The European Central Bank Keeps Its Ultra-Loose Policy in Place

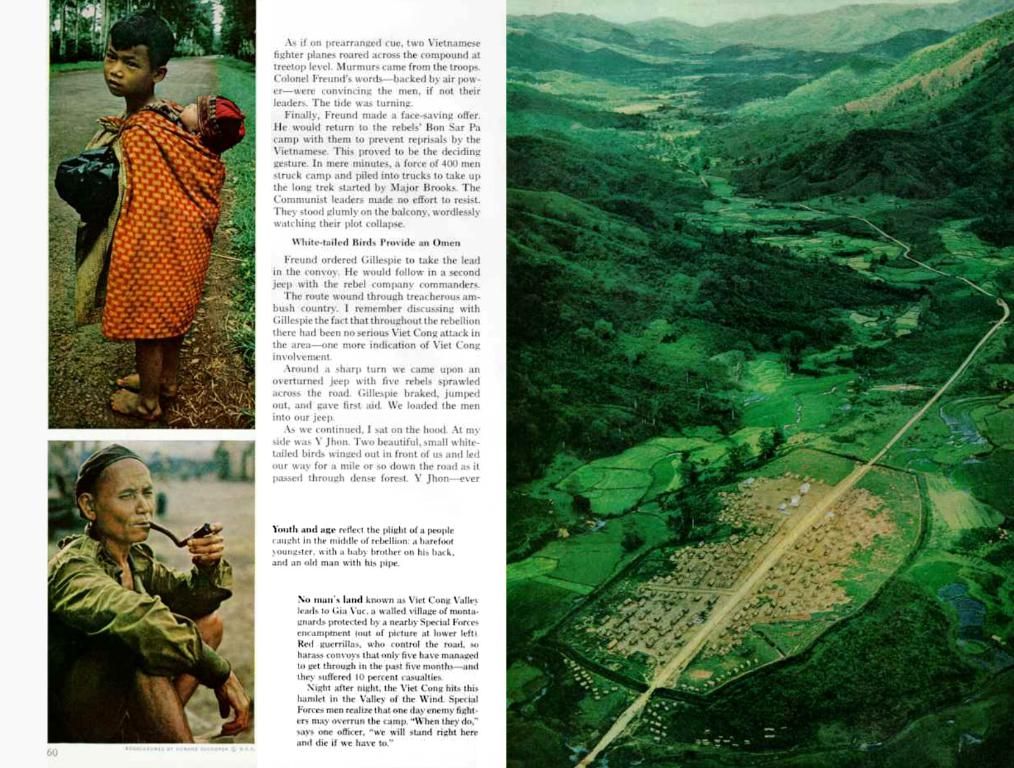

Central Bank Maintains Current Interest Rates Unaltered

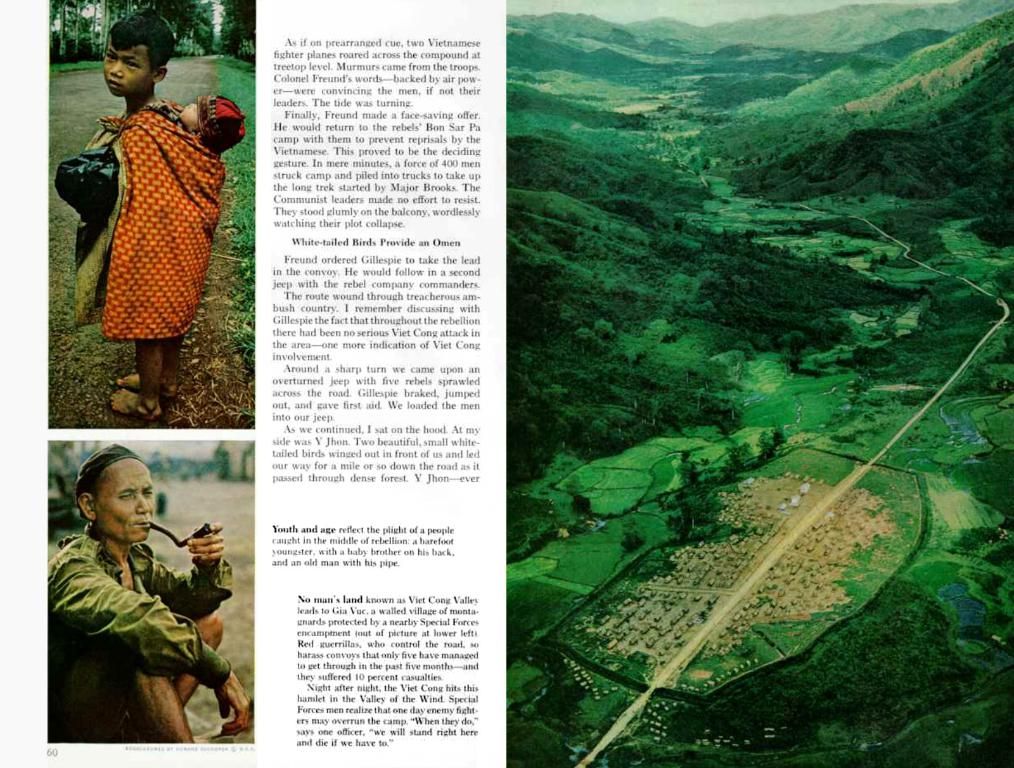

In a move intended to bolster the eurozone's economy, the European Central Bank (ECB) has reaffirmed its loose monetary policy. As of recently, the ECB has kept interest rates unchanged, maintaining a key interest rate of 0.00%, a marginal lending rate of 0.25%, and penalizing banks for holding excess liquidity by docking 0.50%.

This decision was likely expected, as the ECB Council anticipates that ECB key interest rates will remain—at best—unchanged or be lowered until there's tangible evidence that inflation is moving towards a level close, but just below, two percent.

Moreover, the ECB confirmed the size of the so-called "Pandemic Emergency Purchase Programme" (PEPP), which is currently worth €1.35 trillion, aiming to inject capital into the market during the Covid-19 crisis. The PEPP will persist until at least the end of June 2021, with the possibility of extension, as the ECB has stated it will continue net asset purchases under the PEPP until the pandemic crisis has passed.

Furthermore, hinting at a reassessment of economic conditions, the ECB has announcement plans for a comprehensive reassessment of economic prospects in December. Based on this updated assessment, the ECB Council will make necessary adjustments to its instruments accordingly.

A Closer Look: The ECB's Monetary Policy

In efforts to manage inflation and maintain economic stability, the ECB looks poised to lower its benchmark rate on the deposit facility by 25 basis points to 2% in the near future. Future interest rate decisions will depend heavily on inflation trends and economic conditions, aligning with the ECB's primary goal of maintaining price stability.

Although the PEPP has ended, the ECB may reconsider implementing similar asset purchase programs to address future economic challenges, demonstrating the importance of flexibility in monetary policy tools. The ECB is also set to review its monetary policy framework in 2025, assessing the effectiveness of current strategies and considering improvements.

Looking forward, the ECB aims to continue managing inflation within its target range by adapting monetary policy tools in response to changing economic conditions.

(Photo: ECB, via dts Nachrichtenagentur)

- share

- share

- share

In consideration of the ECB's monetary policy, other finance business entities may need to reevaluate their strategies, as the European Central Bank looks poised to lower its benchmark rate on the deposit facility by 25 basis points to 2%. Moreover, the ECB's decision to reconsider implementing similar asset purchase programs in the future underscores the importance of flexibility in managing business finances during unforeseen economic challenges.