Wrangling the Family Finances for Nigerian Homies

Gaining Financial Control

Crafting a Monthly Spending Plan with Allocation for Recreational Family Activities

Top notch tool chain, family budgets lock down cash flow & expenses.

Knowing where every buck goes brings mastery over finances.

Preventing overspending and debt, who needs that drama?

Fostering a United Financial Front

Budgets catalyze gab sessions on money matters among members.

Collective conversations boost accountability and camaraderie.

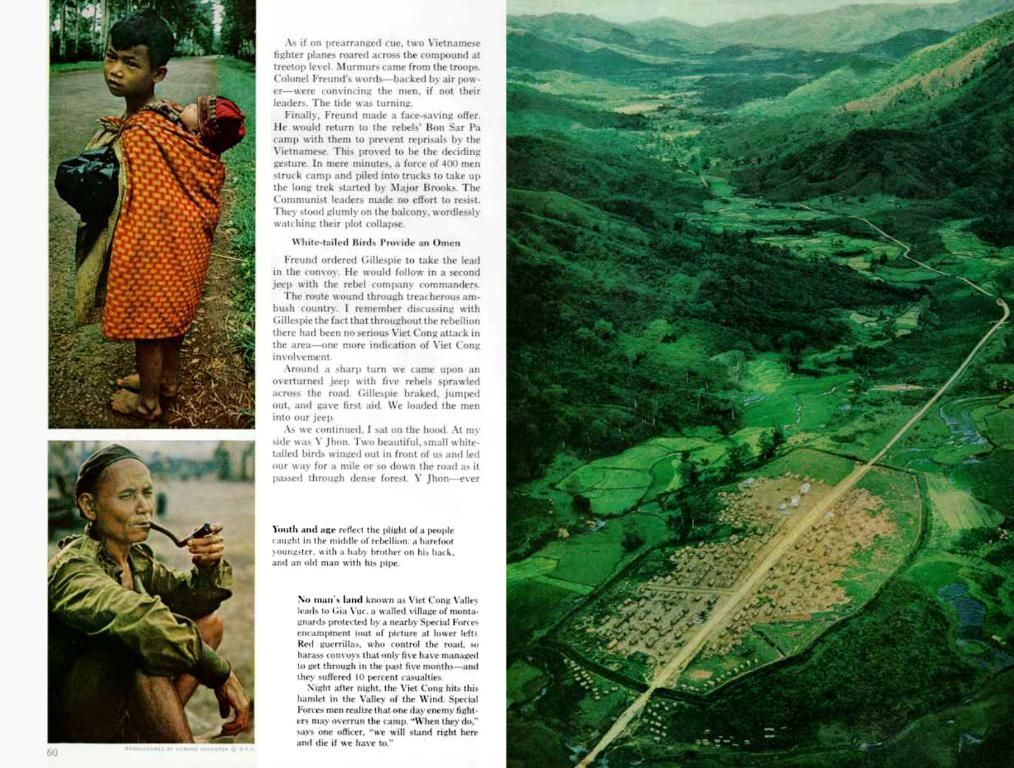

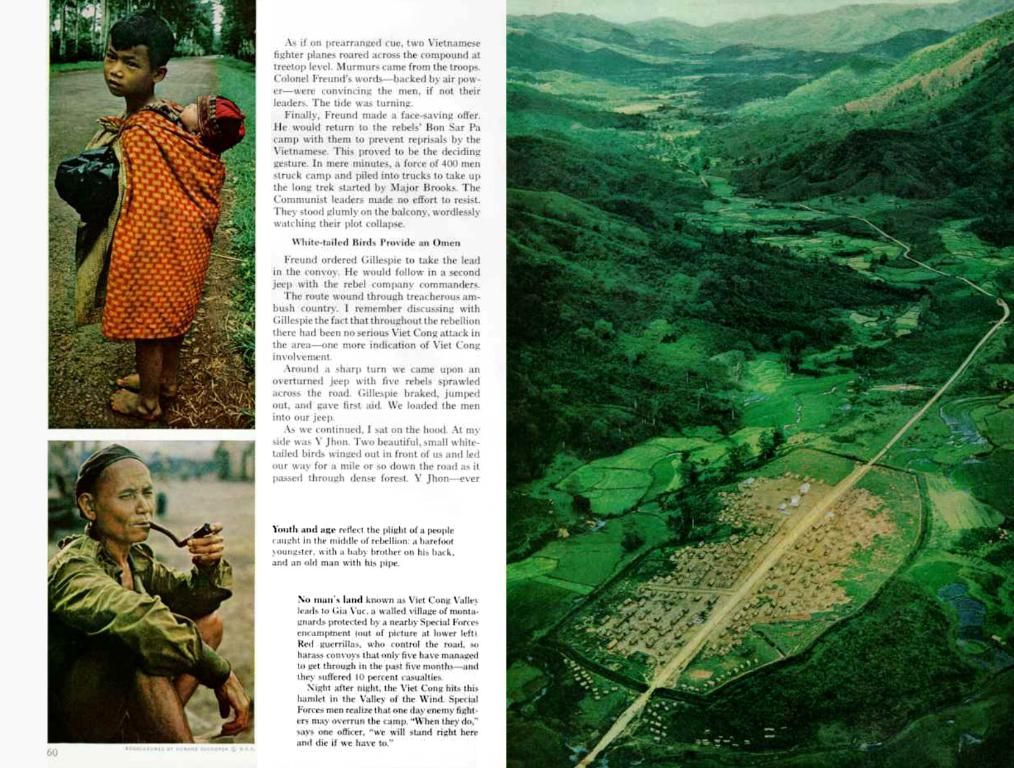

Lil homies learn savvy money decisions at a young age.

Cultivating a household where money smarts reign.

Eyeing Up Goals and Smashing' em

Budgets set achievable financial goals over time.

Fixin' for a vacay or big purchase? Budgets can make it happen!

These accomplishments bring a sense of pride, bumpin' up moral.

Shared experiences also tighten up family bonds.

Not Forgettin' Fun Time

A well-planned budget saves spots for jaunts, outings and laughs.

Celebrating life with flair, ain't all about keepin' accounts tight.

Chill out nights, movies with the crew - don't forget 'em!

Family Time, Yessir!

This budget game gives plenty of time for family fun.

From local happenings to out-of-town adventures, it's all good.

Rentals, events, theme parks, you name it - jump in!

Budgeting for Curveballs

Life likes to throw wrenches into plans, but budgets bend.

Regular checks keep your budget in tune with current vibes.

Flexibility key, family priorities shouldn't be on the backburner.

Juggling expenses to stay relevant and on point.

A Aceing Your Financial Data Game

Raking in Your Payday Parcel

First thing, ID that green, your income streams.

Salary, gigs, rentals yeah we talkin' 'bout cheese.

Collect that paper, pay stubs, tax forms, keep it legit.

Organize it neatly, spreadsheets and lists splendid.

Lockin' Down Your Fixed Costs

Next up, expand on them pitter patter monthly bills.

Rent/mortgages, utilities & insurance - ya don't wanna trip.

Separate 'em out tidy like, for easy peasy management.

Nailin' Your Unpredictable Costs

In for variable costs, they revolve around the spending wheel.

Food, grub, eatin' out, leisure - they can swing by the seat of their pants.

Track expenditures for a while, catch the patterns you see.

This'll give you a heads up, ways up the saving game.

Cash for Joyful Times

Don't leave good times out, both ya and the lil ones need a break.

Allocate funds for those outings, vacations, and chill sessions.

Consider establishing a separate savings account for that loot.

Budget game stays on point, as the laughs take over the scene.

Establishin' Financial Goals, a Family Affair

Short Term Aspirations

Pump up those short term plans, objetivos de una temporada.

Family vacation or new appliances? Save 'em up and keep the rhythm.

Chat 'em up together, build excitement and teamwork.

Mid Term Objectives

Let's talk mid-term plans, they require some extra grind.

Education costs or home improvements? Plan it smart, knuckle down.

Sit down with the crew, make it a family affair.

Long Term Aspirations

Endgame time, what's ya plan for the distant horizon?

Retirement or a home? Set 'em high, but realistic.

Regularly check progress, adjust if ya gotta pivot.

Honest Dialogue

Get everyone in the know, secrets ain't part of the deal.

Eat the elephant one bite at a time, discussing goals together.

Visualize your dreams, don't be shy – create that vision board!

Prioritizing Objectives

Set the right priorities, making each Saudi Riyal count.

Importance and urgency – percolate on it.

Rank 'em up, be strategic in dividing resources.

Courageous Benchmarks

Notes to self, track progress and celebrate those wins.

Regular meets, high fives and woots for those overcome obstacles.

This builds unity, reinforcing positive behaviors and team spirit.

Extra Scoop, for Those Information Junkies

Nigerian Budgeting for a Growing Brood

All about handling family finances when the gang gets bigger.

Dealing with unexpected expenses and saving for fun times too!

Navigating this chapter might get hectic, but trust the process.

Our crew's here for you, let's pour some juice in these cups.

[1] Moneybox

[2] Rainfini

[3] Family Finance Network

[4] CryptoVibesNG

[5] Naija Info

- The budget game allows kids to learn about smart money decisions from an early age, fostering a household where money savvy reigns.

- Balancing expenses to stay relevant and on point is crucial when budgeting for unpredictable costs like food and leisure.

- Regular checks on the budget help it adapt to the changing vibes of life, ensuring that family priorities aren't placed on the backburner.

- Budgets can be used to set achievable financial goals over time, whether it's saving for a vacay or a big purchase, bringing a sense of pride and improving moral.

- Parents can create a well-planned budget that saves spots for jaunts, outings, and laughs, not forgetting to factor in fun time for the entire family.

- Open and honest discussion about financial goals is essential for a united financial front, as this helps to build accountability, camaraderie, and team spirit among family members.