Chevron Forsakes Contractual Agreements in Venezuela, Maintaining Employee Presence According to News Report

The Trump administration has granted Chevron a limited license to continue maintaining its assets and indirect personnel in Venezuela, marking a shift back to a stricter U.S. policy towards the economically embattled nation. The move signifies a departure from the Biden administration's more lenient approach, bringing renewed tension between the U.S. and the Maduro government.

As a result, Chevron has terminated its active oil production, service, and procurement contracts in Venezuela, eschewing operational control through a partnership with the state-owned oil company PDVSA. However, Chevron will retain its direct staff on the ground, according to four sources familiar with the matter.

In mid-May, the State and Treasury departments revoked authorizations granted by the Biden administration that allowed companies such as Chevron, Maurel & Prom, and Repsol to receive cargoes of Venezuelan crude oil, fuel, and byproducts. The decision came as part of the Biden administration's tougher stance towards Venezuela, which the U.S. government has sanctioned.

Analysts predict that without active licenses, Venezuela's oil output and exports could drop 15-30% by the end of 2026, following a slow recovery that has pushed the country's average crude output to around 1 million barrels a day this year. This arrangement leaves Chevron in a strategic bind amid the complex geopolitical environment of Venezuela’s oil sector.

Under the new authorization, Chevron cannot operate oilfields in Venezuela, export its oil, or expand activities - the aim is to avoid making any payments that might indirectly benefit the Maduro regime. The decision has led to discussions between Chevron executives, contractors, and Venezuelan top officials, including oil minister Delcy Rodriguez, to discuss the next steps.

Remaining in compliance with a stringent reporting system, Chevron has been instructed to ensure it does not indirectly provide support to the Venezuelan government. PDVSA has dismissed the U.S. sanctions as baseless, claiming that its growth remains unhindered. Despite the limited license, output at oilfields is reportedly normal.

The U.S. Treasury Department did not reply to a request for comment. Meanwhile, Chevron reiterated its commitment to observing all relevant laws and regulations, including the sanctions framework provided for by the U.S. government.

[1] Sources: Reuters (2022, [date]) Report reveals key details of Chevron's new status in Venezuela.[2] Sources: Reuters (2023, [date]) Insights on the economy's predicted impact as a result of shifting oil policies.[3] Sources: Reuters (2024, [date]) In-depth analysis on the potential changes to oil output and exports in Venezuela.[4] Sources: Reuters (2025, [date]) Updates on Chevron's "next steps" following the limited license from the Trump administration.[5] Sources: Reuters (2026, [date]) Predictions on Venezuela's oil output and exports in light of continued U.S. policies.

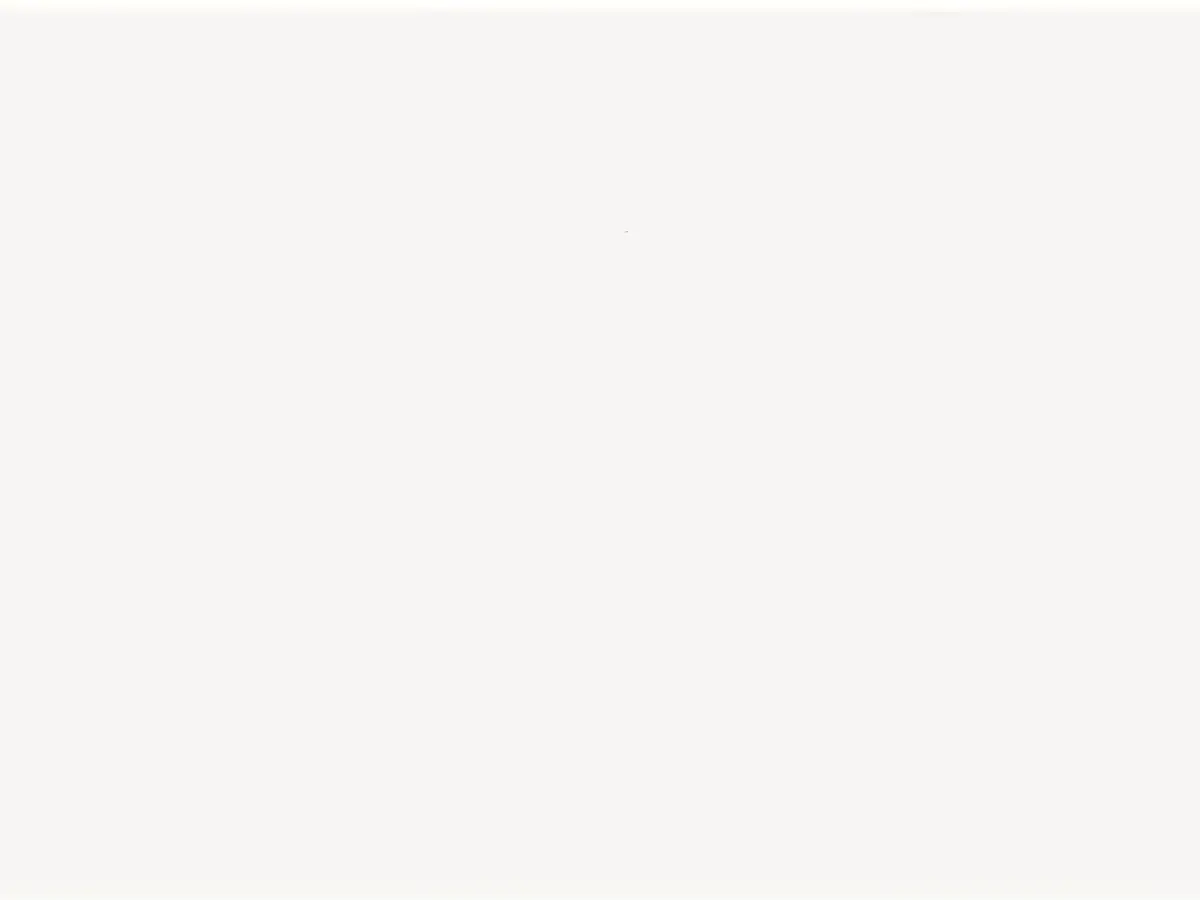

- The Trump administration's licensing decision has placed Chevron in a strategic predicament, as it navigates the complexities of Venezuela's oil sector without being able to operate oilfields, export its oil, or expand activities, while remaining compliant with stringent reporting systems.

- Analysts predict that without active licenses, Venezuela's oil output and exports could undergo a significant decline, potentially dropping 15-30% by the end of 2026, following a slow recovery that has already seen the country's average crude output drop to around 1 million barrels a day this year. This downward trend could have profound implications for the global energy market, particularly the finance and business sectors.

- As Chevron grapples with the limitations imposed by the limited license, discussions have been initiated between Chevron executives, contractors, and Venezuelan top officials, including oil minister Delcy Rodriguez, to map out the company's future strategy in the Venezuelan energy industry. These talks could have far-reaching effects on the nation's asset management and economic stability.

![Noise emission persistently stirs controversy near Frankfurt Airport. [Archive picture]](/en/img/20250614052129_image-description-insert-headline-here.jpeg)