates a complex dance of risk-averse lenders and cautious borrowers. While M1 stagnation might look like a sign of ineffective monetary policy, it's actually more about defensive financial positioning [1][2][4].

[1]: European Central Bank, "Monetary Policy Decisions – Press Release," (Thursday, November 7, 2024)[2]: European Central Bank, "Financial Stability Review," (June 2025)[3]: European Central Bank, "Bank Lending Survey," (December 2024)[4]: Ainvest, "The New Credit Landscape: Adapting to a Shifting Market" (June 2025)

- Despite the lowered interest rates in the Eurozone, banks are still cautious in dishing out corporate loans, with credit standards tightening significantly.

- The slow growth in corporate lending can be attributed to several factors, such as banks' apprehension regarding deteriorating economic outlooks, non-performing loan ratios, and escalating default risks in sectors like energy and real estate.

- On the other hand, demand for corporate loans has decreased, mainly because firms are focused on refinancing existing debt, influenced by geopolitical fragmentation, regulatory ambiguity, and higher operating costs.

- Instead of borrowing, firms and households are using their resources to pay off high-interest debt, build cash buffers, and hedge against economic risks, potentially explaining the sluggish M1 growth.

![Image portrays an individual, recognizable as [person's name], engaged in a heated argument with another person. The setting appears to be a public place, possibly a political rally, and both individuals seem strongly passionate about their respective viewpoints. ECB's interest rate decreases show limited effect on lending expansions, yet conditions for borrowing might become less stringent.](https://capitalvue.top/en/img/20250501181852_pexels-search-image-description-your-specific-description.jpeg)