Austria Braces for EU Commission's Excessive Deficit Procedure in 2023

EU Commission initiates fiscal discipline proceedings against Austria

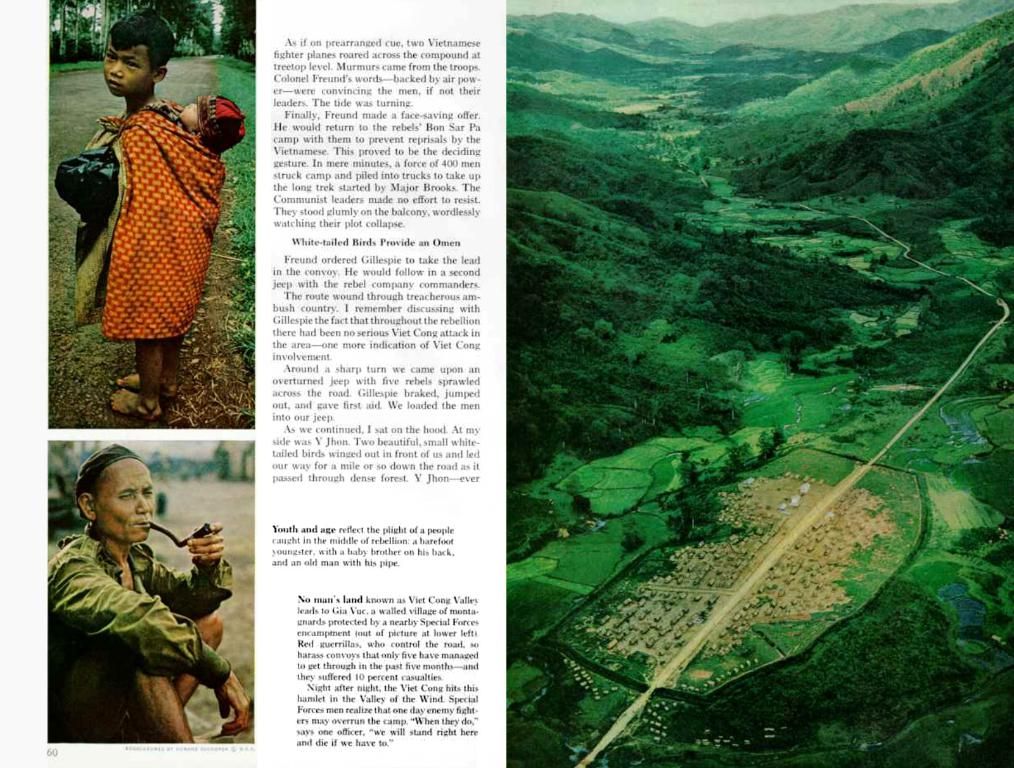

Get the lowdown on Austria's impending financial predicament as the EU Commission steps in with a fix for the nation's bloated debt.

The EU Commission is poised to kick off an infringement procedure against Austria, highlighting the country's ballooning debt. Austria is projected to accrue new debts this year, equating to 4.4% of its GDP, surpassing the EU's fiscal rules ceiling.

The deficit procedure initiated by the EU Commission aims to steer countries towards prudent financial policies. Last year, Austria's public deficit stood at 4.7% of its economic output, amid an economic crisis marked by high inflation, sluggish consumer demand, and persistent recession. The EU Commission anticipates Austria to be the sole EU member state experiencing economic contraction this year. To fund this deficit, Austria intends to borrow another 4.4% of its GDP, escalating its total debt to 84% of its GDP.

With a substantial deficit, the EU Commission has signaled its intention to launch an excessive deficit procedure against Austria, according to reports from Brussels. Following this announcement, the Economic and Monetary Affairs Committee will issue statements, followed by the Commission confirming the existence of an excessive deficit. They will then propose recommendations for deficit reduction to EU's finance ministers.

This anticipated action comes as no surprise to Vienna's frontliners. The current coalition, comprising ÖVP, SPÖ, and NEOS, had previously hinted at the possibility of a deficit procedure. Their predecessors had cushioned economic impacts stemming from the COVID-19 pandemic and the Ukraine conflict via costly support measures and environmental subsidies.

If Austria finds itself under the spotlight for an infringement procedure, it will be expected to take countermeasures to address its debt and deficit. This objective is primarily geared towards the stability of the eurozone, with potential penalties totaling billions of euros for persistent violations, although these have yet to be enforced in practice.

Compared to 2025, there's a lack of specific data detailing Austria's financial situation in 2023. However, general reasons and implications can be inferred from similar contexts:

- Fiscal Discipline: An infringement procedure could compel Austria to tighten its fiscal belt, limiting its ability to boost public spending or launch new social programs.

- Economic Constraints: The procedure could impose restrictions on Austria's economic policy, potentially hampering its response to economic shocks or investments in key sectors.

- International Perception: Being under an infringement procedure might impact Austria's standing and investor confidence.

- Structural Reforms: The EU might require Austria to implement structural reforms to enhance its fiscal sustainability and competitiveness.

- Given Austria's impending excessive deficit procedure, the country might be compelled to tighten its employment policy to ensure fiscal discipline.

- As Austria faces the EU Commission's deficit procedure, the country's industry and business might be subject to certain restrictions or limitations in economic policy.

- The excessive deficit procedure initiated by the EU Commission could potentially impact Austria's general-news coverage worldwide, influencing its international perception and investor confidence.