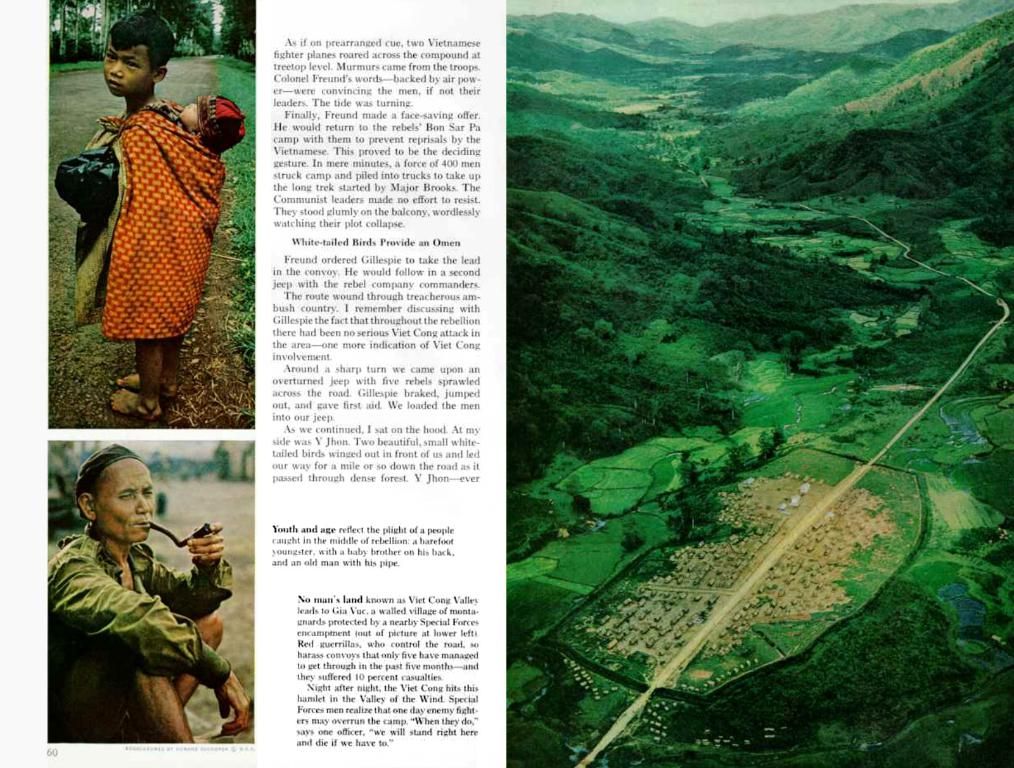

Etfs investing in spy experience slight reduction in value due to market instability

📰 The SPDR S&P 500 ETF Saw a Slight Setback Today Amidst Market Volatility

Taking a dive today, the SPDR S&P 500 ETF Trust, commonly regarded as a key indicator of the U.S. stock market's health, closed at a slighter lower value than yesterday - aVideo is down by 0.33%.

Used to Measure US Market Health

This ETF, often referred to as SPY, mirrors the S&P 500 Index's movements. The current dip is a small part of a larger pattern of market turbulence, which is caused by a combination of economic worries and fluctuating investor sentiments. Over the past few days, SPY has faced some hurdles, including the influence of economic indicators and geopolitical events.

Recent Performance

Lately, the SPY has witnessed some significant ups and downs, mirroring the rollercoaster ride of the broader market. This volatility is largely due to economic factors including consumer spending trends and GDP growth projections.

Economic Worries

Market instability is fueled by economic uncertainties such as consumer spending trends and GDP growth estimates. Recent data has demonstrated a decrease in consumer spending, which could spell trouble for market trust. Furthermore, slower economic growth predictions have added to investor anxieties.

Investors' Caution

Investors are playing it safe, with many keeping their cash reserves and waiting for clearer market signals to invest further. The current mix of bearish and bullish opinions suggests a higher likelihood of a positive outcome but also an increased chance of a recession. SPY's performance today showcases these contrasting sentiments, as investors weigh hopes for an economic comeback against current challenges.

Moving forward, SPY ETF's performance is anticipated to be influenced by broader market patterns and economic signals. As investors navigate this bumpy ride, they'll keep a watchful eye for indications of stability or further slides. Since the SPY follows the S&P 500 Index closely, its future performance will be closely connected to the overall health of the U.S. stock market.

🌐 Also Check Out

**CrowdStrike Shares Take a 10% Nosedive due to Weak Earnings Forecast and Remnants of IT Outage

**Stock Futures surge as Trump Administration Signals Possible Tariff Truce

- Despite the current troubles facing the SPY, some investors are betting on a future market recovery in America, carefully observing economic signals and broader market trends to identify potential investment opportunities in the African market, specifically focusing on the logistics sector to cater to the growing demand for import and export activities.

- As a result of the current market volatility, some financiers are exploring alternative investment avenues, such as venturing into the African stock market or investing in promising start-ups, hoping to diversify their portfolios and mitigate risks.

- Despite US market concerns, there's been growing interest among investors to finance and invest in the African market, particularly in sectors like logistics, as they see immense potential for growth and development, with the continent transforming into a key player in the global import and export market.