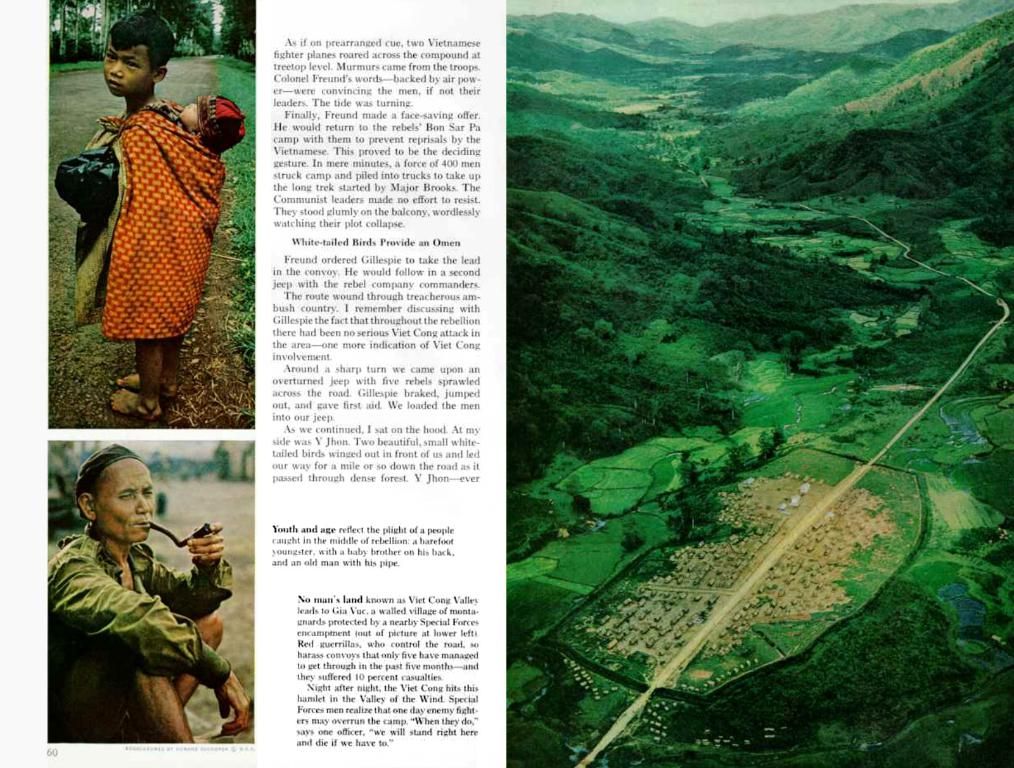

Baby Boomers Bucking Early Retirement Trend: A Time Bomb for Pension Systems? 💣💼💰

Approximately two million individuals from the baby boomer generation have opted for early retirement.

The early retirement trend that once seemed like a dream for the first wave of baby boomers is now backfiring due to financial constraints, forcing millions to extend their working lives. The Institute of the German Economy (IW) warns that the situation is becoming critical, as the retirement wave of these generations puts a massive strain on pension systems, threatening decades of savings and social welfare.

An Early Retirement U-Turn 🔄

According to a new study by the IW, nearly half of baby boomers (1.8 million individuals) have already retired early. This trend seems set to continue, with another million predicted to retire annually from 2025, despite reaching the regular retirement age of 67. Sadly, the increase in the retirement age has not led to a decrease in early retirements. Rather, it's the retirement benefits themselves that are encouraging this trend. The IW's lead researcher, Ruth Maria Schüler, suggests that the coalition government should reconsider its promise to maintain the early retirement pension after 45 years of insurance.

Demographic Pressure and Empty Coffers 💸

The economy is bracing itself for a significant increase in pension expenditure by 2045. The Germans' expected pension outlay will double to €744 billion due to the aging population. Additionally, there's a growing concern over intergenerational fairness, as younger generations are not receiving the same returns on their pension investments compared to their parents and grandparents.

Shifting the Tide: Potential Solutions 🌊

To ease the burden on pension systems, some proposed solutions include raising the retirement age, promoting employment among older workers, strengthening both state and private pensions, and making adjustments to the pension system to ensure greater fairness between generations. Germany is already implementing initiatives such as the "early start pension," which helps children begin saving for retirement at an early age, empowering future generations to take financial responsibility for their golden years.

So, what does the future hold for baby boomers and pension systems alike? Time will tell, but it's clear that the onus is on politicians, policy-makers, and individuals alike to ensure that the retirement dream doesn't become a retirement disaster.

References:

- ntv.de, raf/dpa

- Institute of the German Economy Cologne

- Demographic change

- Employees

- Employers.

- The coalition government might need to rethink its policy on maintaining the early retirement pension after 45 years of insurance, as it could potentially contribute to the financial strain on pension systems, given the rise in early retirements among baby boomers.

- In an attempt to address the growing strain on pension systems, some proposals include increasing the retirement age, encouraging employment among older workers, strengthening both state and private pensions, and making adjustments to the pension system for intergenerational fairness—solutions that could possibly reshape the future of baby boomers and pension systems.