Canadian stock market experiences decline following Trump's fresh tariffs; anticipated Fed decision takes center stage

Stock Market Dips as Trump's Movie Tariffs Stir Anxiety

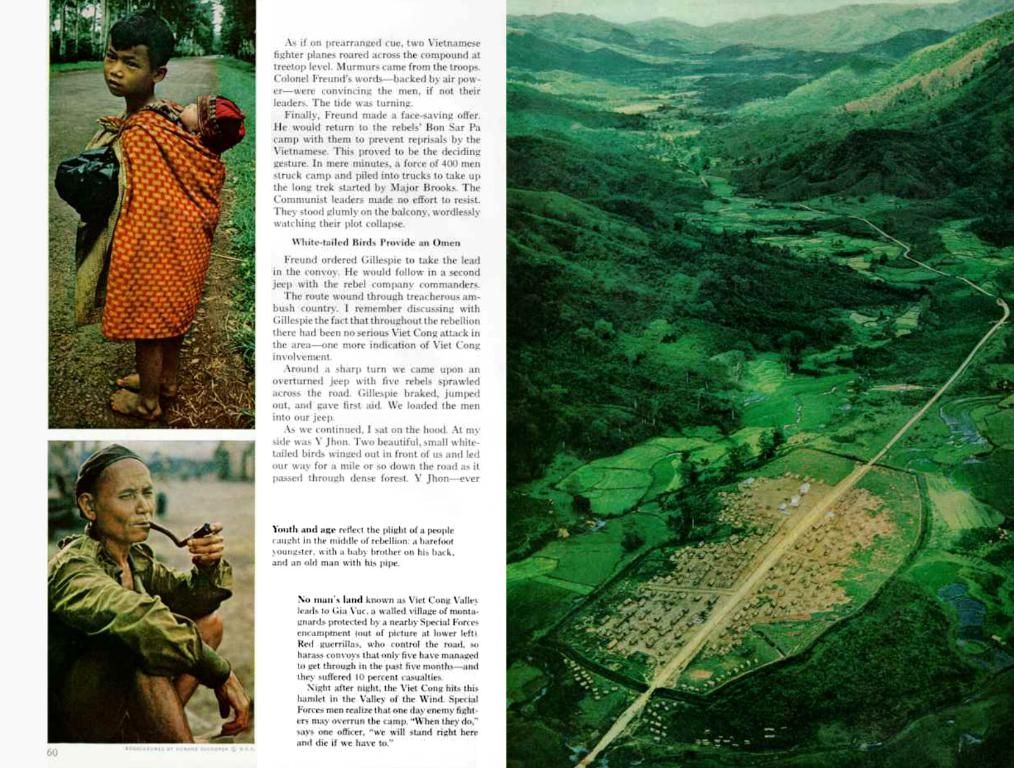

Look out, Canada! Stock prices plummeted on Monday, thanks to Donald Trump's fresh round of tariffs causing a wave of concern among investors. Before the Federal Reserve's monetary policy decision this week, the Toronto Stock Exchange's S&P/TSX composite index took a dive, landing at 24,942.81 points – down by 0.4%.

What, pray tell, are these new tariffs about? Ol' orange-haired Donald announced a steep 100% levy on flicks produced beyond the U.S. borders, but he left us hanging with unclear implementation details.

Hollywood studios are sweating it, as fear of increased production costs might disrupt the global entertainment industry and send waves through the world of American media firms. Allan Small, a senior investment advisor at Allan Small Financial Group with iA Private Wealth, put it bluntly: "Not a good announcement for us here in Canada."

Meanwhile, the Canadian services economy is reeling after contracting for the fifth straight month in April, as confusion around trade policies and the country's election dampened activity. The upcoming Federal Reserve decision will be a hot topic this week. It's widely expected that the Fed will keep interest rates steady on Wednesday.

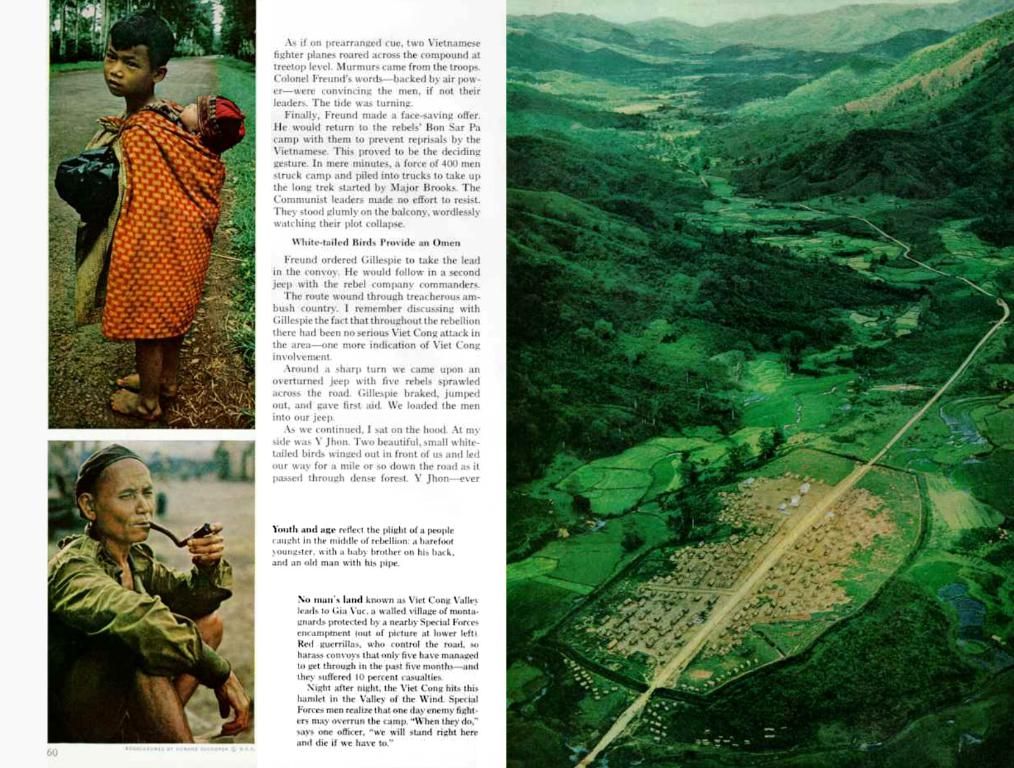

On the upside, the TSX witnessed losses in the energy sector, with a 1.9% fall, reflecting a drop in oil prices. Mining stocks were in the green, climbing 0.8% as gold prices rose more than 2%. Even Canadian fuel refiner and retailer Parkland saw a 7.6% spike after U.S.-based Sunoco LP decided to snap it up in a deal worth about $9.1 billion, including debt.

Now, listen up. If you're still worrying about Donald's latest tariffs, here's a quick glance at their potential impact on Canada's film industry and economy as a whole. Remember, this is all hypothetical at this point. But, just in case:

- Higher costs for Canadian filmmakers could make domestically-produced films less competitive, encouraging more production in the U.S.

- Canadian films may see lower U.S. box office returns and licensing revenue if slapped with tariffs, and co-productions might become less economically viable.

- If these tariffs take effect, reduced film production in Canada could lead to job losses and impact local businesses, subduing the overall economy.

- If Canadian films face U.S. tariffs, Canadian producers' stocks may suffer, along with related ancillary industries.

The bottom line? A new U.S. tariff on movies could seriously impact Canada's film production sector, denting export revenues and weighing on the broader stock market. Stay tuned for more on this developing story!

- The recent dip in the Toronto Stock Exchange's S&P/TSX composite index can be partially attributed to investor anxiety caused by Donald Trump's new tariffs on foreign-produced films.

- The potential implementation details of these tariffs remain unclear, leading to concern within the global entertainment industry and the media industry in the United States.

- If these tariffs drive up production costs, they might discourage film production in Canada, resulting in job losses and a negative impact on local businesses.

- The financial sector, particularly film industry stocks, could experience a decline if Canadian films face U.S. tariffs and suffer reduced box office returns or licensing revenue.

- The upcoming Federal Reserve decision could pose another challenge to the Canadian services economy, which has been contracting for five straight months due to confusion around trade policies and the country's election.

- On a positive note, the mining sector experienced a 0.8% climb as gold prices rose more than 2%, providing a glimmer of hope amidst the economic uncertainty caused by trade policies and political decisions in the world of finance and business.