Lightning-Fast UPI Transactions Coming Soon to India

Accelerated UPI Transactions Await Users: Speed Boost for PhonePe, Google Pay, Paytm Users Starting June 16 - Find Out More Info Here

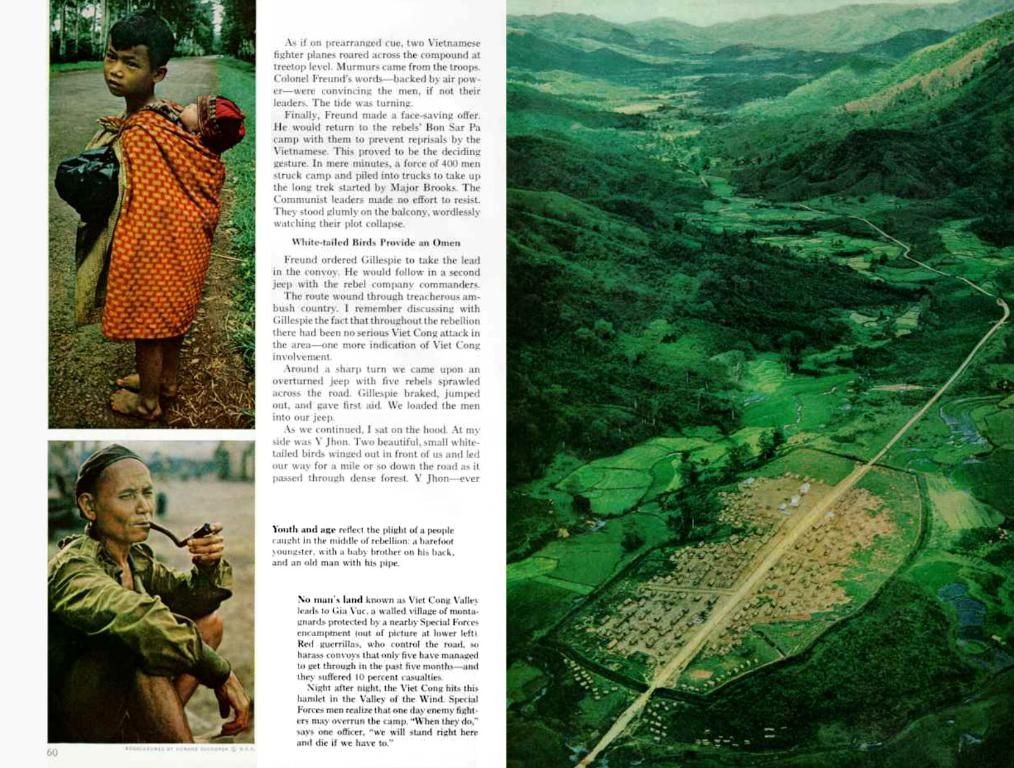

Starting June 16, 2025, UPI transactions in India are about to get a major boost. The National Payments Corporation of India (NPCI) plans to make these transactions quicker and more efficient. Here's what you can expect:

Blazing Transaction Speed

- Zippy Transactions: Say goodbye to 30-second waits! UPI transactions, including balance checks and reversals, will now zip through in 10-15 seconds.

- Swift Payee Validation: Validating a payee's address just got faster, now taking only 10 seconds compared to the previous 15.

Balance Inquiry Made Easy

- Daily Limit: Check your bank balance via UPI apps up to a whopping 50 times a day! Previously, there was no set limit for balance inquiries.

API Request Mastery

- Faster API Responses: The NPCI is slashing UPI API response times to make transactions faster and more reliable.

- API Usage Guidelines: To maintain system smoothness during peak hours, providers are advised to monitor and moderate their API usage carefully. Peak hours are 10:00 AM to 1:00 PM and 5:00 PM to 9:30 PM.

While the details are not explicitly mentioned, the focus on improving transactions efficiency and reducing failed payments may set the stage for smoother auto-payments through quicker confirmation times.

Security and Compliance

- Authentic Beneficiary Name Display: From now on, UPI apps must show the actual beneficiary name during transactions and must disable any name-editing feature within the interface. This compliance change is due by June 30, 2025.

- System Audits: All players in the UPI ecosystem must undergo a system audit by July 31, 2025, with audit reports to be submitted by August 31, 2025.

The new changes aim to provide a superior user experience, reduce transaction times, and enhance overall efficiency in the UPI system. Get ready for a new era of seamless digital transactions in India!

In the upcoming changes, the quicker and more efficient UPI transactions in India could potentially facilitate smoother auto-payments, thanks to the reduction in confirmation times. Furthermore, the integration of technology in UPI payments could lead to faster financial transactions, making the system more responsive and reliable.