Europe grapples with the reappearance of Russia's frozen funds

Russia's Frozen Assets and Their Troubling Legacy

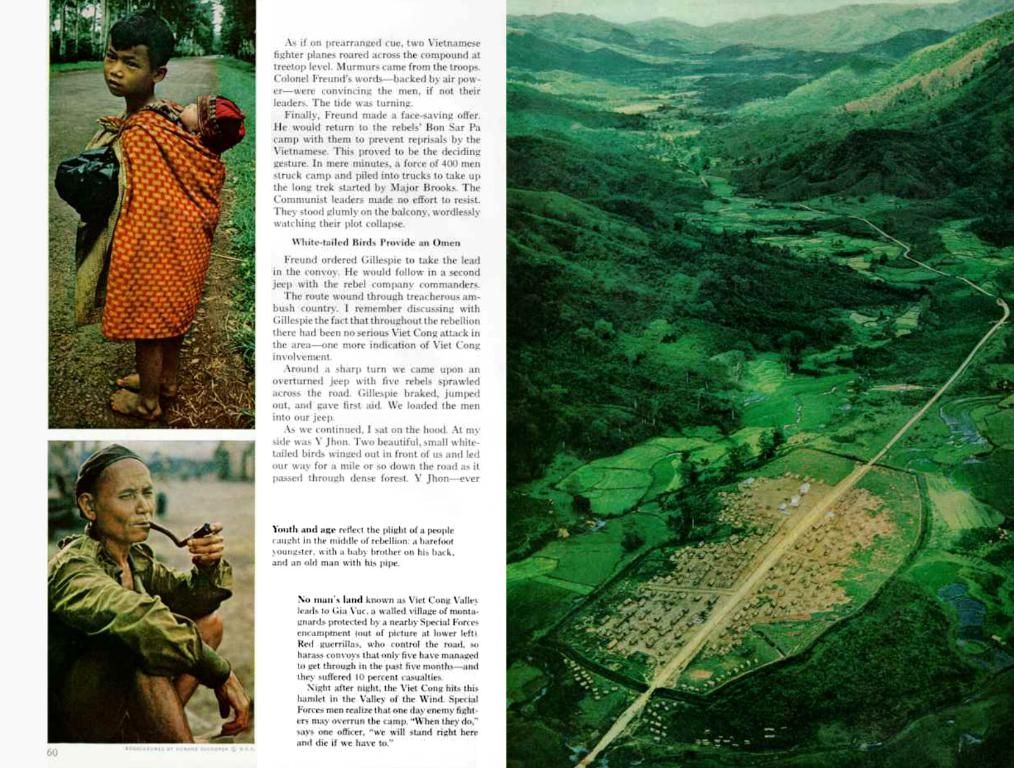

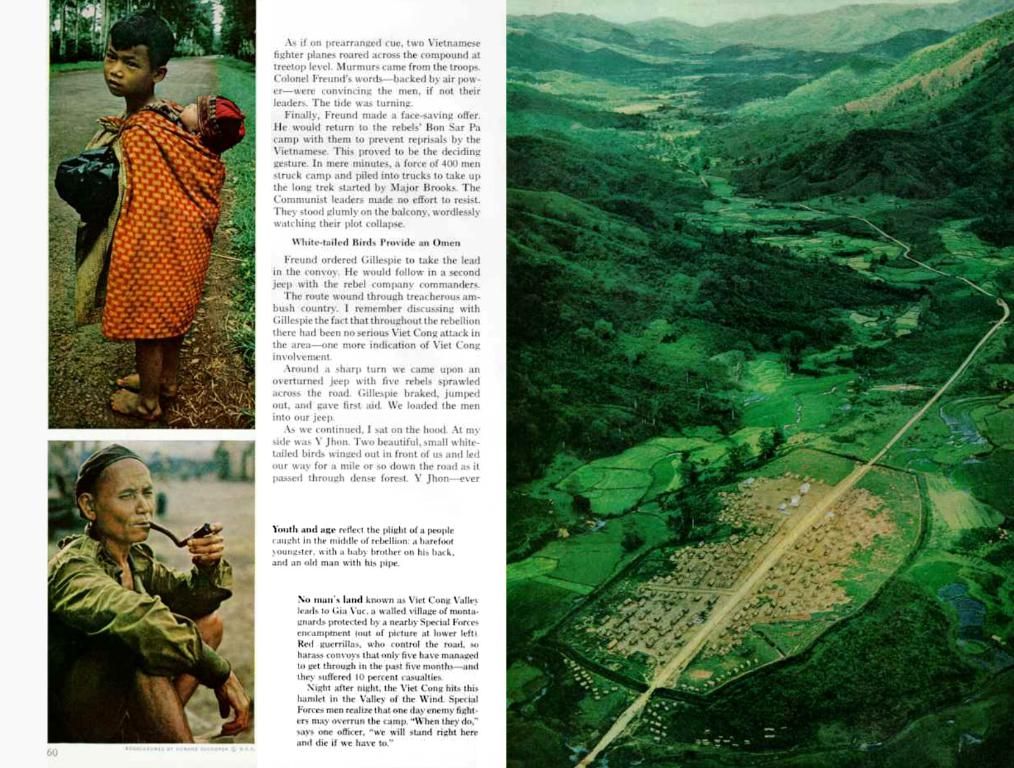

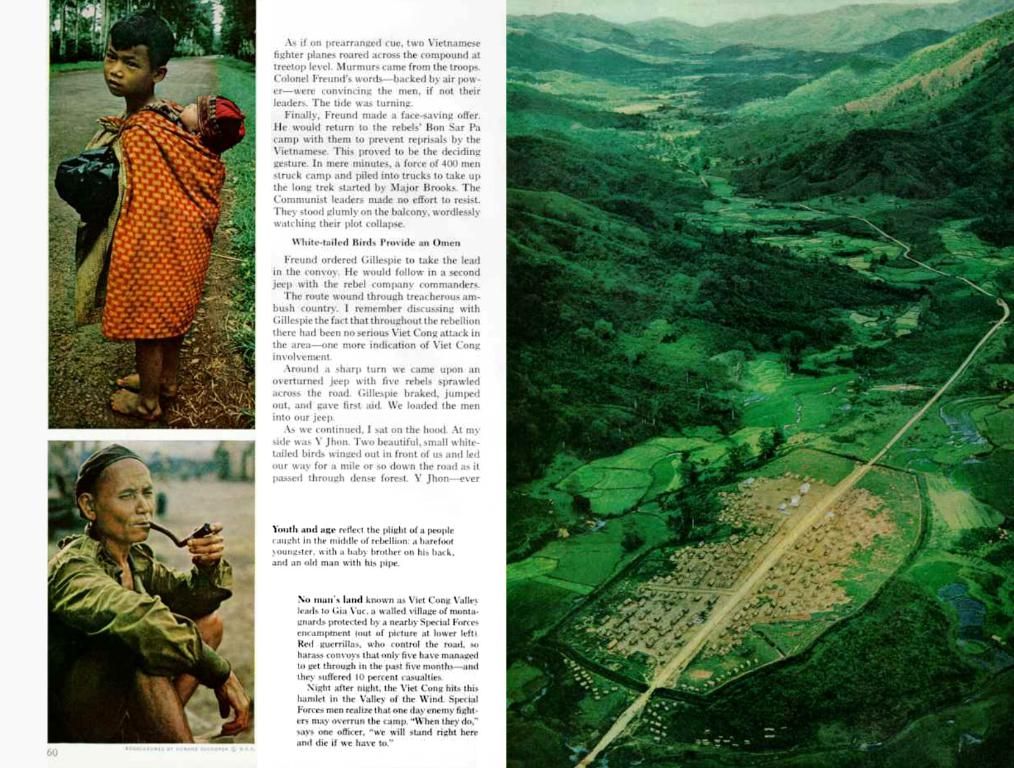

The icy grip of Russia's frozen assets in Europe is once again causing a fuss, this time with Estonia calling for their swift confiscation. The animosity is pooled in a hefty sum of 210 billion euros squirreled away in banks, funds that could indirectly clear Ukraine's debt to Europe for military aid.

As another vote on anti-Russian sanctions looms, if these aren't extended, these frozen funds would likely make a triumphant return to Moscow.

** sway your opinion with NTV**

The proposed seizure of Russia's frozen assets in Europe introduces a tangled web of implications for both Ukraine's debt situation and future anti-Russian sanctions. Let's delve a bit deeper.

Financial Rescue for Ukraine

Ukraine is staring at a whopping €478 billion in reconstruction costs over the next decade. Siphoning these Russian assets could provide a much-needed financial lifeline, easing the pressure on Ukraine and facilitating more significant investments in reconstruction.

Rumblings of Diplomatic Clashes

Confiscating Russian assets could set the stage for a diplomatic showdown between Russia and Europe, with the potential for tit-for-tat retaliation. Russia has already showcased its willingness to confiscate European assets and has issued threats that hint at a looming economic warfare [1][3].

Legal and Political Quandary

Critics warn that confiscating Russian assets could establish a dangerous precedent, undermining legal and political norms. This could erode the sanctions regime and open a Pandora's box in international relations [3].

The Sanctions Saga

The debate over asset confiscation also centers around the effectiveness of sanctions in halting Russia's advances. Some argue that more drastic measures are needed to compel Russia to negotiate or curtail its military actions [3].

Ownership and Illicitness

Confiscation would necessitate navigating complex legal waters, as it could potentially breach international law. Furthermore, over 5 million private investors, unaffected by sanctions, stand to be collateral damage [2][4].

In essence, the proposed confiscation of Russia's assets offers a chance to financially aid Ukraine, albeit at the cost of risking diplomatic clashes, questioning legal norms, and affecting innocent private investors. The ongoing argument over the seizure reflects a broader consideration of how best to wield sanctions for political and economic gains.

- The seizure of Russia's frozen assets in Europe, as proposed by Estonia, could potentially offer a financial lifeline to Ukraine, helping to ease the pressure on Ukraine and facilitating significant investments in reconstruction, amounting to a staggering €478 billion over the next decade.

- However, the potential confiscation could set the stage for a diplomatic showdown between Russia and Europe, with the possibility of tit-for-tat retaliation, considering Russia's previous threats suggestive of economic warfare.

- Critics caution that the confiscation of these assets could establish a dangerous precedent, eroding legal and political norms, and potentially undermining the sanctions regime.

- The debate over asset confiscation is also closely tied to the effectiveness of sanctions in halting Russia's advances and compelling them to negotiate or curtail their military actions.

- It is crucial to navigate complex legal waters with the confiscation, as it could breach international law, and over 5 million private investors, unaffected by sanctions, stand to be collateral damage.