Anticipating Achievement: Ambition to Grant 2.4 Trillion Baht in Loans in 2025 by GHB Remains Steady

Business Beat

GHB Plans to Approve 240 Billion Baht in Loans by 2025, thanks to Government Stimulus and New Borrower Support

Here's the skinny on the Government Housing Bank (GHB) aiming to hit the big time with a whopping 240 billion baht in housing loans by 2025, despite economic doubts looming large. The bank's boss, Kamolpop Virapala, remains bullish about the target, attributing strong growth in the first half of the year for the bank's optimism.

Booming Business so Far

Get this - as of the end of May, GHB had already approved 80 billion baht in loans - 33% of the annual target, and that's a firm 30.75% increase compared to the same period last year! So, it's clear that things are looking up for the bank.

Earthquake? What Earthquake?

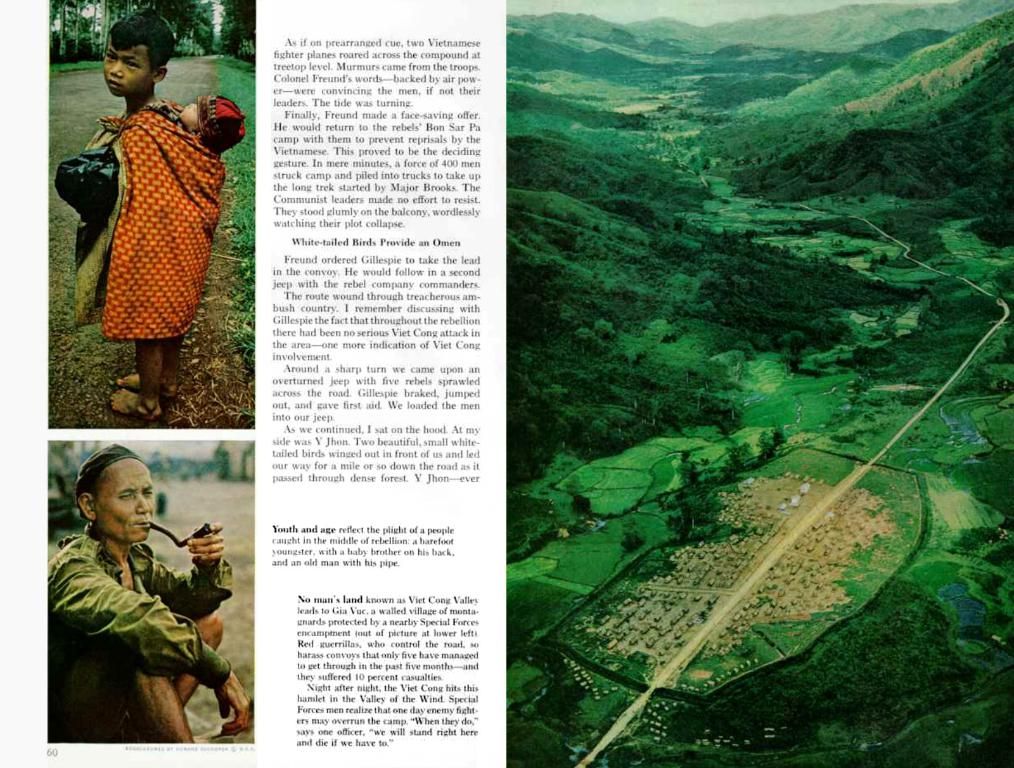

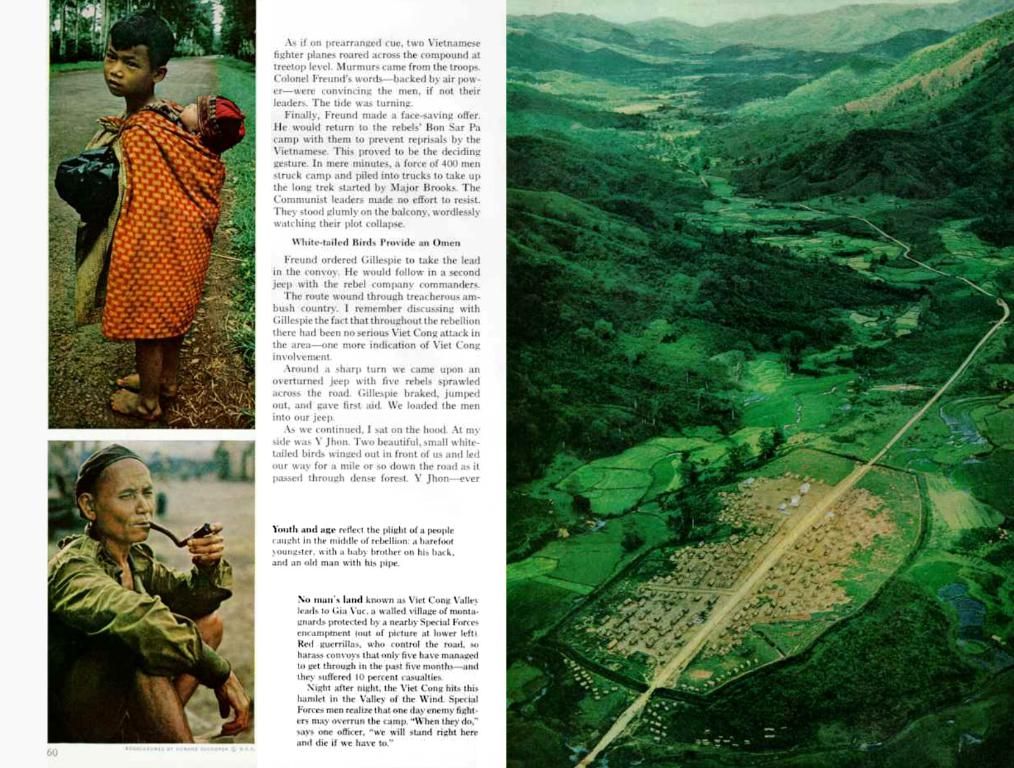

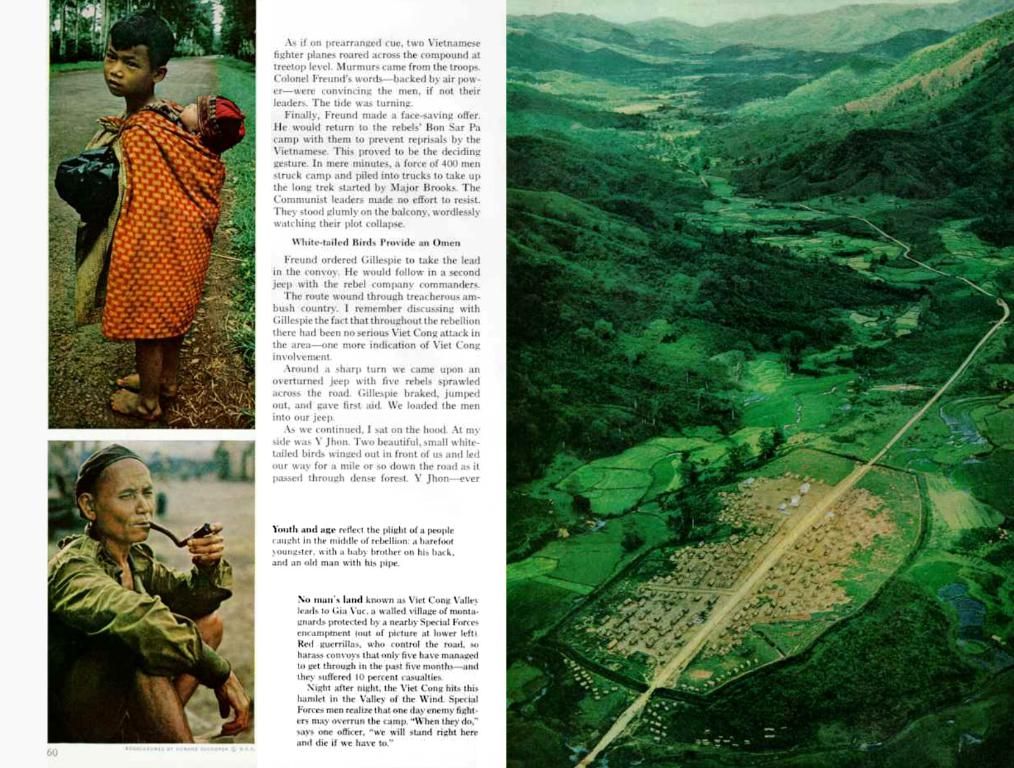

But, get this - a recent earthquake in Myanmar, which was felt in Bangkok, didn't even slow down the transfer of condo ownership for GHB-backed loans. In fact, condo ownership transfers under GHB loan agreements saw a 7.7% increase in the first quarter compared to the same period last year!

Government and BoT Stepping In

Wanna know the secret to GHB's success? It's all about government support! The Finance Ministry is pushing GHB to increase lending through key programs aimed at boosting the property sector and the economy at large. Some programs in the spotlight include:

- Home Renovation Loans and Home Renovation Plus Loans - with a budget of 10 billion baht

- Premier Home Loans - totaling 3 billion baht

- Pre-Finance Premium Loans - for real estate developers in 27 provinces

- Senior Citizen Loan Programmes - with six tailored schemes for borrowers aged 60 to 80, allowing home mortgage terms of up to 70 years

No Pain, Gain for GHB

GHB's Managing Director, Kamolpop, believes these government real estate stimulus policies, such as reduced transfer and mortgage registration fees, along with the Bank of Thailand's easing of loan-to-value (LTV) measures, will further fuel growth.

Non-Performing Loans – Go Away!

Despite plans to approve billions in loans, GHB projects that its non-performing loans (NPLs) will stay low, at 5.13%, come year-end – an improvement compared to last year.

Keeping NPLs at Bay – 11 Steps Forward

To maintain the bank's portfolio quality, Kamolpop revealed 11 strategies aimed at preventing borrowers from becoming NPLs. The majority of clients, he said, have managed to dodge entering the debt restructuring program thanks to these efforts! And, around 330,000 GHB customers are currently part of the "You Fight, We Help" debt restructuring program.

Helping Hand for Vulnerable Borrowers

One of the 11 strategies involves the Debt Relief Programme (DC3) for "Special Mention Loan" debtors, who are financially vulnerable and at risk of default. This program offers some pretty sweet perks:

- No interest charged for the first six months

- 1,000 baht monthly payments during that period

- An interest rate of 1.9% from months 7 to 9, with monthly installments increasing by 100 baht

- An interest rate of 3.9% from months 10 to 12, with further monthly installment increases of 100 baht

That's Kamolpop's rundown on the comprehensive measures GHB is taking to support homeownership, uphold financial discipline, and keep economic conditions in check!

Stay tuned for more on GHB, emerging loan programs, and efforts to maintain a healthy loan portfolio in the face of uncertain economic conditions!

[1] Government Housing Bank, (2023). [GHB Progress and Measures]. Retrieved from www.ghb.or.th/en.[2] Government of Thailand, (2023). [Government Stimulus Policies]. Retrieved from www.thailand.go.th/stimulus-policies.

- In light of the Government's stimulus measures and new borrower support, the Government Housing Bank aims to approve 240 billion baht in housing loans by 2025, a significant increase in their business and real-estate investing sector.

- As a result of the Government's support and various loan programs, such as Home Renovation Loans, Premier Home Loans, Pre-Finance Premium Loans, and Senior Citizen Loan Programmes, the bank's first-half growth indicates a booming business in the real estate market.

- Despite economic doubts, the bank's non-performing loans are projected to stay low at 5.13% due to 11 strategies aimed at preventing borrowers from becoming delinquent, ensuring the stability and quality of their portfolio.

- To further fuel growth and address vulnerability among certain borrowers, the Debt Relief Programme (DC3) has been introduced, offering financial relief to debtors at risk of default by providing reduced interest rates and flexible monthly payments.